Imagine: you’re home alone, it’s late, and suddenly your device turns on with a phone call from a number you don’t know.

You respond, only for them to tell you they are an Apple representative. They tell you your computer has been hacked. If you don’t follow the instructions, they claim you will be charged with a crime. You need to go to the bank, withdraw $36,000 of funds and deposit them into cryptocurrency machines. Frightened by what they say, you listen and follow the instructions – and before you know it, you’ve lost the money for good.

This story is not imaginative. It’s the story of a real Bozeman fraud victim that Kaitlyn Wenzel, a policy analyst and public outreach coordinator with the Montana Securities and Insurance Commissioner’s (CSI) office, shared with a crowd of seniors in Kalispell Tuesday morning.

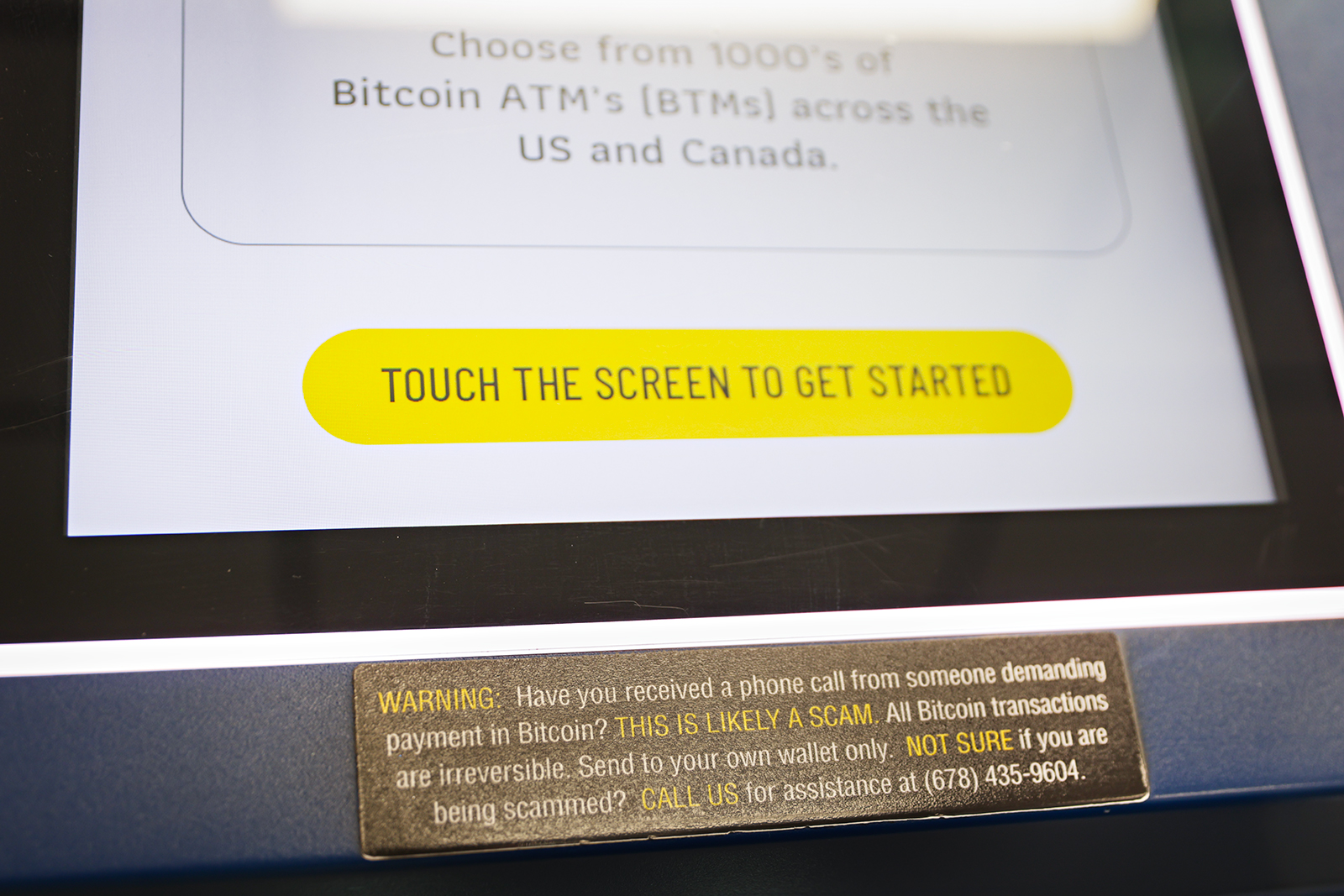

“Now, a crypto ATM is a machine used to convert money into cryptocurrency. In this case, it’s a Bitcoin ATM,” Wenzel said, pointing to a photo. “So the money put into that machine is converted from cash to Bitcoin. Now Bitcoin payments are permanent. When you put money into that machine and send it to someone’s digital wallet that’s not yours, that money disappears in a blob of money. It disappears instantly and forever.”

She added that crypto ATMs are still not regulated by the federal or state government.

Wenzel presented at Immanuel Living and joined a panel of representatives from the Flathead County Sheriff’s Office to warn local seniors about how scammers are using cryptocurrency to defraud their victims. Nationally, Wenzel said people ages 60 and older are the most commonly defrauded age group. They are also susceptible to the growing threats of cryptocurrency scams.

His presentation covered statistics, how to recognize scams and offered several stories like that of the fraud victim in Bozeman, while law enforcement panelists shared ways to stay safe in the digital world.

Wenzel told the crowd that to spot a scam, you need to look for the “four Ps.” A scammer will pretend to be someone trustworthy; present either a problem to be solved or a prize to be won; pressuring their victim to act quickly; and request payment in an unusual way. She also encouraged people who have been scammed to report it to CSI.

According to a March press release from State Auditor James Brown’s office, 15 Montanans filed crypto fraud complaints with the state in 2024. These 15 cases totaled nearly $900,000 in financial losses. The true figure is likely higher, as Wenzel said shame can be a barrier to reporting scams.

Wenzel also pointed out that crypto ATM scams are also on the rise at the federal level. In the first half of 2025 alone, Americans lost $240 million to crypto ATM scams across the country. But what worries Wenzel and CSI more is that this figure represents the total amount lost to similar scams in 2024. This means that the scams are accelerating.

The rise in crypto crimes and fraud, along with pressure from CSI and local police, prompted state Rep. Courtenay Sprunger, R-Kalispell, to take action. Sprunger hosted the “Scam Smart” seminar for seniors in the Flathead Valley on Tuesday to begin educating the community, something panelists said is important in the fight against scams. But in the long term, Sprunger said she plans to work with CSI to draft legislation regulating crypto ATMs in Montana.

“I always joke that I don’t have a lot of good ideas, but I know people who do,” Sprunger said.

She is in the early stages of working on several options for potential legislation, she shared with the crowd Tuesday morning.

She said she doesn’t think outright banning cryptocurrency machines is the solution. The machines have their place in a free market, but increased regulation could help reduce the harm they can cause.

For example, what would happen if the machines were placed behind the counter in stores, requiring interaction with a real human before depositing money? What if there were limits to the amount you can deposit per transaction?

Similar ideas have been explored in other states of all political stripes. Democratic-led Illinois, deep red Oklahoma, and more purple Arizona have all passed crypto-related legislation this year. Their legislation covers a range of regulations from requiring warnings on machines to limiting the amount of money customers can dispense or withdraw in a day and allowing customers to have recourse in cases of fraud.

Sprunger said she is looking at what other states are doing for inspiration as she works with CSI and local law enforcement agencies to determine what type of policy might be suitable for Montana.

(email protected)