Join our Telegram channel to stay up to date with the latest news

A wave of crypto ETF (exchange-traded fund) launches in 2026 could lead to widespread liquidations later, Bloomberg ETF analyst James Seyffart warned.

Seyffart pointed out in comments on Dec. 17 on X that research from crypto asset manager Bitwise projects that more than 100 crypto ETFs could launch next year.

He also noted that 126 ETF filings are currently awaiting SEC approval, adding, “Issuers are throwing A LOT of products at the wall.”

The risk is that supply exceeds demand, making it difficult for many products to reach a sustainable level of assets under management, particularly if the crypto market remains in poor shape.

“We are going to see a lot of liquidations of crypto ETP products,” he said. “This could happen at the end of 2026, but probably by the end of 2027.”

I agree 100% with @BitwiseInvest here. I also think we are going to see a lot of liquidations of crypto ETP products. This could happen in late 2026, but probably by the end of 2027. Issuers are throwing A LOT of product at the wall – there are at least 126 filings. pic.twitter.com/UELUKUng7Y

–James Seyffart (@JSeyff) December 17, 2025

SEC Generic Listing Standards Make New Product Launches Easier

Seyffart’s warning and Bitwise’s 2026 ETF boom prediction follows a September decision by the U.S. Securities and Exchange Commission (SEC) to approve generic listing standards for crypto ETFs.

This allows national securities exchanges such as the New York Stock Exchange (NYSE), Nasdaq, and Cboe to list certain commodity-based and crypto-related ETPs (exchange traded products).

Before approving the generic listing standards, the SEC had reviewed each crypto ETF application on a case-by-case basis. This process was slow and unpredictable, and subsequently presented a bottleneck for issuers and managers wishing to launch new products.

Now the new standards change the process by setting objective, rules-based criteria. This is similar to the number of traditional commodity ETFs listed.

As the new generic listing standards streamline the process, several issuers have filed to launch products for a range of cryptos in an effort to repeat the success of spot BTC and spot ETH funds in the United States.

The funds were expected to spark a crypto market rally earlier in the year, but the US government shutdown halted the market’s momentum.

Crypto ETFs could repeat the trend seen in the TradFi space

The warning of a boom in crypto ETFs and subsequent liquidations also comes after several traditional financial sector funds failed to take off.

Last year, a total of 622 ETFs closed their doors. This included 189 funds in the United States, according to a report from the Daily Upside last month. Morningstar too reported as of January 2024, the 244 ETFs closed in the United States in 2023 had an average age of only 5.4 years.

Many of these ETFs closed because they failed to attract sufficient capital flows, which ultimately led to low assets under management.

Indications that this trend could make its way to the crypto market have already emerged this year. In 2025, several crypto products were liquidated. Among them are the ARK 21Shares Active Bitcoin Ethereum Strategy ETF (ARKY) and the ARK 21Shares Active On-Chain Bitcoin Strategy ETF (ARKC).

Altcoin ETFs Lag Old Bitcoin Spot Funds

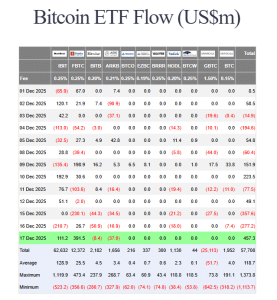

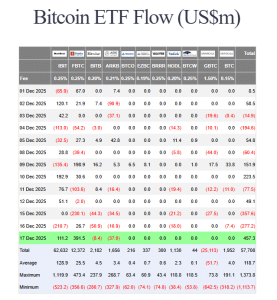

Spot Bitcoin ETFs launched in the United States in early 2024 and have since seen over $57.7 billion in net inflows. BlackRock’s IBIT led the charge with cumulative net inflows of more than $62.6 billion, according to data from Farside Investors.

US Spot BTC ETF Flow (Source: Distant investors)

Spot ETH ETFs, launched a few months later, only brought in $12.636 billion in cumulative net entries.

Earlier this year, SOL spot ETFs also made their market debut, but only attracted $725 million in total inflows.

Spot XRP ETFs are the newest products on the market and appear to have resisted the trend observed with altcoin products. After a multi-day entry streak since its debut, spot XRP ETFs have already managed to surpass $1.1 billion in total net assets.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news