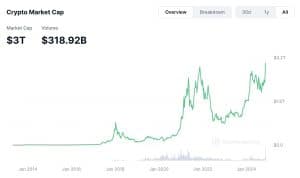

The global cryptocurrency market has surpassed $3 trillion, fueled by renewed investor optimism following the re-election of Donald Trump as president of the United States. Meanwhile, Bitcoin reached an all-time high of $93,434.

According to CoinMarketCap, the total market capitalization currently stands at $3 trillion, up 4% over the past day. CoinGecko reports an even higher figure of $3.15 trillion, tracking over 15,000 cryptocurrencies, compared to 10,000 for CoinMarketCap.

The $3 Trillion Surge: What’s Driving the Crypto Boom?

The milestone marks an all-time high, surpassing the bull run of 2021. This surge, dubbed the “Trump Bump,” reflects expectations for a favorable regulatory environment for cryptocurrencies under the new administration.

Trump’s campaign promises, including making the United States a global crypto hub and establishing a national Bitcoin reserve, have boosted market confidence.

Institutional appetite for digital assets continues to grow. A recent survey of 400 global institutional investors found that 57% of them plan to increase their crypto allocations, with many aiming to do so over the next 6 months.

Companies like MicroStrategy have also made significant investments, recently acquiring $2 billion in Bitcoin.

Analysts expect continued growth but warn of possible corrections, citing external risks such as weak U.S. economic data.

Bitcoin’s Record Rally: Will $100,000 Be Next?

Bitcoin has been one of the main drivers of this crypto rally, reaching a new all-time high (ATH) of $93,434 on November 13. Its market capitalization now stands at almost $1.8 trillion, or 60% of the total crypto market.

Altcoins are also seeing significant gains, contributing to the bullish momentum of the market as a whole.

Maksym Sakharov, CEO of DeFi platform WeFi, attributes the rise to “Bitcoin’s price rise above $93,000, growing demand and regulatory clarity.” Bitcoin more than doubles in 2024, fueled by the launch of spot Bitcoin ETFs and increased institutional interest.

Many crypto analysts suggest that Bitcoin’s rally is far from over. Some predict it could reach $100,000 in the coming months.

Mike Novogratz, CEO of Galaxy Digital, offers an even bolder outlook, predicting a potential rise to as much as $500,000, if Bitcoin gains traction as a national reserve asset in the United States.

Bitcoin overtakes silver and becomes the 8th global asset

Even more remarkable, Bitcoin has reached a new milestone. It surpassed silver with a market capitalization of $1.8 trillion, positioning itself as the 8th largest asset in the world. This marks a significant leap in Bitcoin’s trajectory, as it now lags behind only major players like gold, Apple and Microsoft, according to Companies Market Cap.

This rise comes as the price of Bitcoin surpassed $93,000, with even more bullish projections to come. In contrast, silver fell 2%, helping Bitcoin secure its place ahead of the precious metal.

Institutional dynamics drive the rise of Bitcoin

Institutional activity has played a crucial role in today’s recovery. BlackRock’s iShares Bitcoin Trust (IBIT) recorded $4.5 billion in trading volume, reflecting growing interest in Bitcoin from major financial players.

Bloomberg’s Eric Balchunas highlighted this trend, noting that Bitcoin ETFs and related assets, including MicroStrategy and Coinbase, reached a combined trading volume of $38 billion.

Optimism in the crypto market has increased following Donald Trump’s re-election, with analysts suggesting his pro-crypto stance could pave the way for favorable regulation. This sentiment has fueled predictions that Bitcoin could surpass the $100,000 mark by the end of 2024.

However, behind all this hype around the crypto industry, particularly the sudden rise of Bitcoin, is the environmental impact of the digital asset.

Crypto’s environmental record: balancing growth and sustainability

The increasing energy consumption linked to cryptocurrency mining has sparked global concern due to its environmental impact. The 2022 White House report highlighted the significant electricity demand from cryptocurrency mining, which now rivals the energy consumption of countries like Poland.

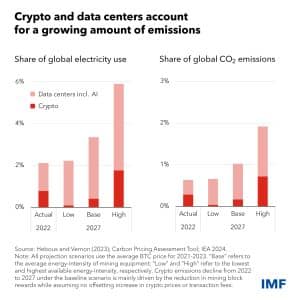

According to an analysis by the International Monetary Fund (IMF), cryptocurrency mining and data centers accounted for 2% of global electricity demand in 2022. This figure could reach 3.5% within three years, corresponding to Japan’s current electricity consumption, the fifth highest in the world. world – according to projections from the International Energy Agency.

- Bitcoin’s proof-of-work (PoW) consensus mechanism is one of the main contributors, with global electricity consumption for PoW estimated between 97 and 323 terawatt hours annually. This results in significant greenhouse gas emissions, with Bitcoin alone responsible for approximately 88 million tonnes of CO₂ every year.

The United States represents nearly 46% of Bitcoin mining emissions, releasing approximately 15.1 million tonnes of CO₂ annually. Other major contributors include China and Kazakhstan, highlighting the global nature of the problem.

The mining process also has indirect environmental impacts, such as e-waste and water consumption, with one Bitcoin transaction consuming thousands of gallons of water.

Efforts to reduce Bitcoin’s carbon footprint include transitioning to less energy-intensive consensus mechanisms like proof-of-stake (PoS) and adopting renewable energy sources for mining.

However, regional efforts to reduce emissions often fail due to the carbon intensity of the global supply chain. For example, even countries with cleaner energy networks, like Norway, face indirect emissions from imported mining equipment manufactured in coal-dependent regions like China.

Interestingly, recent studies challenge the perception of the environmental impact of Bitcoin mining.

The Role of Bitcoin Mining in Reducing Carbon Emissions

Research from the Bitcoin Policy Institute (BPI) highlights how mining is increasingly relying on renewable energy, turning excess energy into a valuable resource. By using excess energy from renewable sources like wind and solar, mining helps stabilize grids and reduce energy waste, proving it can help reduce emissions of carbon rather than exacerbating emissions.

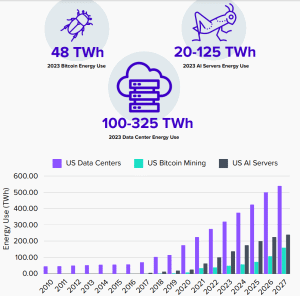

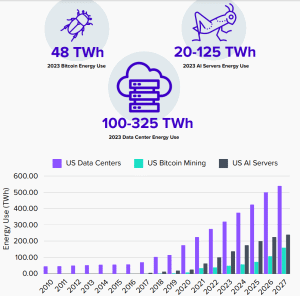

The researchers also compared the energy consumption of Bitcoin mining, data centers, and AI server energy in the United States in 2023. Bitcoin used 48 TWh in 2023, while AI servers consumed between 20 and 125 TWh. In contrast, data centers have the highest energy consumption, ranging from 100 to 325 TWh.

The following chart shows historical results and forecasts through 2027.

Another report from the Digital Assets Research Institute (DA-RI) reveals flaws in previous research on Bitcoin’s energy consumption. He criticizes outdated models that have neglected miners’ shift to renewable energy, resulting in sensational headlines and misinformed policies.

The new findings urge regulators to base their decisions on empirical data, highlighting Bitcoin’s potential to align with global goals to reduce carbon emissions.

These studies suggest that sustainable Bitcoin mining could play a crucial role in green initiatives. By leveraging clean energy, mining could evolve into a climate-friendly industry, providing both economic and environmental benefits. As this perspective gains traction, policymakers could adopt more balanced regulations, supporting sustainable growth in the crypto sector.