Regulate or innovate?

In our polarized political system, even the regulation of the cryptographic industry of several billion dollars seems to be a history of diametrically opposite approaches. As always, however, the best way can devote to the selection of a cautious path between extremes angry their opinions.

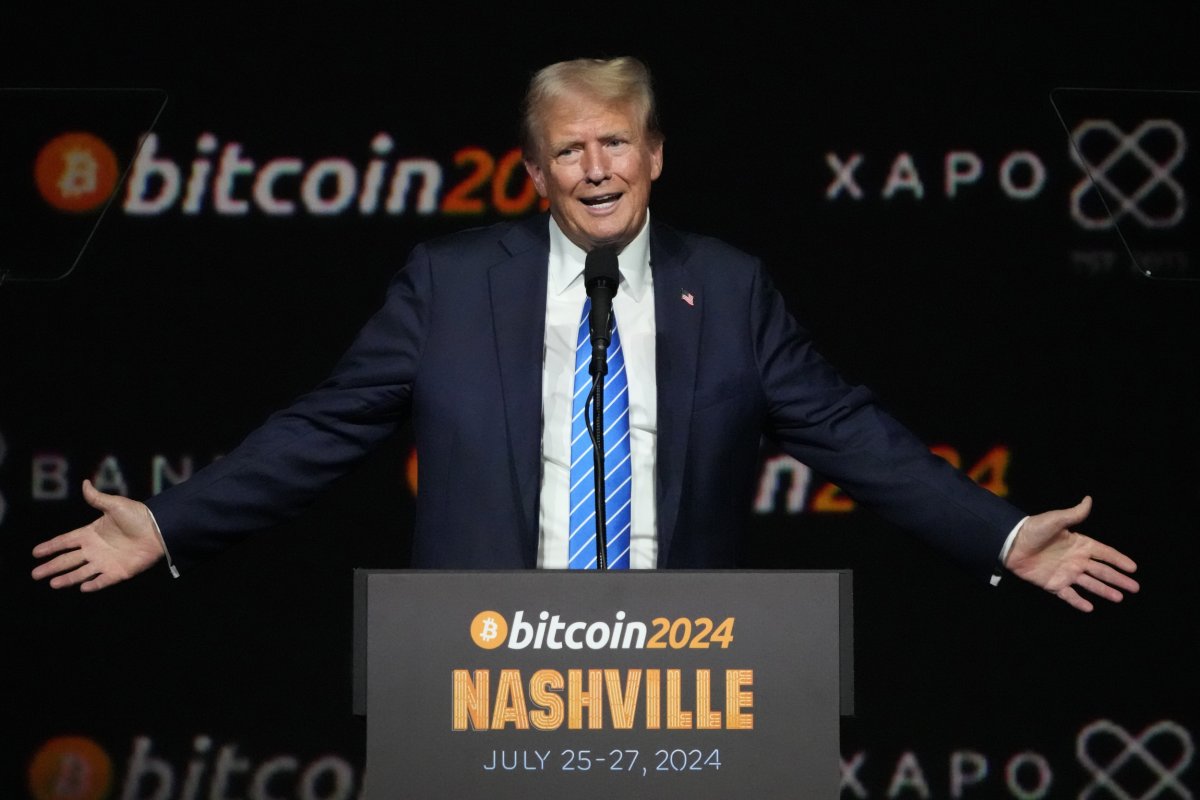

Admittedly, the approach of the Trump administration towards digital assets marked a spectacular gap in the strategy of the application of the Biden era by using the existing legal structures that many in the cryptographic industry do not believe. Even the president himself launched a piece of memes called $ Trump on the Solana blockchain, generating nearly $ 100 million in negotiation costs. It is difficult to imagine another president of the American history which does something similar at a distance. He also signed a decree on January 23, 2025, aimed at establishing a “cryptographic strategic reserve” and improving American leadership in digital assets.

Previously, Silicon Valley startup leaders examined the easier and more welcoming jurisdictions for their cryptographic companies, some moving through the Atlantic in Switzerland or the Pacific in Singapore. Now, with the actions of the Trump administration relating to the regulation of cryptography, the United States is again more attractive.

AP photo / Mark Humphrey, file

Change represents more than a simple political preference – it signals a fundamental redress of the way America should position itself in the economy of rapidly evolving blockchain.

Under the Biden administration, the chairman of the securities and exchange committee, Gary Gensler, continued what criticisms have qualified “regulations by application”, applying the laws in terms of existing securities to the cryptocurrency markets which, according to many, did not think of applying to the markets without providing clear potential advice. This approach has treated most digital assets as unregulated titles subject to traditional recording requirements, creating uncertainty that many industry participants considered a stifling innovation. The dry of peopleler has brought numerous application measures against cryptographic companies, arguing that existing financial laws were sufficient to govern digital assets without new regulatory executives.

In striking contrast, the president of Trump’s dry, Paul Atkins, defends more innovation and clearer and more predictable regulations specifically adapted to the markets of cryptocurrencies. His approach emphasizes collaboration with the industry to create a framework where the rules are clearly known as the main regulatory tool rather than an aggressive application based on the application of existing laws, which many initiates in the industry have described as a square ankle in a round hole.

The philosophical fracture extends beyond the strategy to apply fundamental questions on innovation and financial inclusion. The prudent position of the Biden administration reflects concerns concerning consumer protection and financial stability, dealing the crypticism with skepticism inherited from traditional banking surveillance. Critics have argued that this approach ignored crypto potential to democratize finance by offering alternatives to conventional banking systems and providing greater control over their financial assets.

However, while Trump’s cryptography policy is said that this will cause more problems due to reduced federal surveillance, Adkins said that there would be regulations, but regulations will be adapted to cryptographic industry, which would make a square ankle in a square hole. A key factor in this new regulation will be whether the new cryptographic federal regulations “will preempt” state laws – which means that federal law prevails over the law of the state – which is the key to making cryptographic regulations effective.

Remember that the United States has 50 states and many have its own laws and regulations on investment. Without “pre-emption”, cryptocurrency companies will be subject to a series of registration regulations and requirements to the federal government and many governments of states that could increase the costs of the cryptography market and make it more complicated and complex to function. For example, crypto companies operating in New York will remain subject to the regulatory and license of “Bitlicense” in New York. California has also recently promulgated and is currently implementing its digital financial asset law, which will also require that many cryptographic companies get a license. Many laws on the licenses to transmit money from states will also continue to apply to crypto companies.

In addition, state -of -the -art prosecutors and securities regulators can try to fill a gap perceived in the application linked to the crypto. The New York Attorney General, Letitia James, was particularly active in the introduction of implementing measures against eminent cryptographic companies, and it is difficult to imagine the financial markets without New York. This state application activity will continue and should increase, during the mandate of President Trump, in particular in the states that oppose many of his ideas.

Consumer defenders fear that Trump’s regulations can lead to a chaotic Wild West, where scams and patterns could engage in amoes. Fraud and scams and shady characters have long haunted the financial system. Charles Ponzi, whose name is eponymous of fraud, and Bernie Madoff was able to commit fraud without crypto and more fraud are committed in American dollars than the crypto. For what? Think of what the famous bank thief Willie Sutton said in the 1930s: “Because this is where money”!

The answer is not and has never been to close the banks, close the stock market or stop in American dollars. Likewise, it is not a question of prohibiting grandparents from investing in the crypto.

The answer is as it has always been: to encourage innovation, regulate with the right balance between relaxation and control with reasonable regulations that do not charge innovation or oppress industry while simultaneously allowing a harsh repression when someone becomes out of line.

America will not win if its markets are too loose and unregulated. But the American will not win either if all the innovation is motivated abroad and Singapore, Switzerland and Shenzhen become the financial capitals of the world.

It is a debate on our future and as such, it is too important to get black and white about political polarization. We have to work together to decide whether America leads or follows in the next phase of financial innovation, and how we can do it best.

Bryan Sullivan is a leading lawyer who has represented high -level customers in entertainment, intellectual property and business investments.