XRP fell below $ 2.30 this week, destroying all the gains recorded during the short -term rally last week. The cryptocurrency, which increased by $ 2.06 to $ 2.06 by $ 2.06 last week, has now lost 3.5% compared to the opening price on Monday and 7% compared to its weekly summit of $ 2.36.

Market experts provide that the potential of 30% drops to $ 1.55

Cryptocurrency analyst, Block Bull, plans that XRP could go much deeper in the near future. From the post of April 29 of the analyst, XRP could not break the level of resistance at the top of a Taurus flag model on daily cards.

This technical failure can push the price to $ 1.55, which would be “boring like hell”, according to Block Bull – a 30% drop in the top of the model – and 28.6% of the current levels.

Block Bull informed subscribers This drop in the possible price would be brief and could prove to be the perfect entry point for investors. The analyst has suggested that large fund players tend to use such slowdowns on the markets to accumulate assets at negotiation rates.

Likely $ XRP will fall by 30% with $ XLM that I have just published.

The bottom of the bull flag and the FIB level will be an excellent entry

$ 1.55 (boring like hell)

Bleed the average guy and that is why the rich are enriched because they are the only ones capable of affording Hodl pic.twitter.com/pg3:30

–

Block the bull

(@Theblockbull) April 29, 2025

XRP not alone because Bitcoin and Ethereum also have trouble

The drop pressure on XRP complies with lower trends in major cryptocurrencies as a whole. Bitcoin is struggling to stay above the $ 95,000 threshold while Ethereum fell below $ 1,800. That it is a market scale correction and not a specific XRP problem is indicated.

A competing analysis provides more optimistic forecasts

All those who look at the market do not see the dismal perspectives. Others have noted that while decreasing 6% in two days from $ 2.28 to $ 2.14, XRP was able to stay above important levels of support on shorter deadlines.

They said that if XRP could have a support at $ 2.14, the price can bounce at $ 2.24 or more in a short time. More positive predictions even indicate that XRP could reach $ 5 in a month, a new summit of all time for cryptocurrency.

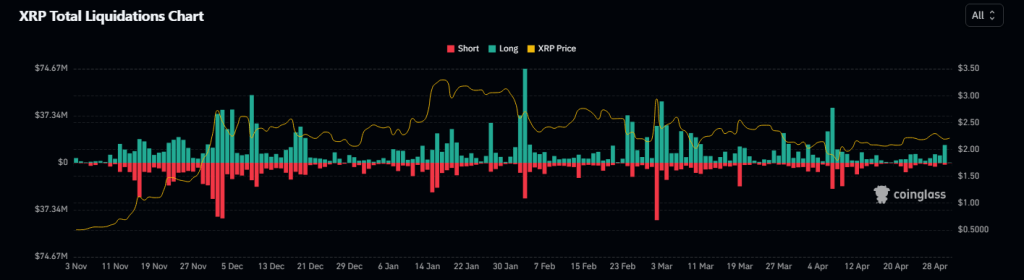

Liquidation data show market imbalance

Meanwhile, the latest Corcinlass trade statistics indicate a shocking disparity in market positions. Within 24 hours, nearly $ 14 million in long positions (Paris on the price increase) were liquidated, while only $ 1.48 million in exposed positions were sold.

This difference of almost 1000% indicates that the majority of traders placed bets on price increases when the market began to decline.

The sudden sale of such a large number of long positions had a cascade effect, lowering prices even faster. Open interests also decreased by 4%, indicating that traders ended in the form of uncertainty supports.

Since the most recent negotiation figures, XRP has been $ 2.20, down 1.14% since the start of the day. Investors now have contradictory messages concerning the opportunity to anticipate additional declines or perhaps a possible rebound in the coming days.

Felash star image, tradingView graphic

Block the bull

Block the bull