The data show that Bitcoin recently lost its interest in the face of Ethereum and Altcoins while their combined term volume has exceeded the 85%mark.

Ethereum and Altcoins have seen their long -term volume increase recently

In a new article on X, the cryptocurrency community analyst Maartunn spoke of the latest trend on the long -term trading of Ethereum and Altcoins. The volume of term exchanges here naturally refers to the amount which is involved in transactions linked to term contracts on the various derived grants.

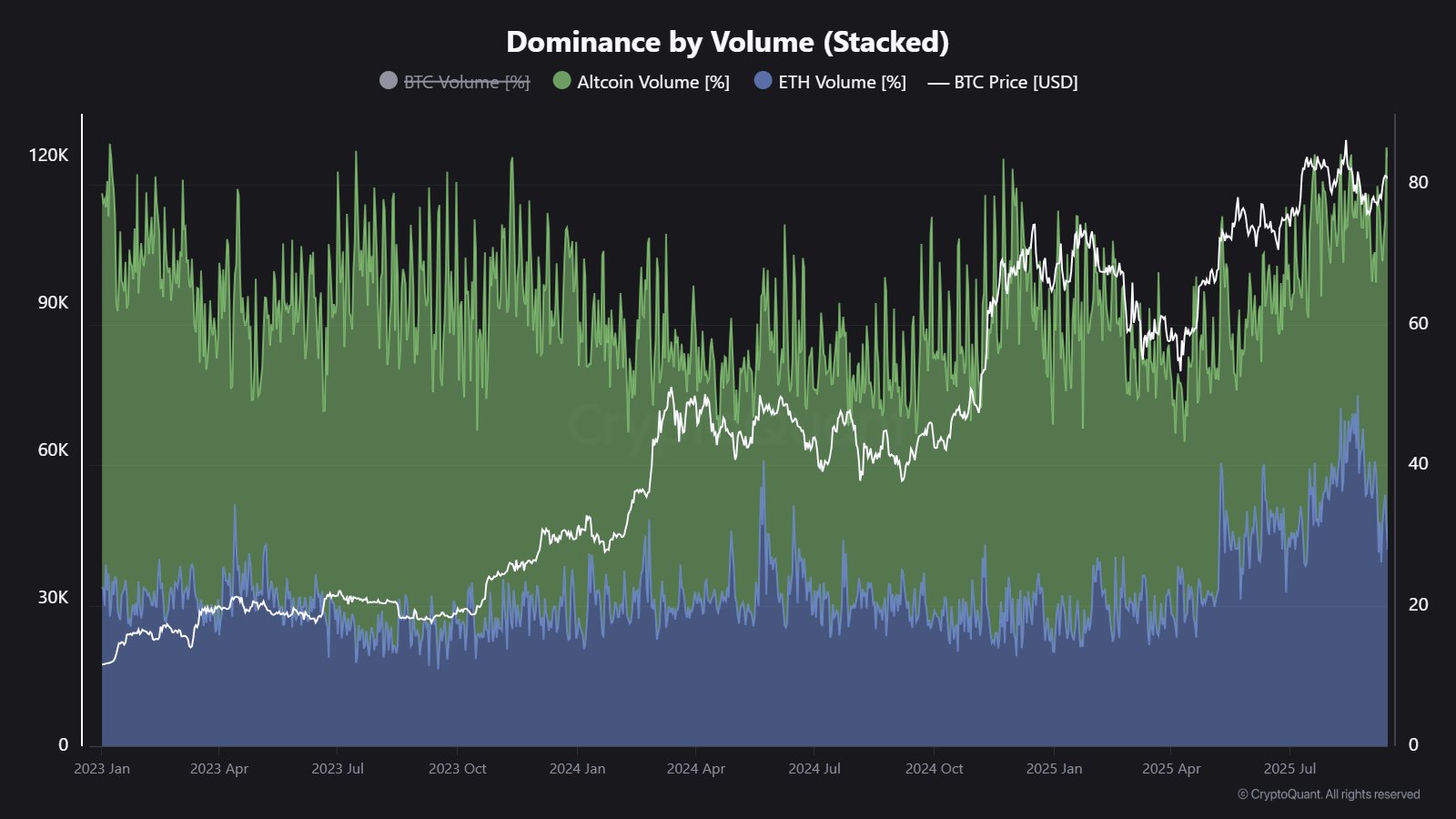

You will find below the graph shared by Maartunn which shows the trend to dominate this metric for ETH and the alts in the past two years:

The value of the indicator appears to have gone up for both of these assets in recent days | Source: @JA_Maartun on X

As it is visible in the graph, the domination of the long -term trading volume has recently experienced a strong increase for altcoins, which implies that the speculative interest in these parts has increased.

Metric is still considerably decreasing for Ethereum compared to its previous summit, but it has nevertheless experienced an increase at the same time as the growth of Altcoin.

Combined, ETH and the alts occupy approximately 85.2% of the total cryptocurrency negotiation volume after the increase. This means that the remaining part, Bitcoin, exceeded 15% in dominance.

Historically, periods like these were a bad omen not only for the BTC, but the market as a whole. Examples of these are visible in the graph at the end of 2024 and in the summer of 2025.

Thus, given that Ethereum and Altcoins again dominate the trading activity in the long term, it is possible that bitcoin and other assets can be in a certain volatility.

In some other news, the Santiment Chain Analysis Society shared an update in an X post on the way in which the various projects in the digital asset sector are classified in terms of development activity. This indicator measures the total quantity of work that the developers of a given project do on its GitHub public standards.

The metric performs its measure in units of “events”, where an event is any action taken by the developer on the repository, such as the push of a commitment or the creation of a fork.

Here is the table published by Santiment which shows the classification of cryptocurrency projects on the basis of their 30-day development activity:

Looks like ICP has maintained its position at the top | Source: Santiment on X

As indicated above, Ethereum is only the 10th larger project in terms of development activity of 30 days, although its market capitalization is second behind Bitcoin. The project that sees its developers working the hardest part at the moment is the Internet Computer (ICP), which has metrics sitting at a value almost three times that of ETH.

Ethn price

Ethereum withdrew above $ 4,750 earlier, but it seems that the price of the assets again faced a decline because it is now back at $ 4,450.

The trend in the price of the coin over the last five days | Source: ETHUSDT on TradingView

Dall-E, santiment.net, cryptotic.com image, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.