Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum is currently negotiating at a level of critical resistance while the bulls try to resume the momentum and put pressure for a new summit. The wider market remains under pressure while global uncertainty degenerates, largely fueled by the current commercial tensions between the United States and China. Last week, US President Donald Trump announced a 90 -day price break from all countries, with the exception of China, intensifying the concerns about an prolonged trade conflict that could destabilize the global financial markets.

Related reading

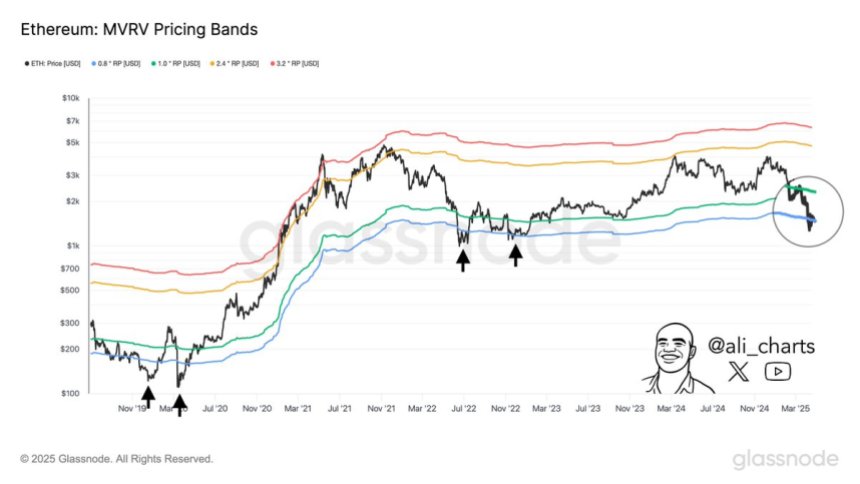

In this high challenges environment, the action of Ethereum prices draws particular attention to investors and analysts. Top Crypto’s analyst, Ali Martinez, shared that, historically, the best purchase opportunities in Ethereum emerged when the price drops below the MVRV price band (market value of the value achieved) – a level that signals a potential undervaluation. In particular, ETH is now negotiated precisely in this area.

This alignment between technical conditions and macroeconomic instability suggests that Ethereum could enter an accumulation phase, long -term investors seeking to capitalize on reduced prices. However, a sustained ascending dynamic will depend on the question of whether the bulls can overcome the immediate resistance and if the macro-conditions are improving. The next few days could be essential for ETH because it tests the technical and psychological thresholds.

Ethereum plunges into the historic opportunity area

Ethereum is currently negotiated below key resistance levels after hardening several weeks of sales pressure and low market performance. Since the loss of the crucial level of support of $ 2,000, the ETH has dropped by around 21%, a clear indication that the bulls have not yet resumed control. Larger macroeconomic pressures, in particular the increase in global tensions and uncertain commercial conditions between the United States and China, have further attenuated the feeling of the market. These conditions have prompted many investors to leave risky assets such as cryptocurrencies, leading to high volatility and a reduction in market participation.

Despite this downward trend, some analysts think that Ethereum could approach a pivot recovery area. According to Martinez, one of the best historical signals of the Ethereum accumulation was the plunge of the action of prices below the lower limit of the MVRV price strip – a metric which compares the market value to the value achieved to assess whether an asset is on or underguised. Currently, Ethereum is negotiated under this lower strip.

Martinez stresses that this positioning has generally preceded strong rising inversions, especially during periods of extreme market pessimism. Although short -term volatility can persist, ETH entry into this area could have a rare opportunity for long -term investors to accumulate at historically reduced levels – if market conditions are stabilized and changes in feeling.

Related reading

ETH stands in a tight beach

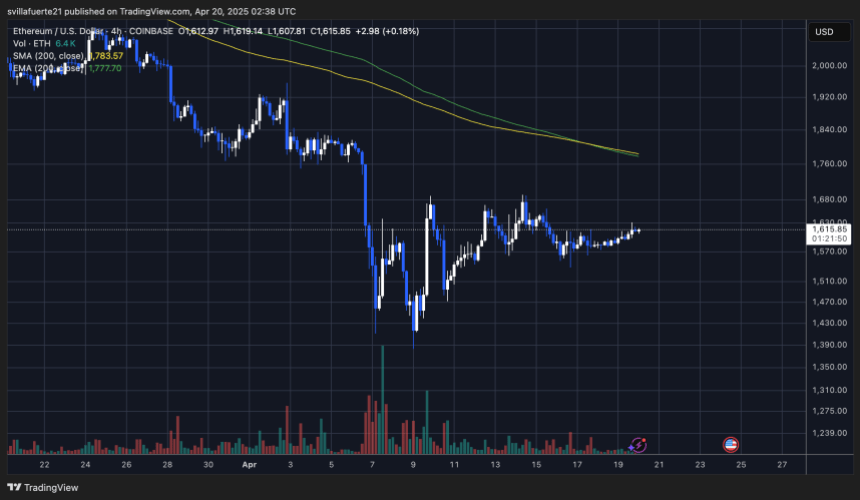

Ethereum is currently negotiated at $ 1,610 after almost a week of low volatility and lateral action. Since last Tuesday, ETH has remained locked in a tight range between $ 1,550 and $ 1,630, reflecting the uncertainty and hesitation of the market to adopt a clear directional position. This narrow trading area highlights a period of price compression, often a precursor to a larger movement in both directions.

In order for the bulls to resume the momentum and the feeling of change, Ethereum must recover the level of $ 1,700 and push decisively above the $ 2,000 mark. These levels serve not only as key psychological barriers, but also represent critical areas of previous support which have now turned into resistance. An escape greater than $ 2,000 would probably trigger a renewal of purchasing interests and would prepare the land for a potential recovery rally.

Related reading

However, if the downstream pressure constructions and the $ 1,550 floor is violated, Ethereum could quickly test the $ 1,500 support area. A ventilation lower than this level would confirm an additional risk risk, potentially accelerating sales and would deepen the current correction. Until a break or a breakup occurs, traders should prepare for more consolidation and volatility because the market awaits a macro or a technical catalyst.

Dall-e star image, tradingview graphic

(Tagstotranslate) ETH (T) Ethereum (T) Ethereum Accumulation (T) Ethereum Buy Signal (T) Ethereum MVRV Prix Bands (T) Ethereum News (T) Ethereum Prix (T) Ethusdt

Source link