After a rejection of $ 4,946 on August 24, Ethereum (ETH) is now negotiated at a low level of $ 4,000. However, some analysts still hope that the ETH will be likely to exceed $ 5,000 in the coming weeks, thanks to its growing illiquid supply and its momentum of positive exchange funds (ETF).

Ethereum should reach $ 5,500 in September?

According to a Quicktake Cryptoque post of the Arabic Arab Channel, the latest resumption of Ethereum in August which postponed the digital asset of a range of $ 3,700 to $ 4,000 at its last summit of all time (ATH) of $ 4,946, was largely supported by wider market rallies and positive FNB entries.

Related reading

The analyst noted that ETH reserves on Binance Crypto Exchange experienced a sharp increase in August. The rapid elevation of the chips on the stock market shows that holders choose to sell or make profits at higher prices.

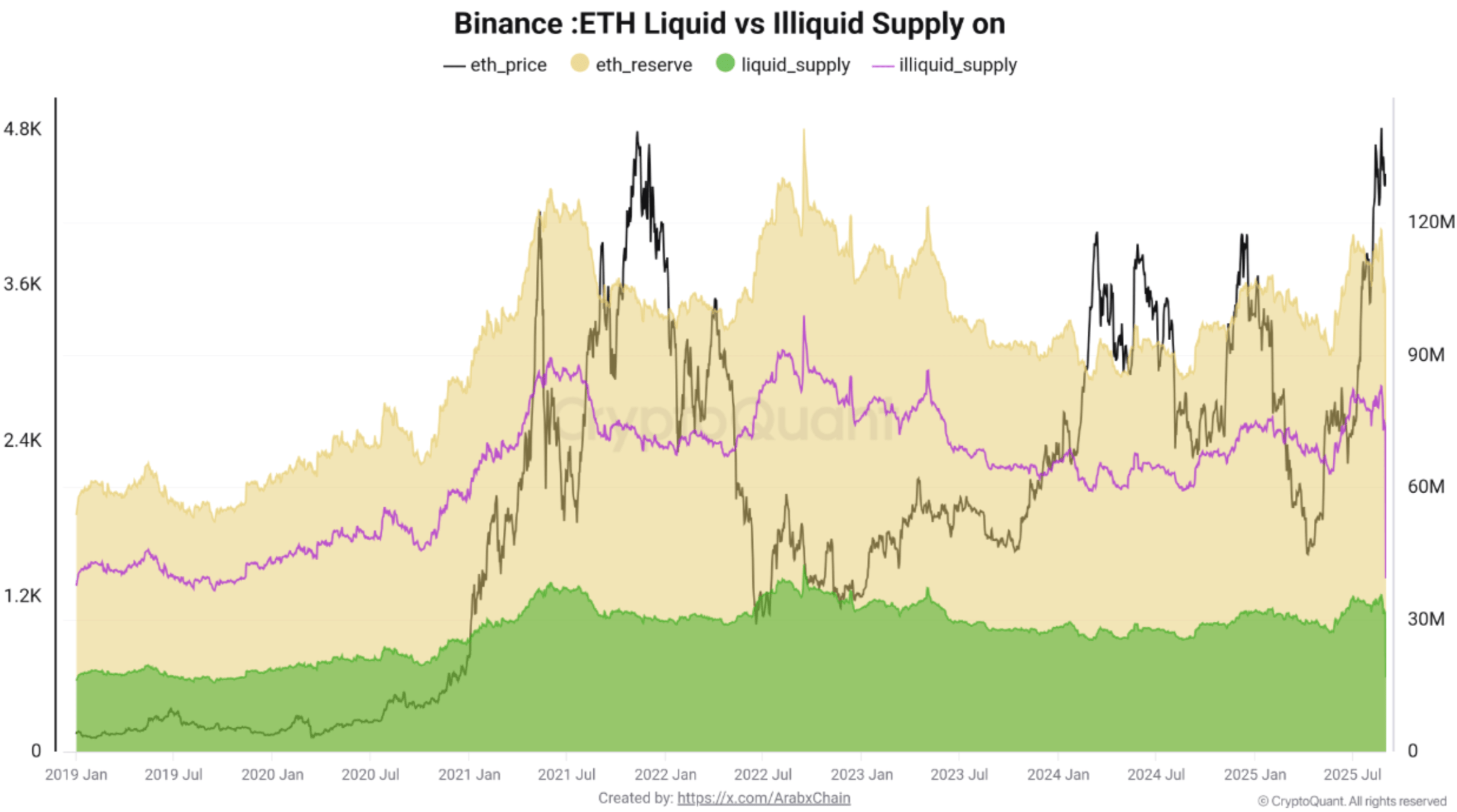

The Arab chain shared the following table which shows both the supply of liquid (green) and illiquid (beige) ETH. According to the graph, the vast majority of ETH’s offer remains illicid, creating a structural supply shortage.

On the other hand, the graph shows a slight increase in liquid food, which suggests that part of the ETH has returned to circulation and could add to short -term sales pressure. The analyst pointed out:

The overall illiquidity of the offer strengthens long -term upward perspectives. Short -term warning signals – increasing binance reserves combined with a small increase in liquid food – suggest a potential correction after the recent strong increase.

If the growth of ETH reserves on the Binance shows signs of slowdown or withdrawals, the shortage of supply of digital assets will remain pronounced. Consequently, a clear and decisive rupture above the resistance level of $ 4,800 could propel the ETH to $ 5,200 to $ 5,500 in the short term.

The cryptocurrency analyst concluded by saying that September is likely to see a slightly optimistic decision for ETH between $ 4,300 and $ 5,000. However, non -compliance with the level of $ 4,800 – associated with an increase in exchange reserves – could increase the possibility of a correction to $ 4,200.

What’s in store for ETH?

Although an escape greater than $ 4,800 is possible, some analysts are offset by expectations by adage This ETH can test the level of $ 4,000 psychologically important before resuming its upward trend.

Related reading

Meanwhile, the chain data show that the whales accumulated ETH at record rhythm. According to a recent report, Eth Whales added A huge 260,000 ETH in their wallets on September 1.

Offering a more ambitious prediction, the co-founder Ethereum and CEO of Consensys Joseph Lubin recently said This “ETH will probably be 100x from here”. At the time of the press, ETH is negotiated at $ 4,429, up 2% in the last 24 hours.

Star image of UNPLASH, cryptocurrency graphics and tradingView.com

(Tagstotranslate) Altcoin

Source link