Este Artículo También is respondable in Español.

Ethereum (ETH), the second largest cryptocurrency by market capitalization, flashes several bullish signals which suggest an upward potential movement. However, the increase in trade reserves dip this optimism.

Has Ethereum formed a local background?

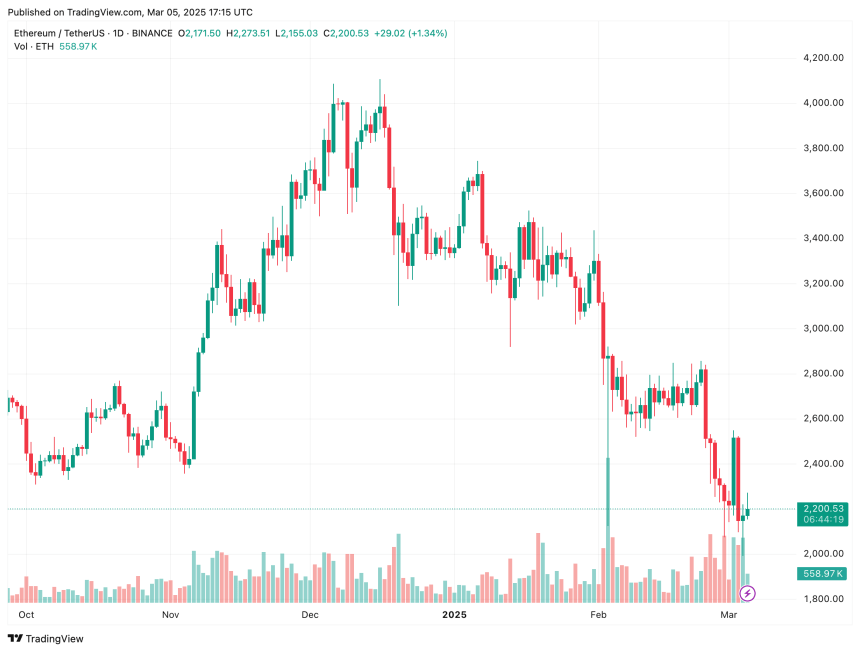

Ethereum has dropped almost 20% in the past two weeks, from around $ 2,805 on February 23 to just over $ 2,200 at the time of the editorial staff. This drop eliminated $ 80 billion from ETH’s market capitalization.

Related reading

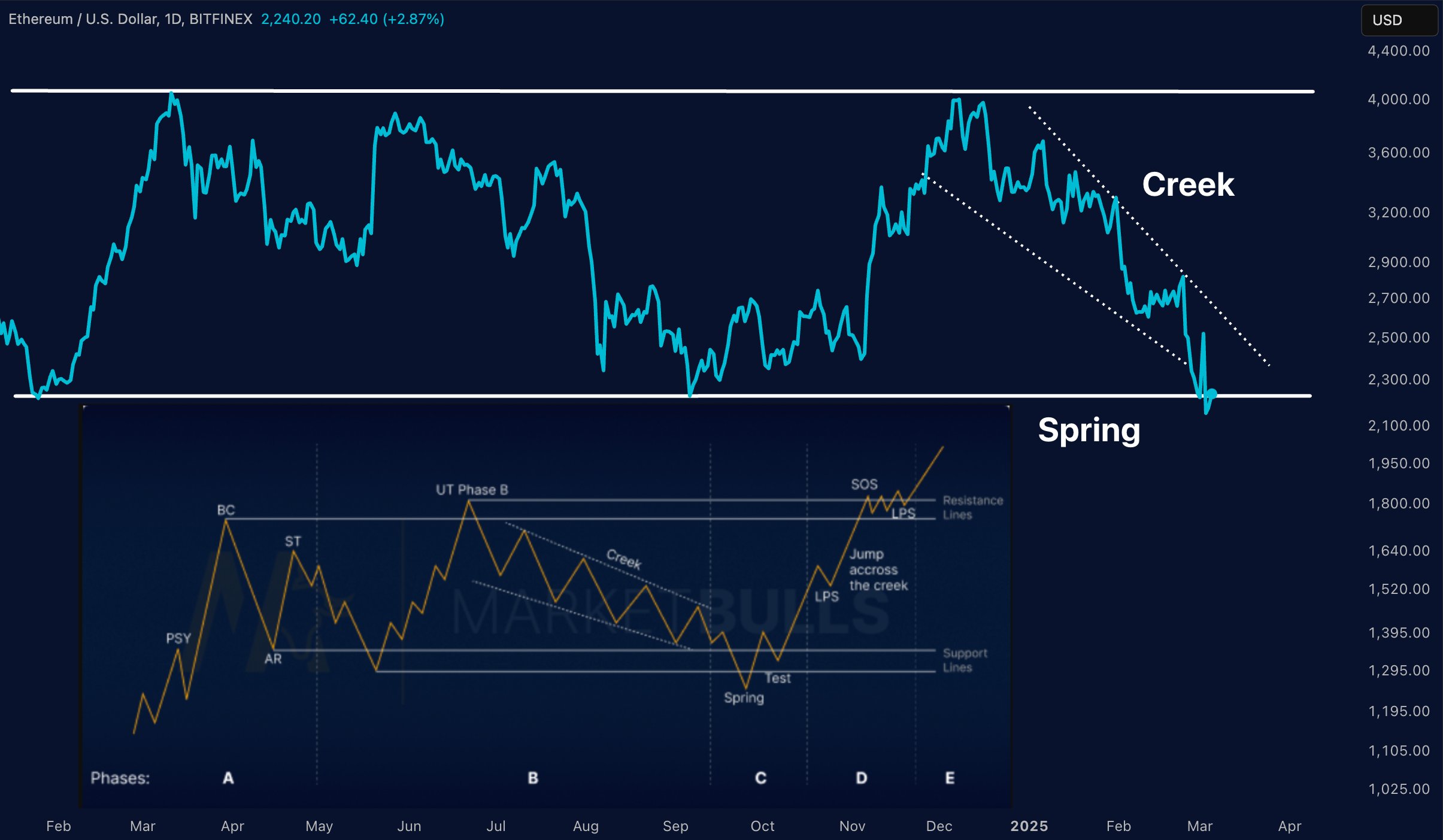

Despite this lively withdrawal, cryptographic analysts point to several bruise indicators which could point out an imminent price reversal. Analyst of Crypto Merlijn the merchant, for example, has highlighted This ETH follows the Wyckoff reactile model.

For those who are not familiar, the Wyckoff reactive model is a technical analysis method developed by Richard Wyckoff. In the context of the action of current ETH prices, this model suggests that assets can enter an accumulation phase before a potential ascending movement.

The analyst also noted that the “spring phase” has just been triggered – indicating a possible bear trap where a brief drop below the support levels mislead the sellers, potentially preparing the ground for a rally. A rebound of this level could see ETH climb to $ 4,000.

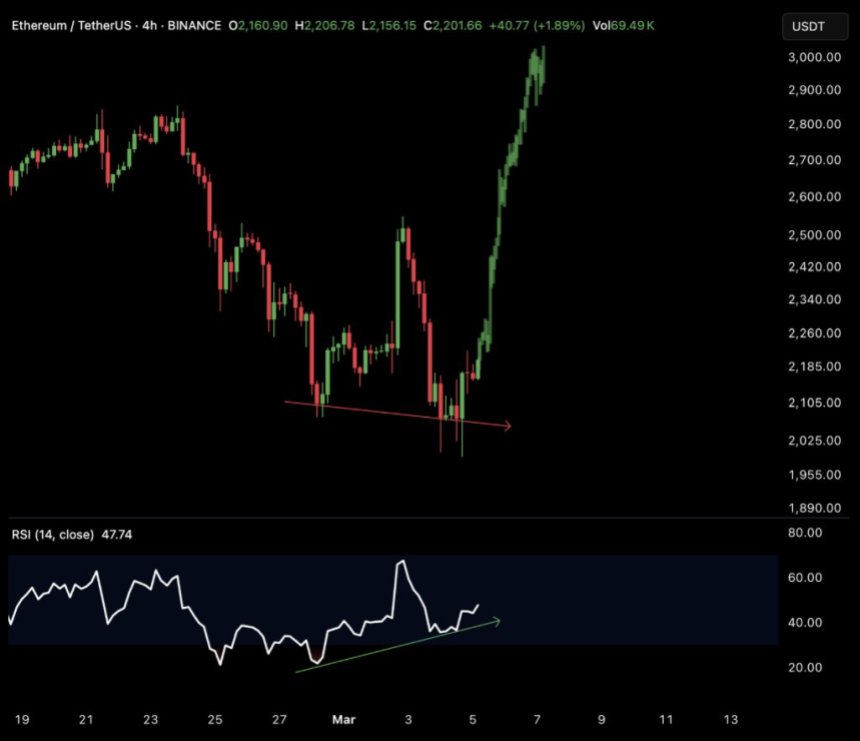

In a separate X jobMerlijn The merchant also underlined a bullish divergence in the 4 -hour table of Ethereum. According to the analyst, the immediate objective of the ETH is $ 2,700 before rising higher. Other Cryptogoos Cryptogoos analyst echo These feelings.

Beyond the technical indicators, the activity of the whales added to the bullish feeling surrounding the ETH. In a post X, the Crypto Ted analyst note::

Ethereum Whale bought 17,855 Ethn worth $ 36,000,000 at an average price of $ 2,054. Total holding $ 2,530,000 Ethereum. Do you think it drops? Be careful again.

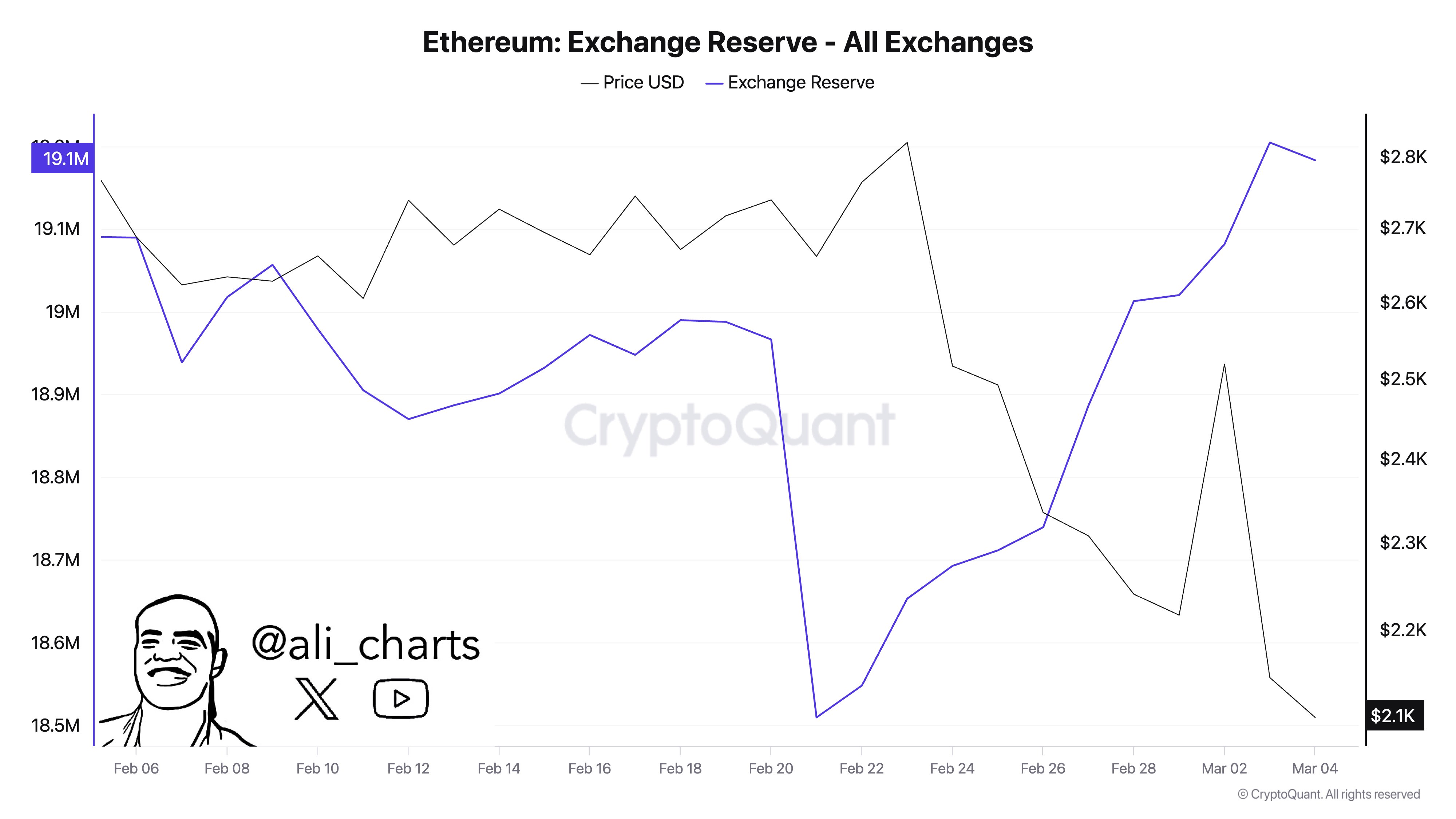

Increasing exchange reserves can spoil the party

On the lower side, the Crypto analyst Ali Martinez sharp that ETH reserves on exchanges increased regularly. In the past two weeks, more than 610,000 ETH have been transferred to the scholarships, which could increase the sales pressure.

Martinez’s analysis aligns with a recent report This has revealed that, although the relative force index of the ETH (RSI) is in a multi -year hollow, there could still be descent in store for digital currency.

Related reading

Indeed, ETH was spoiled By a significant lowering feeling because of its relatively low price performance in the past two years compared to cryptocurrencies such as Bitcoin (BTC), Solana (soil) and XRP.

However, an extreme lowering feeling could act as a contrary signal, setting The scene for a surprise rally. At the time of the press, the ETH is negotiated at $ 2,200, up 6% in the last 24 hours.

Star image of Unplash, X graphics and tradingView.com