After failing to reach a new summit of all time (ATH) of $ 5,000 in August 2025, Ethereum (ETH) could finally be ready to break the price level psychologically important. A drop in the open interest of the Binance suggests that the ETH is probably close to a local background, ready for its next step.

Ethereum open interest drops, is the local background close?

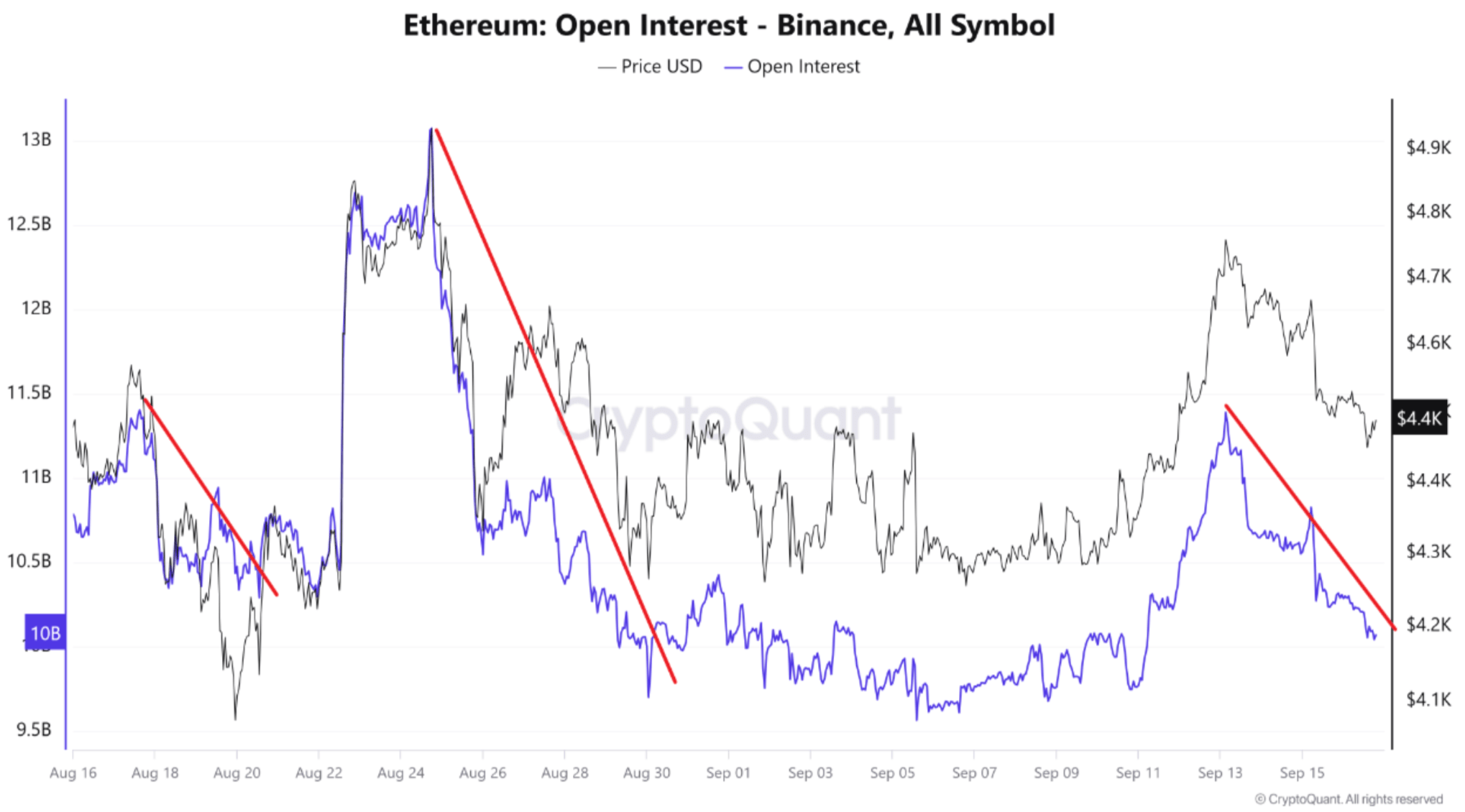

According to a cryptocurrency quicktake by the contributor Burakkesmeci, Ethereum can approach a local background. The analyst referred to the metric of the time period of the open interest of Binance ETH (OI) for their analysis.

Related reading

In their analysis, Burakkesmeci noted that according to the metric of the ETH OI of the Binance, the local funds were formed with an average drop of 14.9% in the last three months. On the spot market side, these corrections generally led to an average drop of 10.7%.

The analyst said that ETH OI decreases have generally reported price corrections in advance. For example, on August 17, the Binance ETH OI increased from 11.4 billion to $ 10.2 billion, which represents a drop of 10.52%.

Similarly, on August 20, the ETH OI of Binance increased from $ 13 billion to $ 9.7 billion, a correction of 25.38%. The last major major in Binance ETH OI was observed on September 13, when it increased from $ 11.39 billion to $ 10.4 billion. The analyst concluded:

So, we can say this: when the cash supply rallies are supported by the long -term side, the trend progresses healthier – just like a flying plane with two wings. In the opposite scenario, Oi signals potential corrections. Binance ETH OI (measured on the highest volume exchange, acting as a main indicator) gives us a chance to catch local stockings early.

The analyst added that on the basis of recent trends, it can be assumed that the ETH OI of the Binance can decrease to $ 9.69 billion. He also suggests that ETH is currently in the local local area. However, the price of ETH can fall more before finding its local background.

Does ETH send $ 6,800?

Meanwhile, his other cryptocurrency analyst, Pelinaypa, noted that the Fund market premium (FMP) remained mainly neutral or positive between July and September 2025 – indicating a renewed institutional request. During the same period, ETH increased from $ 2,500 to $ 4,400.

Related reading

For the uninitiated, the FMP in the context of Ethereum measures the price difference between the term contracts and the cash market. Currently, with dominant positive bonuses, the market has solid institutional support for ETH. Pelinaypa added:

This environment could help Ethereum maintain stability greater than $ 4.4,000 and potentially maintain upward momentum. Major target $ 6.8K.

In addition, ETH exchange reserves continue Exhaust at a quick pace. Recent analysis by another cryptocurrency contributor named Arabic chain foreseen ETH to receive $ 5,500 in September.

That said, the current break in the rally of Eth remains a concern. At the time of the press, the ETH is negotiated at $ 4,491, up 0.8% in the last 24 hours.

Star image of UNPLASH, cryptocurrency graphics and tradingView.com

(Tagstranslate) Altcoin

Source link