Ethereum is showing signs of strength on two critical fronts at once. On-chain activity has reached record levels, reflecting higher real-world usage across the network, while the long-term technical structure is leaning towards continued upwards.

Together, these signals suggest that Ethereum’s current phase could be more than just a sideways move, as the underlying data indicates sustained demand and constructive price behavior.

Related reading

Ethereum Daily Transactions Hit New High

Ethereum price action is turning bullish with a steady increase in recent days. Notably, on-chain data shows that this increase comes on top of consistent on-chain activity in recent days.

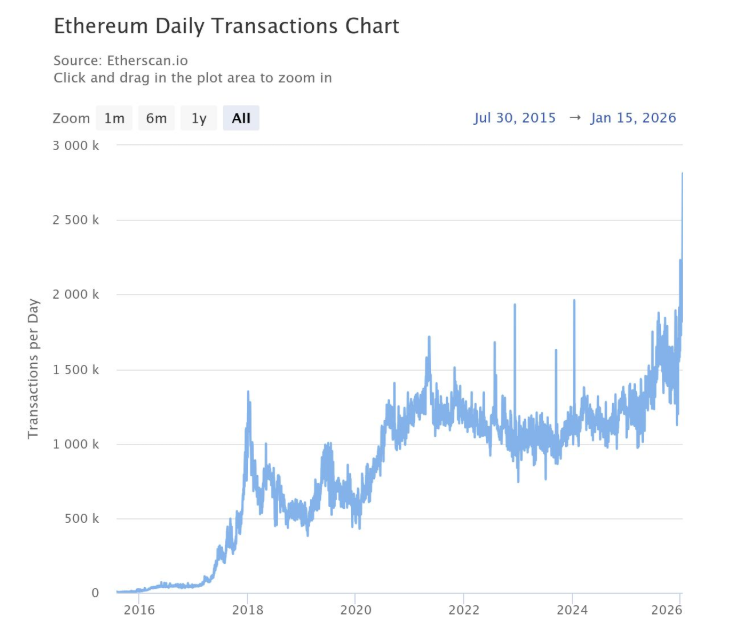

Data from Ethereum’s on-chain activity shows that daily transactions recently climbed to around 2.8 million, setting a new all-time high for the network. Interestingly, this figure is not only a record high, but also because it is approximately 64% higher than the daily trading levels seen during the peak of the 2021 bull market.

Chart data from Sentora illustrates a progression showing Ethereum’s transaction count steadily increasing over the years and increasing in early 2026.

Comparison of transaction activity to 2021 adds more context given the intense activity the Ethereum network was witnessing at the time. At the time, Ethereum was at the center of an altcoin season and an NFT boom, all of which contributed to an increase in transaction activity and a push to new price highs.

The fact that Ethereum is now processing significantly more transactions per day compared to 2021 shows that its network usage has moved beyond speculative behavior. The steady increase in transaction activity shows the scale of the use of decentralized finance and stablecoin settlement, among others.

Ethereum daily transactions chart. Source: @SentoraHQ on X

Ethereum reaccumulation in a macro bullish trend

Technical analysis of Ethereum market capitalization over a three-week candlestick period shows that the cryptocurrency is still trading in a stability zone. In particular, technical analysis made by a crypto analyst Egrag Crypto suggests Ethereum is present reaccumulation in a macro bullish trend.

A look at the 3-week time frame shows that the ETH market cap is holding above the 21 EMA, respecting the ascending macro trendline, printing higher highs and lower lows, and compressing below historical resistance. This is constructive behavior, not weakness.

History shows that periods where Ethereum’s market cap remained above the 21 EMA over this period led to expansion phases, while sustained moves below marked bear market conditions.

Related reading

Currently the structure indicates the The support of the EMA is defended. From a probabilistic perspective, the current pattern leans toward continuation rather than collapse. A move through the overhead resistance band would likely confirm an expansion phase and allow Ethereum to continue a 70-75% bullish continuation.

ETH market capitalization. Source: @egragcrypto on X

On the other hand, a bearish outcome will become possible if the price action loses the 21 EMA on the three-week chart. This could validate a deeper 25-30% correction towards the lower trendline, but this scenario carries a lower probability.

Featured image from Unsplash, chart from TradingView