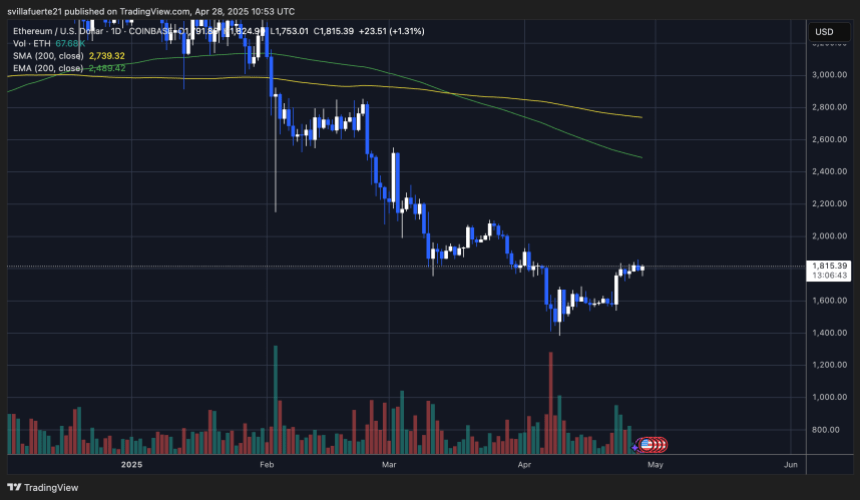

Ethereum is now faced with a critical test because it is negotiated in a tight beach, seated below the resistance of $ 1,850 and above the $ 1,750 support. After a strong resumption of the level of $ 1,400 earlier this month, the Bulls managed to stabilize the action of the prices, but the real challenge takes place now. To confirm a sustainable upward structure, Ethereum must decisively recover the level of $ 2,000 in the coming days.

The feeling of the market remains cautious as Ethereum is consolidated below the resistance while macroeconomic uncertainty continues to weigh on risk assets. Top Crypto Analyst Big CHEDs shared information on X, highlighting a technical concern: Ethereum displays a 4 -hour divergence of bear on the balance sheet volume indicator (REBR), as well as a higher shadow structure.

With the volatility that should increase and merchants, closely monitoring a break or a rupture, future sessions could define the trend of Ethereum for the coming weeks. The bulls must act quickly to maintain the momentum and prevent the bears from regaining control.

Ethereum beats the resistance while the bulls try to keep control

Ethereum begins to show the first signs of a bullish structure on the low -time deadlines, giving the bulls of hope for a wider recovery. After pushing from the local hollow of $ 1,400, ETH managed to maintain the key mobile averages and to consolidate in a tight beach. However, the market remains very cautious and the sales pressure could increase rapidly if the bulls did not recover higher levels.

The momentum has moved in favor of Ethereum in recent days, and several analysts call for a potential massive escape if the key resistance levels are violated. A confirmed escape greater than $ 1,850 could open the door to a rapid return to the psychological level of $ 2,000. Nevertheless, the risks remain high and an opposite downward vision suggests that Ethereum could review the area of $ 1,300 if the bulls lose control.

CHED’s critical ideas emphasize that Ethereum forms a 4 -hour divergence on the balance sheet volume indicator (REBR). This, combined with the appearance of a higher shadow on the local structure, signals weakening the purchase pressure. According to CHEDS, a short position could be triggered if Ethereum loses the support area of $ 1,750, which would confirm ventilation of the current consolidation model.

Technical details: Key levels to change the structure

Ethereum is negotiated at $ 1,815 after days of tight consolidation and modest ascending movement. The Bulls managed to defend the support range from $ 1,750 to $ 1,800, but the real test remains to come. To move the wider lower structure into an increased trend confirmed, Ethereum must recover the level of $ 2,100. Without this break, the rallies are likely to be considered a temporary relief in a wider drop trend.

Holding above $ 1,800 is essential in the coming days. A firm base above this area would help strengthen a high demand and create the necessary conditions for a sustained recovery gathering. The bulls earn a short -term momentum, but they are still faced with a market darkened by macroeconomic uncertainty and a cautious feeling.

If Ethereum does not maintain support at $ 1,750, lower risks will increase rapidly. The rupture below this area could trigger a net sale, probably sending ETH to the bar of $ 1,500. As the market shows signs of force, Ethereum’s next decision will be decisive. He will determine if he can join a greater recovery trend or continue to struggle in a volatile and uncertain environment.

Dall-e star image, tradingview graphic

(Tagstotranslate) Eth (T) Ethereum (T) Ethereum Barith Signal (T) Ethereum News (T) Ethereum Price Analysis (T) Ethereum Recovery (T) Etheruem Prix (T) Ethusdt

Source link