Ethereum has recovered from the $3,240 level and is currently testing the $3,150 area as support, a key area that traders are watching closely. Bulls are attempting to defend this level after a modest rebound, but uncertainty remains high as the market attempts to establish direction after weeks of volatility and aggressive selling pressure. While some analysts view this consolidation as the first stages of a recovery, others warn that ETH could still be vulnerable to larger pullbacks if momentum does not strengthen.

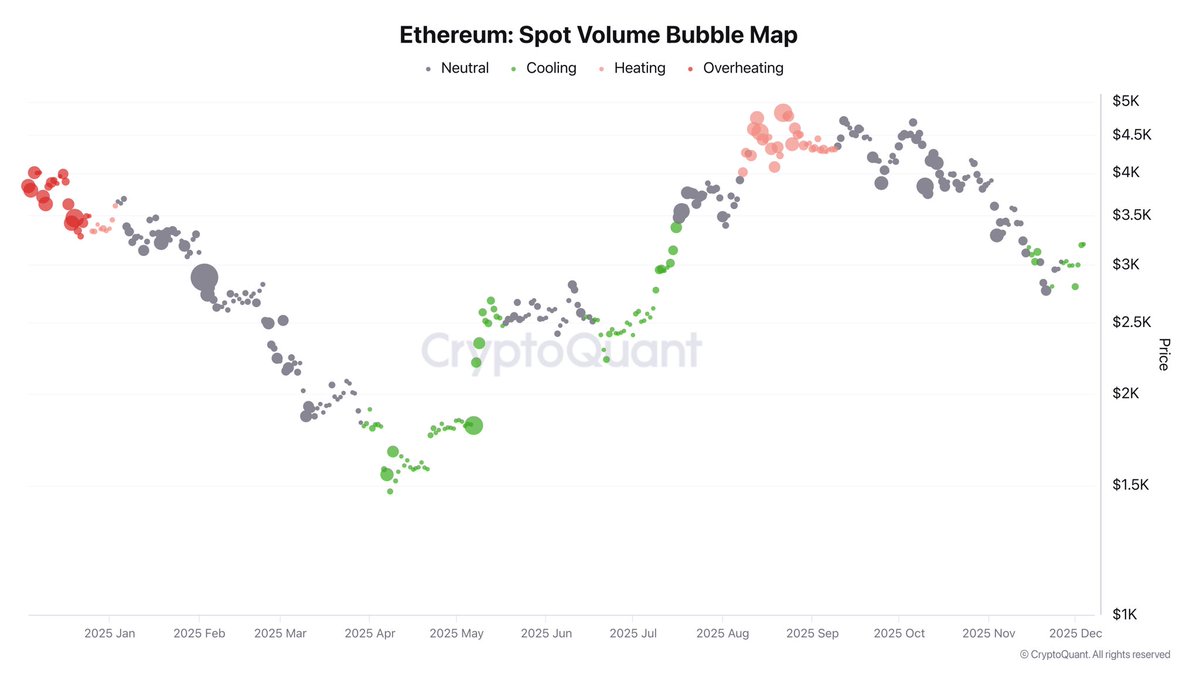

According to lead analyst Darkfost, Ethereum’s recent price action is shaped by a notable change in market structure. Over the past few days, spot volumes continued to decline, even as the price attempted to recover slightly. This weakening of spot activity reduces the impact of actual buying and selling on the underlying asset, making futures markets increasingly influential in shaping short-term price direction.

As Darkfost explains, when spot volume declines, futures often become the primary driver of volatility. This dynamic can accelerate both upward and downward movements, depending on traders’ positioning. With Ethereum now at a critical support level, the market awaits clearer signals to determine whether this rebound can evolve into a sustainable recovery or simply represents a temporary pause in the downtrend.

Future-focused momentum raises the stakes for Ethereum

Darkfost expands on this dynamic by noting that when spot volumes decline as much as those seen in recent days, the risk of increased volatility rises sharply. Low spot liquidity means fewer buy and sell orders are available to absorb sudden moves, allowing futures-driven momentum to exert an outsized influence on prices. This environment often produces sharper swings and rapid changes in direction as leveraged traders and algorithmic strategies dominate short-term market behavior.

For now, the futures market is tilting higher, providing constructive strength that helps Ethereum hold above the $3,150 support zone. Darkfost points out that this upward pressure from futures could work in favor of the bulls, as volatility, if extended higher, could push the spot market to follow the same trajectory.

In other words, a sustained futures-led rebound could provide the spark needed for a broader recovery, particularly if spot buyers regain confidence and begin to re-enter the market.

However, this setup cuts both ways. Without greater spot participation, any reversal in futures positioning could quickly translate into accelerating downward pressure. For now, Ethereum is in a tricky phase where volatility is both a potential catalyst and a potential threat, making the next few sessions crucial in determining the near-term direction of the market.

ETH Weekly Structure Holds Key Support

Ethereum’s weekly chart shows a market attempting to stabilize after a sharp decline from the $4,500 region. ETH rebounded towards $3,140, reclaiming its 100-week moving average (green line) – a historically important support level that often defines the boundary between bull and bear phases in the medium term. This rebound signals renewed demand in a critical area, especially after the strong wick rejection seen near $2,700, where buyers moved in aggressively.

However, Ethereum still faces significant resistance overhead. The 50-week moving average (blue line), now hovering between $3,400 and $3,500, has become resistance and remains the next major obstacle for the bulls. A successful recovery of this zone would significantly improve the technical structure of ETH and open the door to challenge at higher levels. Until then, the weekly trend remains neutral to slightly bearish.

The volume offers an encouraging signal: the recent rebound occurred with a notable uptick in buying activity compared to previous weeks, suggesting renewed interest at these lower levels. Still, the broader structure shows a trend toward lower highs since August, meaning ETH needs to show follow through to avoid falling back into deeper consolidation.

Featured image from ChatGPT, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.