ETHZilla (NASDAQ: ETHZ) officially launched its first tokenized aviation product on Thursday, offering investors equity in leased commercial aircraft engines. The new Eurus Aero Token I marks the company’s strategic pivot from operating strictly as a crypto treasury to on-chain real-world asset (RWA) management.

The offering allows qualified investors to hold part ownership in two CFM56 engines currently leased to a major U.S. airline. By leveraging the Ethereum Layer 2 Arbitrum network, the company aims to democratize access to institutional-grade aviation financing, an industry typically reserved for the private equity and institutional credit markets.

This initiative follows the growing industry trend of institutionalizing tokenized assets. It uses blockchain to streamline settlement and increase the liquidity of traditionally illiquid infrastructures.

🛫Eurus Aero Token I from ETHZilla Aerospace is live. Aviation meets Blockchain. Real jet engines. Actual rental income. Real yield.

✈️CFM56 engines with major US airline

💵~Target rate of return of 11% based on holding for the entire lease term

🇺🇸 Monthly payments in USD… pic.twitter.com/zy2BkljrSH– ETHZilla (@ETHZilla_ETHZ) February 12, 2026

EXPLORE: What is the next crypto to explode in 2026?

Eurus Aereo Token I: token structure and financial projections

The Eurus Aero Token I is priced at $100 per unit with a minimum purchase of 10 tokens. The issuance is accessible exclusively via the Liquidity.io platform on Arbitrum, with ETHZilla targeting an annualized return of 11% over a lease term extending to 2028. The tokens are backed by the physical value of the two engines, rental receivables and a put/call option of $3 million per engine exercisable at the end of the lease.

Monthly distributions will be paid via smart contracts when funds become available. The $12.2 million purchase of the engines in January was financed by liquidating a portion of the company’s Ether cash. This operational shift comes as DeFi infrastructure integrates more deeply with traditional financial models, moving beyond simple speculation to manage assets in cash flow.

McAndrew Rudisill, Chairman and CEO of ETHZilla, highlighted the usefulness of the structure in a statement:

“Offering a token backed by leased engines to one of the largest and most profitable US airlines provides a strong use case in applying blockchain infrastructure to aviation assets with contractual cash flow and global investment demand.”

DISCOVER: Best Solana Meme Coins by Market Cap 2026

A Strategic Shift in On-Chain Revenue – Why ETHZilla Shifted to Tokenized Jet Engine Products

Crypto continually adapts and ETHZilla’s evolution from tokenized jet engine products highlights the volatility and opportunistic shifts within the small-cap crypto stock sector. Originally a biotechnology company known as 180 Life Sciences, the company pivoted to a crypto treasury strategy before adopting its current RWA focus. The company plans to expand its on-chain portfolio to include manufactured home loans and short-term auto loans.

This aggressive move towards the use

ETH

$1,954

24h volatility:

1.6%

Market capitalization:

$236.17 billion

Flight. 24h:

$18.99 B

for settlement reinforces Vitalik Buterin’s vision of Ethereum as a base layer for complex financial applications. However, this turning point comes during a complex market cycle where DeFi TVL has faced price pressures and volatility in the underlying assets, which remains a key factor for treasury managers.

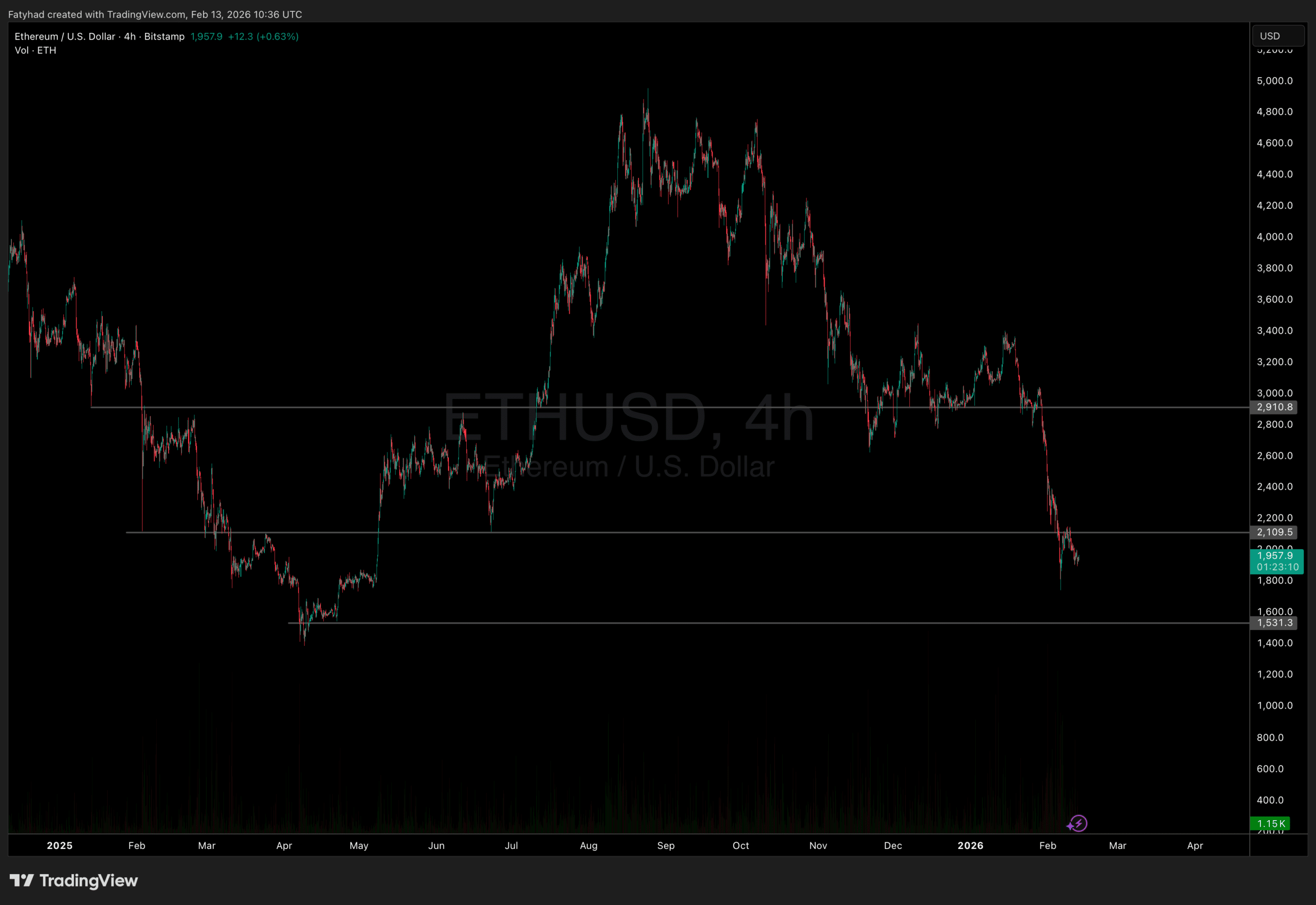

Ethereum Price Analysis Source: TradingView

Successful execution could validate the thesis that high-value physical infrastructure can be efficiently managed on public blockchains.

EXPLORE: 10 new Binance announcements to watch out for in February 2026

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Daniel Frances is a technical writer and Web3 educator specializing in macroeconomics and DeFi mechanics. Hailing from crypto since 2017, Daniel leverages his experience in on-chain analytics to write evidence-based reports and in-depth guides. He holds certifications from the Blockchain Council and is dedicated to providing “insight gain” that overcomes market hype to find real utility for blockchain.