The Fed’s rate cut odds reportedly fell to around 14% after Donald Trump hailed tariffs as a source of American “wealth” and cryptocurrency prices fell in response. Bitcoin and major altcoins were trading nervously as traders reassessed how long they could live with higher U.S. interest rates. This comes compared to a year in which central banks cut rates 32 times globally, so any indication that the U.S. may stay tighter for longer quickly affects stocks and crypto.

What do Trump’s tariff talks and Fed rate cuts have to do with your pieces?

Let’s translate the jargon first. A “rate cut” refers to a reduction in interest rates by the U.S. Federal Reserve. Cheaper money generally helps riskier assets like Bitcoin because borrowing costs fall and dollars look less attractive when held in a bank.

The United States is increasingly an exception. While the US Fed cut its odds to 14%, we saw the Bank of England and ECB cut rates on December 18, totaling 32 global cuts this year by major central banks. Frankly, markets expected the Fed to join this party.

But when the odds of a U.S. rate cut drop to just 14%, traders hear one thing: silver remains expensive. The consequence? This divergence makes the dollar look like a “fortress,” which is exactly what removes Bitcoin’s breakout momentum.

Now add the rates. A tariff is like a tax on imported goods. Trump not only defended them, but he also praised them for their wealth creation. Higher tariffs can push up prices, which can keep inflation persistently high. If inflation remains stable, the Fed has less reason to cut rates. This is why Trump’s comments are important for your Bitcoin stack, even if he never says the word “crypto.”

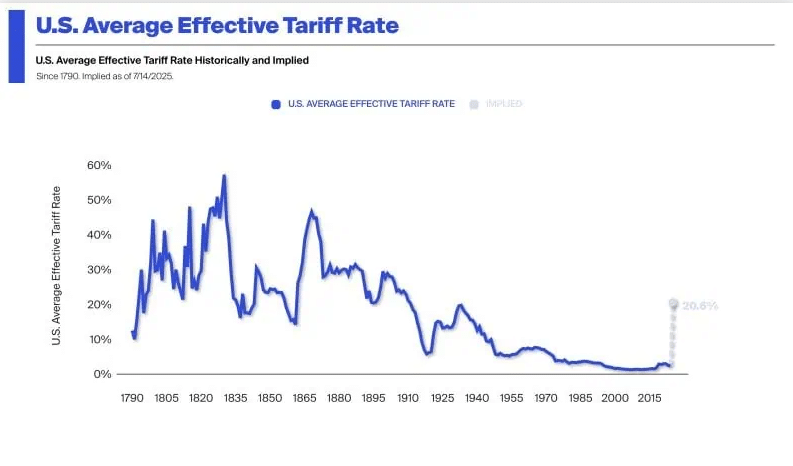

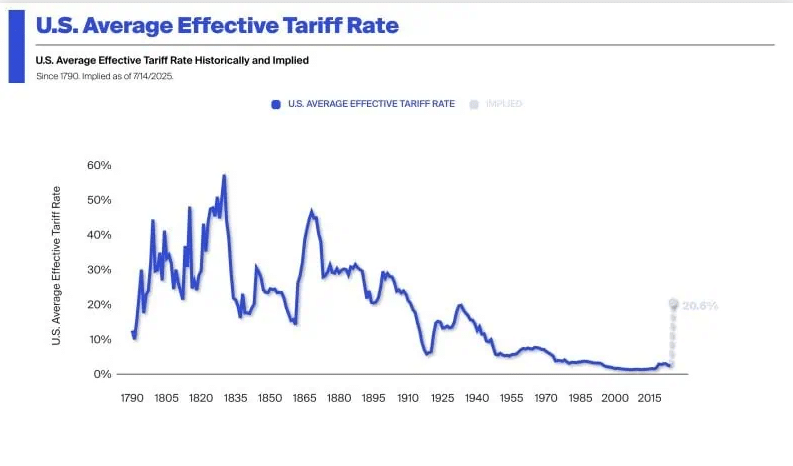

While Trump touts tariffs as “wealth generators,” the data shows a different pressure. THE The effective rate of US customs duties has reached 17% in November 2025, a level not seen since 1935. This is the real reason the Fed is hesitant; they can’t cut rates when a 17% “tax” on imports is actively fueling the fire of inflation.

(Source – Knode Wealth Management, average effective tariff rate in the United States)

We’ve seen this movie before. When headlines about Trump’s tariffs hit the headlines, Bitcoin often swings wildly. Futures markets fell as previous tariffs took effect, and Yahoo Finance reported that BTC “tumbled then exploded” as traders tried to gauge the political chaos.

If you want to learn more about how central banks are acting to hit the price of Bitcoin, check out our coverage of Federal Reserve liquidity and Bitcoin price as well as our guide to rate cuts and crypto outlook for 2026.

What does this macroeconomic shift mean for Bitcoin and Altcoin investors?

When the chances of a rate cut decrease, dollars appear stronger and more secure. This often pushes some money out of Bitcoin, Ethereum, SOL, and smaller coins, especially those with tiny market caps that behave like high-beta tech stocks. Crypto cares about liquidity. Expensive money means less new money to chase the next story.

The Fed has already cut its odds sharply this year, falling to 30% during previous political crises. This type of instability makes traders nervous and shortens their time horizons. They scalp the moves instead of holding patiently.

There is another side of the coin. Tariff tensions and loss of consumer confidence, which AP News reports have hit new lows since the tariffs were introduced, which may prompt some investors to see Bitcoin as protection against political chaos. So we sometimes see a strange mix: short-term sell-offs when rate expectations change, followed by stories of “flight to hard assets”, especially if the dollar starts to wobble again.

If you follow us crypto regulations and policies, this also ties into the broader political story we cover in our article on US crypto regulations, which are changing, and how economic ideas from the Trump era have already shaped Bitcoin reactions..

EXPLORE: Best Meme Coin ICOs to invest in 2025

How Should Beginners Manage Risk When Politics Beats Crypto?

First, treat macro headlines like weather alerts, not trading signals. They’re important, but overreacting to every Trump quote or Fed ratings change usually ends with FOMO buying at the top and panic selling at the bottom.

Second, tailor your strategy to your time horizon. Looking at Bitcoin as a multi-year savings experiment, a change in the chance of a rate cut from 30% to 14% is short-term noise. If you trade altcoins based on narratives, this same movement can drain liquidity and make sharp wicks more likely, especially on thin order books.

Third, assess your risk. Never use rent money or emergency savings for this part of your wallet. Treat it like venture capital: high risk, possibly high reward, always optional.

Finally, separate your “macro-education” from your actual buy button. Find out what rate cuts, tariffs, and dollar strength mean so you don’t feel lost when the charts move. The macroeconomic drama will continue to oscillate between fear of tariffs and hope for a rate reduction. If you stay focused on education, position sizing, and time horizon, rather than reacting to hot takes, you turn that noise into context rather than chaos.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

Chances of Fed Rate Cut Drop to Just 14% After Praise for Trump Tariffs: Here’s Why Crypto Flinched appeared first on 99Bitcoins.