- FET experienced a sharp drop to $ 0.34 during the recent market -scale sale, but has since bounced almost 50%.

- Chain data has strengthened the accumulation of stealth and the potential deployment of smart money.

Artificial superintelligence alliance (FET) Naughty with $ 0.34 handle during the recent market -scale sale. However, it has since reversed almost 50%, indicating signs of high demand for decline.

In fact, in the last 72 hours, chain and CEX data shows more than a million FET on the cash market. Therefore, a clear sign of furtive accumulation.

Consequently, market manufacturers now envisage $ 0.34 as a level of structural support, potentially at the front a wider leg.

If the entries persist, can FET prepare the ground for a reversion in small groups to the macro resistance at $ 1 – which was raped at the end of January before the distribution settled?

Weekly growth underlies the IA market trend

On the weekly graphic, the combined market capitalization of IA tokens increased from $ 21.33 billion to $ 24.43 billion, highlighting a strong capital of capital in the last seven days. FET illustrates this trend, presenting a solid price action.

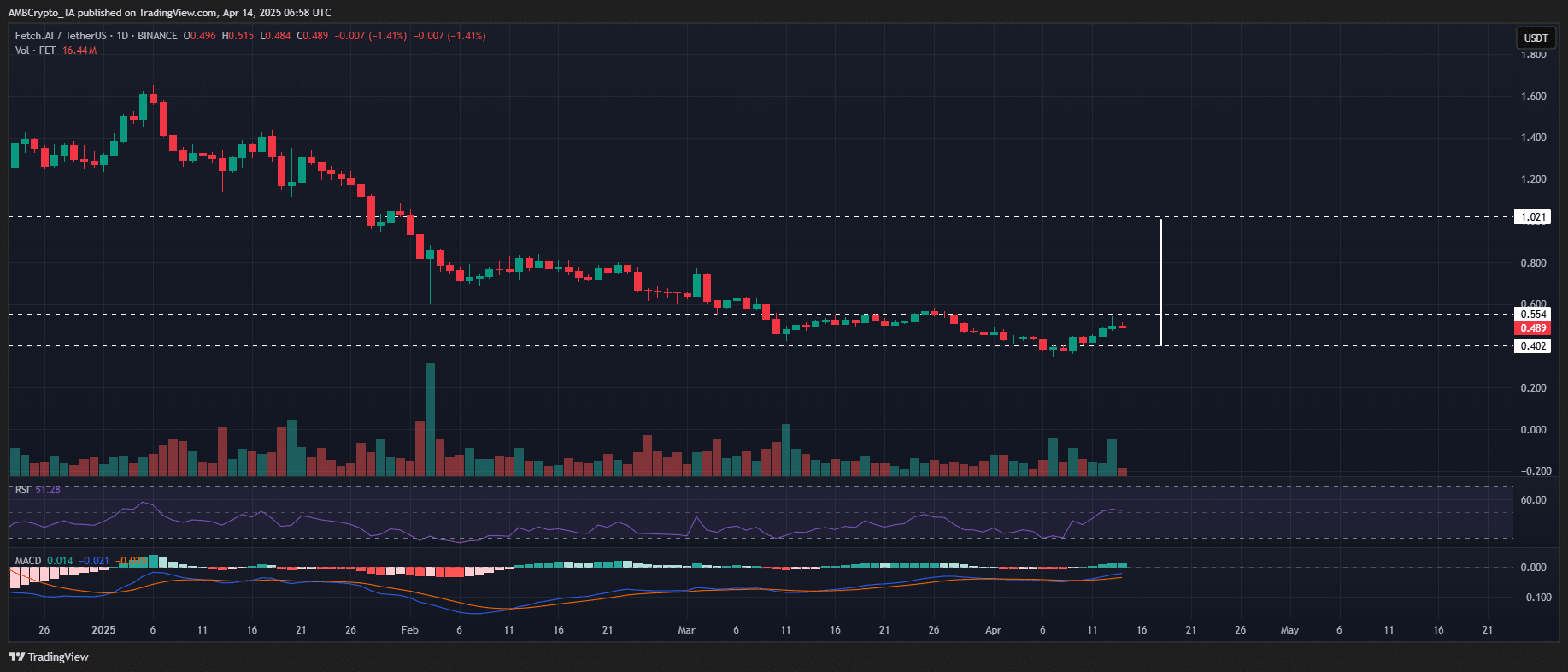

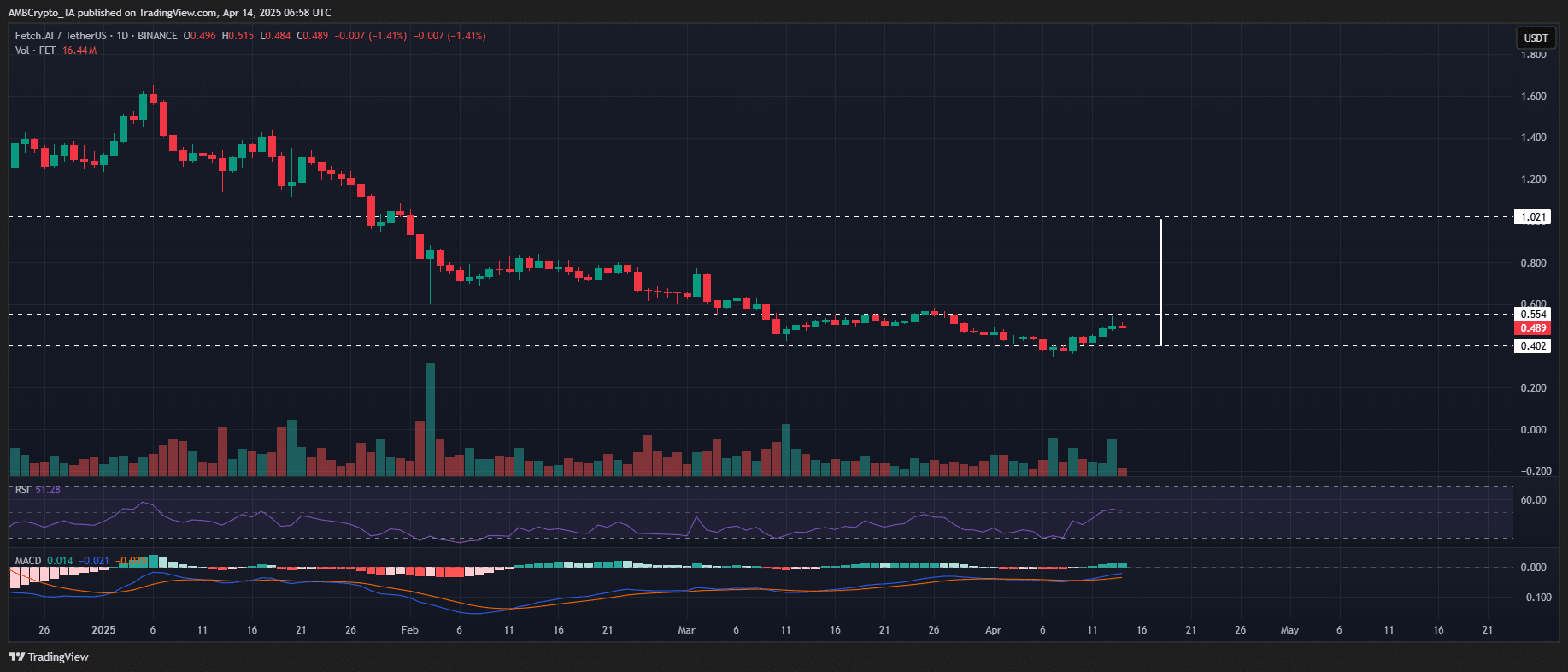

During this period, FET exceeded assets with large capitalization with a rally of 47% to $ 0.54 on April 13. Before this break, its price action was linked to the beach in an accumulation area of several weeks – a configuration of the manual for the expansion of volatility.

Source: TradingView (FET / USDT)

As mentioned earlier, the chain outputs and CEX data validate the move, the accumulation trends signaling intelligent money in front of the break. Meanwhile, while capital continues to turn in majors AI, speculation rises around a retest of all potential time at the end of Q2.

In particular, with FET now classified among the best weekly winners, climbing punctual demand and technical alignment for an escape from the range, $ 0.34 could now be established as structural launchpad.

Does this whole configuration transform the recent “dip” of the award in a high risk / reward opportunity?

FET undervaluation cannot attract the attention of smart money

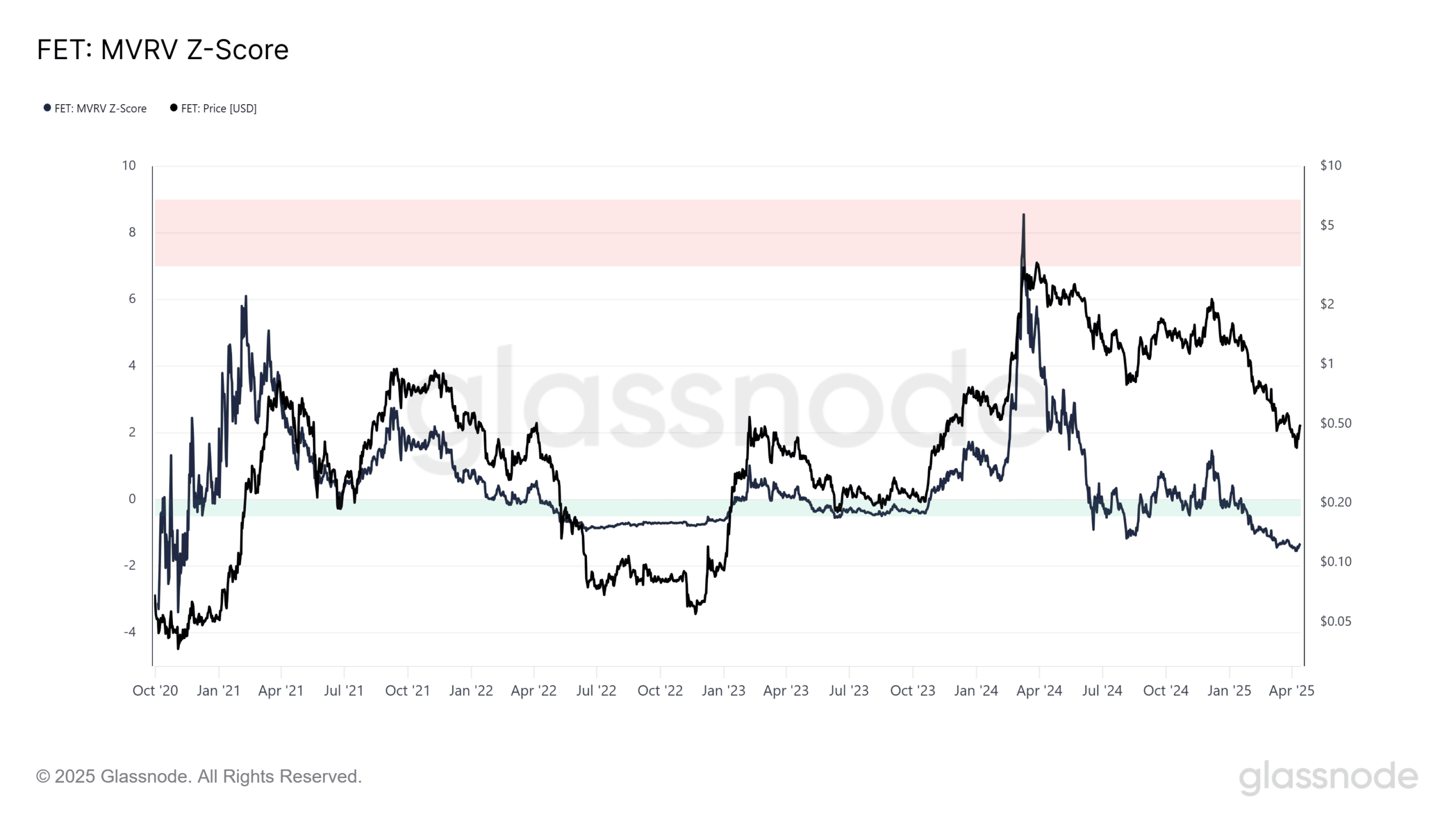

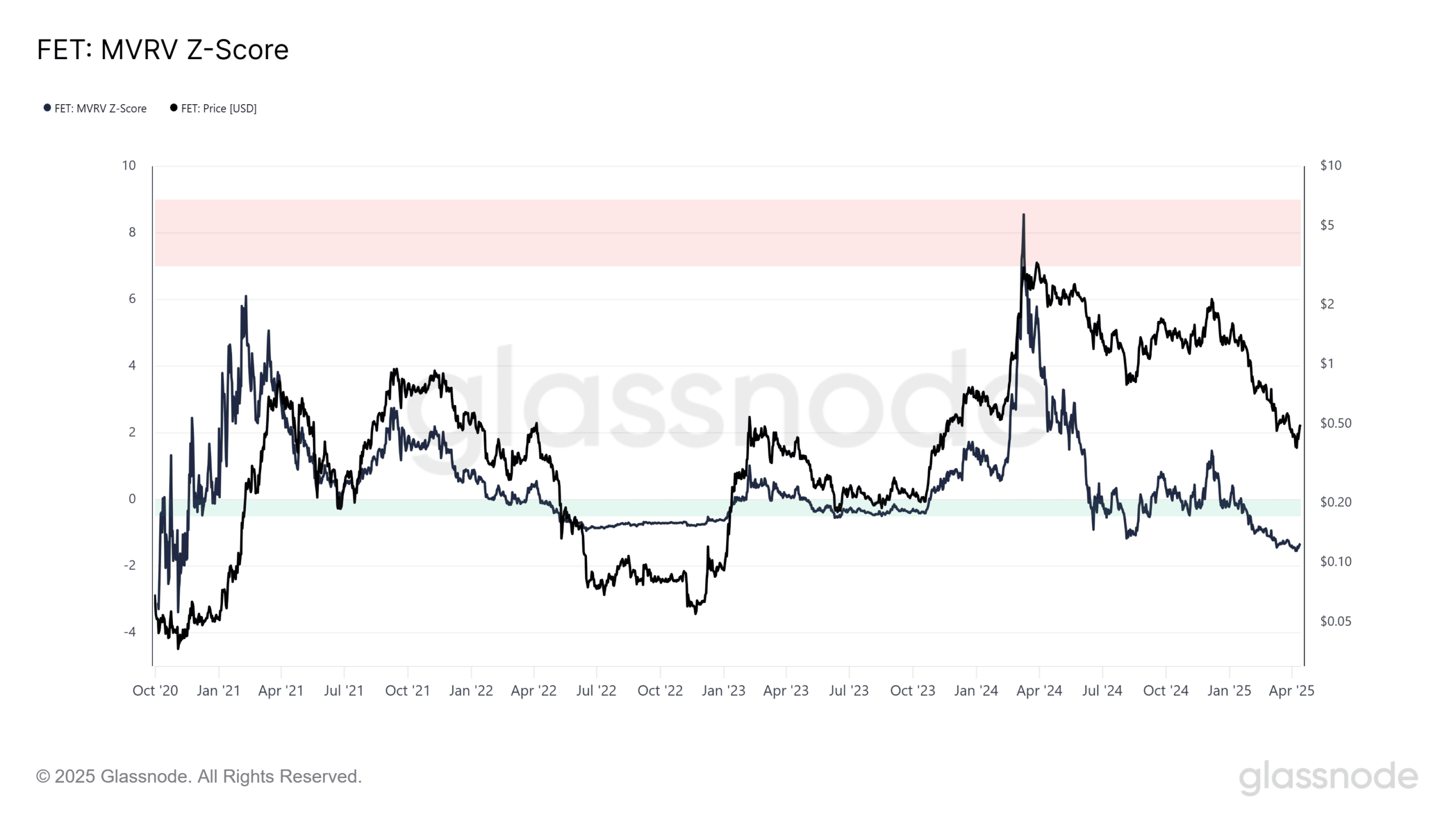

The FET undervaluation is reflected in its MVRV Z-SCORE, which is currently two years lower by -1.50. Consequently, below the green band, a region traditionally indicative of occurrence conditions and potential accumulation areas.

Based on the graph, the level of $ 1.12 aligns with the previous interaction in green band, suggesting a potential local background.

Source: Glassnode

However, FET (NUPL )’s benefit / net loss (NUPL) has remained rooted in red since January 5, when the price share was $ 1.60.

This is correlated with a fibonacci retracement of 70% compared to the January summit, which brought the assets at its current market price of $ 0.50, which indicates an extended phase of stock market capitulation.

Why is it important? This correlation shows that the capital of institutional and intelligent money has largely remained on the sidelines, unable to absorb the sale of the sale, which prevented $ 1.12 from serving as a confirmed support zone.

The NUPL, always deeply negative, alongside a positive sopr, suggests that taking advantage is always active, showing that the market has not reached exhaustion. In short, the liquidity of the sale remains high.

While the first signs of emerging intelligent currency accumulation, net flows remain insufficient to absorb supply to general costs. This puts $ 0.34 at risk of failure as a structural support – reflecting ventilation at $ 1.12.