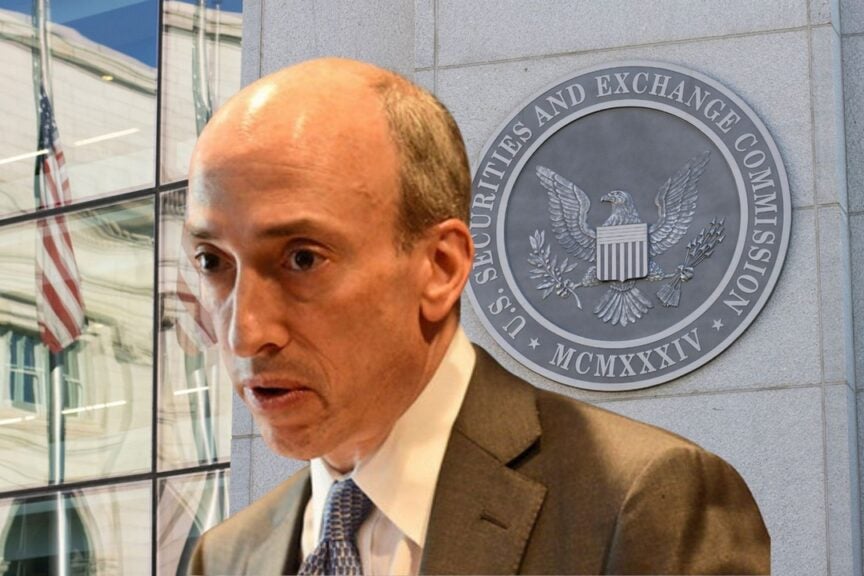

President of the SEC Gary Gensler On Thursday, he defended his regulatory approach to crypto markets, with a focus on investor protection and compliance, hinting at the end of his term as president of the agency.

What happened: In his remarks at the Practicing Law Institute’s 56th Annual Securities Regulation Institute, Gensler noted that his agenda builds on the SEC’s history of crypto oversight, referencing cases such as Ripple XRP/USDand underlined the consistency of the Commission’s actions over the years.

He said that since 2018, about 5-7% of the SEC’s enforcement actions have concerned digital assets, saying the agency’s approach targets specific non-compliant participants rather than the entire crypto market .

He asserted that “court after court” has upheld the SEC’s jurisdiction over offerings involving securities, even in digital form.

Also Read: Investor Loses $25 Million Due to Misplaced Crypto Transfer, Says CEXs Feel Safer

“Everything we have done is to ensure our laws are respected,” Gensler said.

He added that investor protection, through disclosure and monitoring, was a central priority, adding that compliance promotes market confidence.

Highlighting SEC Approval of Bitcoin Futures ETFs in 2021 and Beyond Bitcoin BTC/USD And Ether ETH/USD products, Gensler claimed that these regulated products offer benefits such as lower fees and increased transparency, setting them apart from broader crypto markets.

He also noted that while Bitcoin, Ether, and stablecoins make up a large portion of the crypto market, other assets, often speculative, had yet to demonstrate sustainable use cases.

Gensler closed by thanking the team at the Securities and Exchange Commission, noting that it has been a “great honor to serve with them, doing the work of the people and ensuring that our capital markets remain the best in the world “.

And then: As Gensler’s tenure comes to an end, his approach remains influential. His remarks come as the digital assets community gathers information at events such as Benzinga’s Future of Digital Assets conference on November 19, where discussions around regulation and innovation continue to unfold.

Read next:

Image: Shutterstock

News and market data powered by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.