- Helium sees growth surge that could be linked to its collaboration with traditional carriers

- HNT Bulls Show Up, But Signs Indicate Potential for Natural Correction

Helium is one of the crypto projects that advocates decentralized physical infrastructure (DePIN). However, despite being a pioneer in its segment, the network’s growth has long been limited by the pace of adoption.

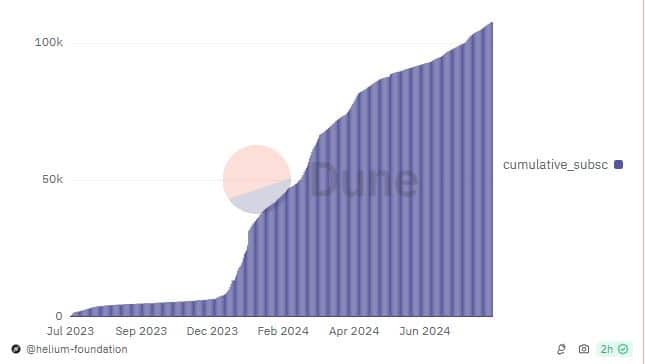

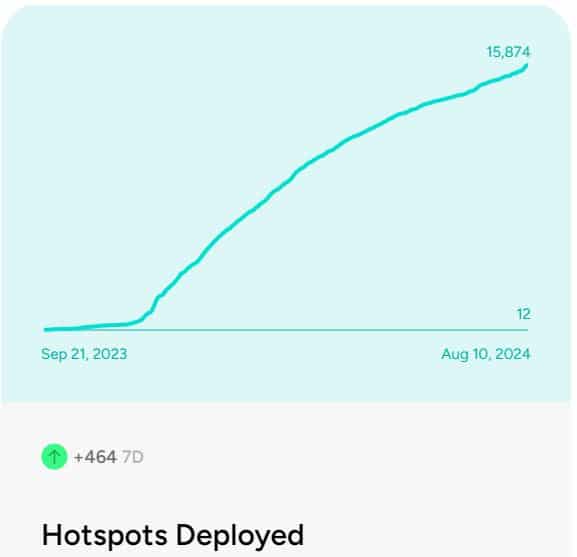

Despite a slow start, Helium adoption is now starting to grow at a faster pace. This is particularly evident in the user growth figures. In fact, the latest data has revealed an acceleration in the pace of adoption over the last 12 months.

Source: Dune.com

Helium’s subscriber base is also growing exponentially. Twelve months ago, the network had fewer than 1,000 subscribers to its unlimited plan. In contrast, Helium now has more than 108,000 subscribers to its unlimited plan, a sign that the company is well into its strong growth phase.

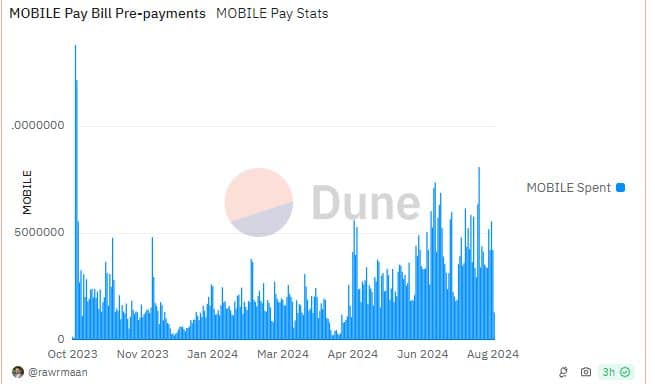

Early mobile bill payments also indicated notable revenue generation. This is also a sign of strong customer retention for Helium.

Source: Dune.com

Discharge subscribers by pumping helium

Today, Helium is exploring growth by leveraging existing carriers. Its new Total Carrier Offload service allows existing mobile operators to leverage Helium’s mobile hotspots to decentralize their offerings. This approach provides Helium with the opportunity to scale rapidly in terms of adoption.

The network is reportedly already working with two operators to test this feature.

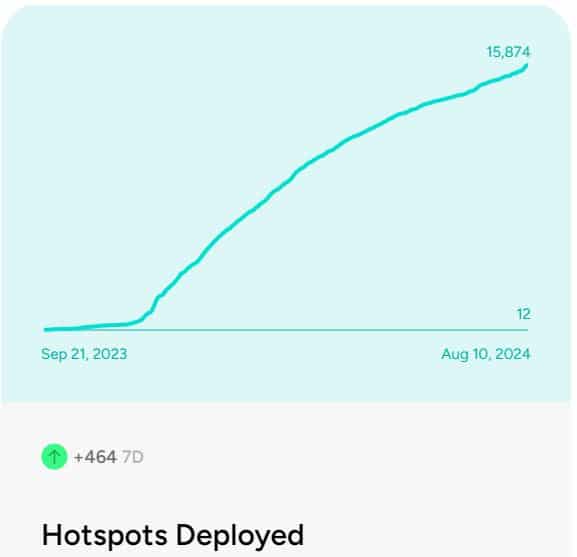

Helium’s physical infrastructure is also expanding rapidly. In fact, the network revealed on its official website that it has deployed nearly 16,000 access points so far.

Source: Hellohelium.com

Access point data showed a strong correlation with subscriber numbers, confirming that the network has adjusted to accommodate more users.

It could also be seen as an indicator that the expansion of the network infrastructure has helped attract more users.

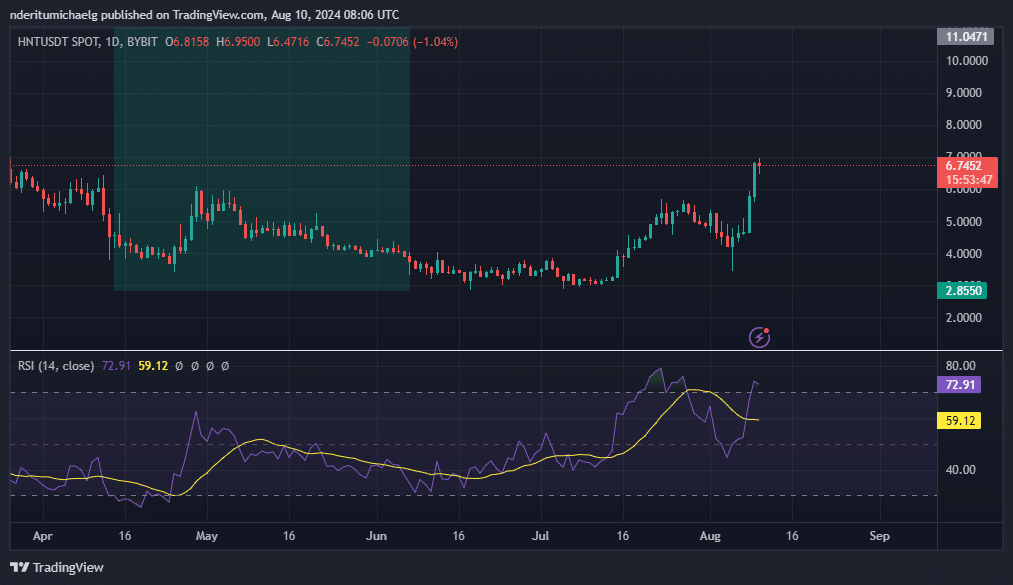

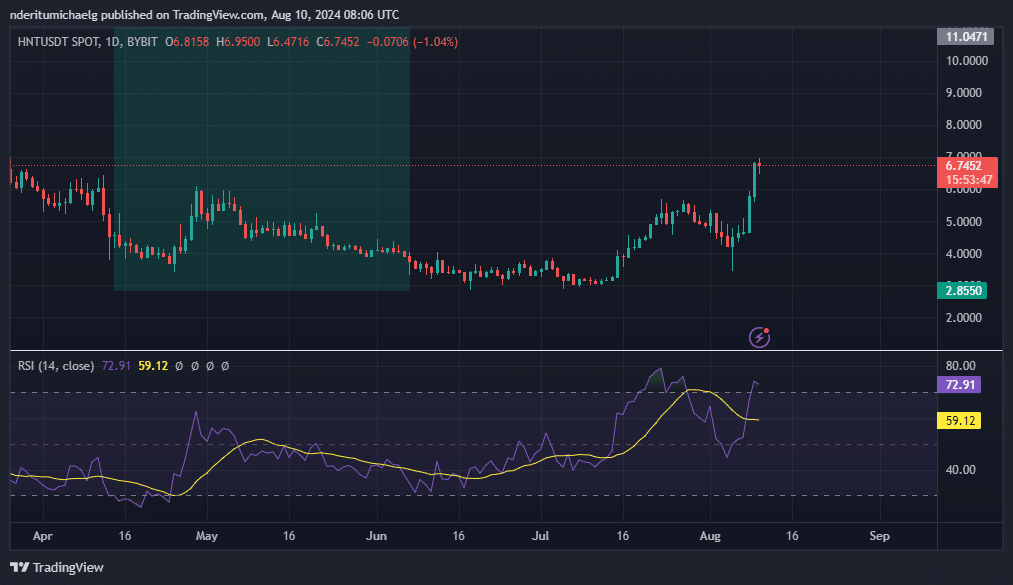

Impact on HNT performance

Helium’s native token, HNT, has been on a generally bullish trajectory since the second week of July. This is a clear sign that it is recovering after going through a tough bearish period that saw it fall from its 2024 high of $11.06. – a 74% discount to the lower range just below the $3 price level.

At the time of writing, HNT was trading at $6.74. This price represented a 133% recovery from its low range.

Source: TradingView

Our analysis, however, indicated that HNT could be under some selling pressure. Indeed, its price was not only overbought, but it also demonstrated a price-RSI divergence. The RSI had a lower high compared to the previous peak towards the end of June, while the price is higher now than it was during its June peak.

While a bearish pullback is on the cards, it is hard to say whether it will be intense or whether it will be able to sustain its current price. This may be because the new pace of growth could encourage HNT holders to hold their securities for longer in anticipation of higher prices.