In one of the most dramatic implosions of recent cryptography events, the mantra OM token crushed 90% in a few hours, wiping $ 5.4 billion in market value. The price collapsed from $ 5.21 to $ 0.50 during the weekend before a brief rebound at ~ $ 1.2 – a flash accident that amazed market veterans, even hardened.

The community quickly compared the event with the historic collapse of Luna, but the data show that the fall of Mantra was only self-inflicted.

Cracks under the surface

Although the immediate trigger for OM’s collapse was a sudden cascade of forced liquidation totaling $ 66.97 million in just 12 hours, it seems that the underlying fragility had been built for months. The Mantra team would have exercised extreme control over OM’s supply, with up to 90% of tokens – About 792 million OM – held in a single portfolio. This has left only 10 to 20% of the total food circulating freely, which makes the token very vulnerable to any significant sales pressure.

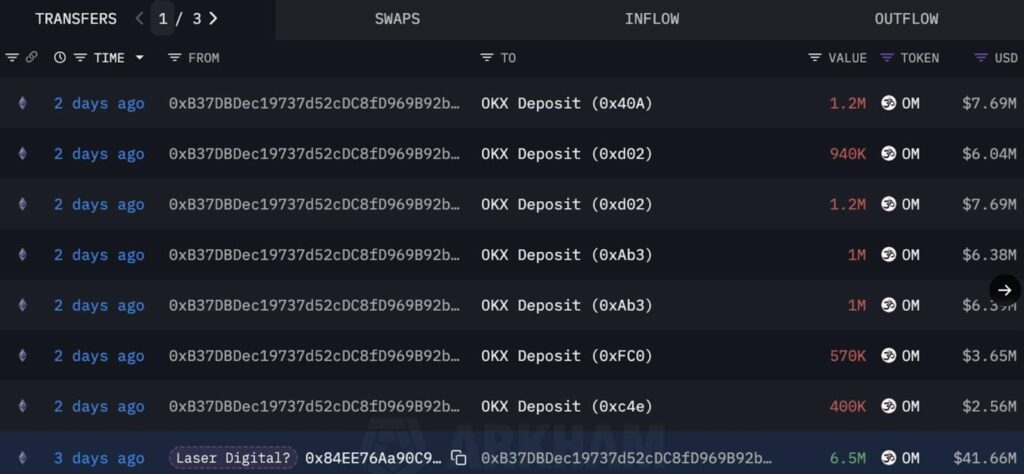

In the days preceding the crash, data on the chain seems to have revealed that 17 portfolios have collectively discharged 43.6 million OM – worth around $ 227 million – to trade, representing 4.5% of the supply in circulation. At the same time, rumors emerged according to which tokens were sold out of exchange at 50% or more discounts, more confidence in the free market.

In the past two days only, a total of 43.6 million $ om tokens were sent to the scholarships, equivalent to … More

These conditions would later open the land for a spiral of liquidity death. When the main holders started out, the already thin control books could not absorb the sudden wave of sales orders, triggering cascade liquidations through exchanges and accelerating the collapse of OM.

“Check the power supply, control the story” – until it breaks

Before the crash, Om seemed almost unstoppable. The token reached a summit of $ 9.04 at the end of February this year and was still in place 825% from one year on the other Just before collapse, according to CoinmarketCap data. The resilience of OM prices, even if wider cryptography markets have corrected, painted a painting of the force that has made the community follow.

With hindsight, it seems to have proven to be largely a fabricated illusion. The tight grip of mantra on the supply in circulation, the aggressive manufacturing of the market and the repeated delays in the distributions of aerial departure – often justified by questionable “attack of Sybil” claims – continued to sell an artificially low pressure. The public image of the project was further reinforced by the announcement of an ecosystem fund of $ 108 million a few days before the crash.

Behind the scenes, however, reality was much more fragile. OM’s liquidity was thin, the property remained very centralized and the outputs of initiates accelerate quietly, all preparing the way for the possible implosion of the token.

The lessons of the collapse of the mantra

The mantra crash is more than an isolated incident – it is a manual case of how the hidden risks can build quietly until they explode. The fine liquidity combined with heavy holders of initiates created a fragile system, where even minor shocks had the capacity to trigger a complete collapse. Sales of over -the -counter discounts of rumors have eroded market confidence, producing swollen assessments that have never been really supported by free market demand.

Flashy growth stories can temporarily support prices, but they cannot hide the underlying structural weaknesses forever. Despite Mantra’s fall, the wider RWA sector remains resilient, the total locked value reaching a record $ 11 billion in the first quarter.

However, Mantra’s fate serves as a brutal reminder: in crypto, control is a double -edged sword. When a handful of players dominate the offer, what is called “price stability” can break almost overnight.