- WLD Continues to take the dynamics of AI with an increase in market capitalization of $ 200 million, fueled by macro and micro-pilots.

- Altcoin faces a key test at the $ 1 threshold, where the violation of this level could trigger a widespread FOMO.

The AI sector notes a strong offer following recent price exemptions on semiconductors and the main technological imports from China.

The artificial superintelligence alliance (FET) is not the only one to benefit – Worldcoin (WLD) capitalizes on momentum, recording a solid gain of 30% for the week.

However, just like Trump’s erratic trade policies, is the WLD rally just another liquidity sweep targeting weak hands, or does it structural to maintain its ground against imminent resistance? Ambcrypto has investigated.

Macro and micro-controller fueling the boom WLD

Worldcoin, launched by AI visionaries behind Chatgpt, continues to capitalize on AI’s account on the sector scale. During last week, the WLD market capitalization increased by almost $ 200 million, currently oscillating nearly $ 945 million. Consequently, a clear sign of acceleration of capital entries.

In fact, with a circulating offer of 1.25 billion, a recovery of the level of $ 0.80 vaultrait in territory in mid-cap.

Enimony indicators strengthen optimistic continuation. At the time of the press, RSI remained in neutral territory but pointed out north, while MacD was close to turning up bull.

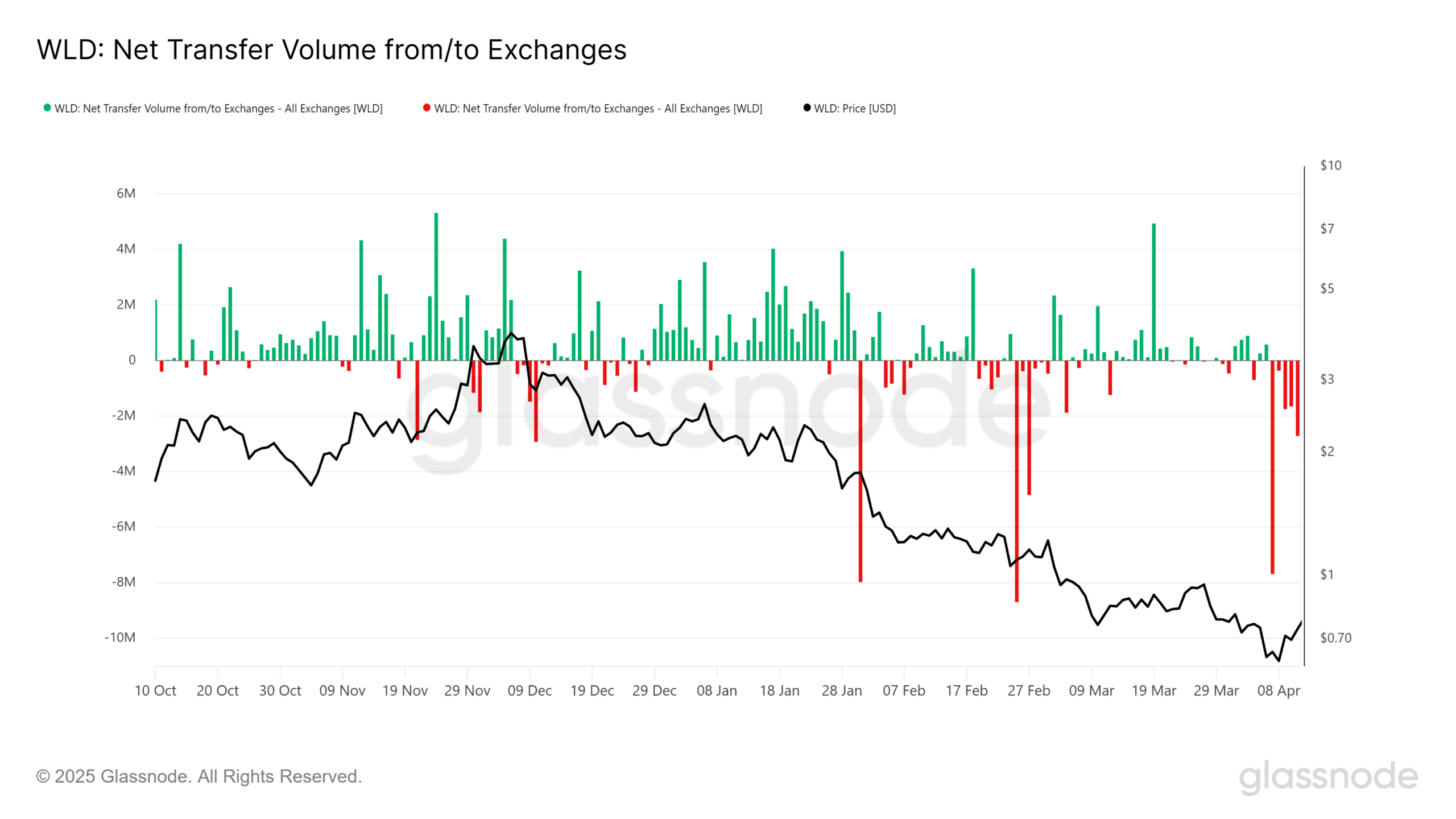

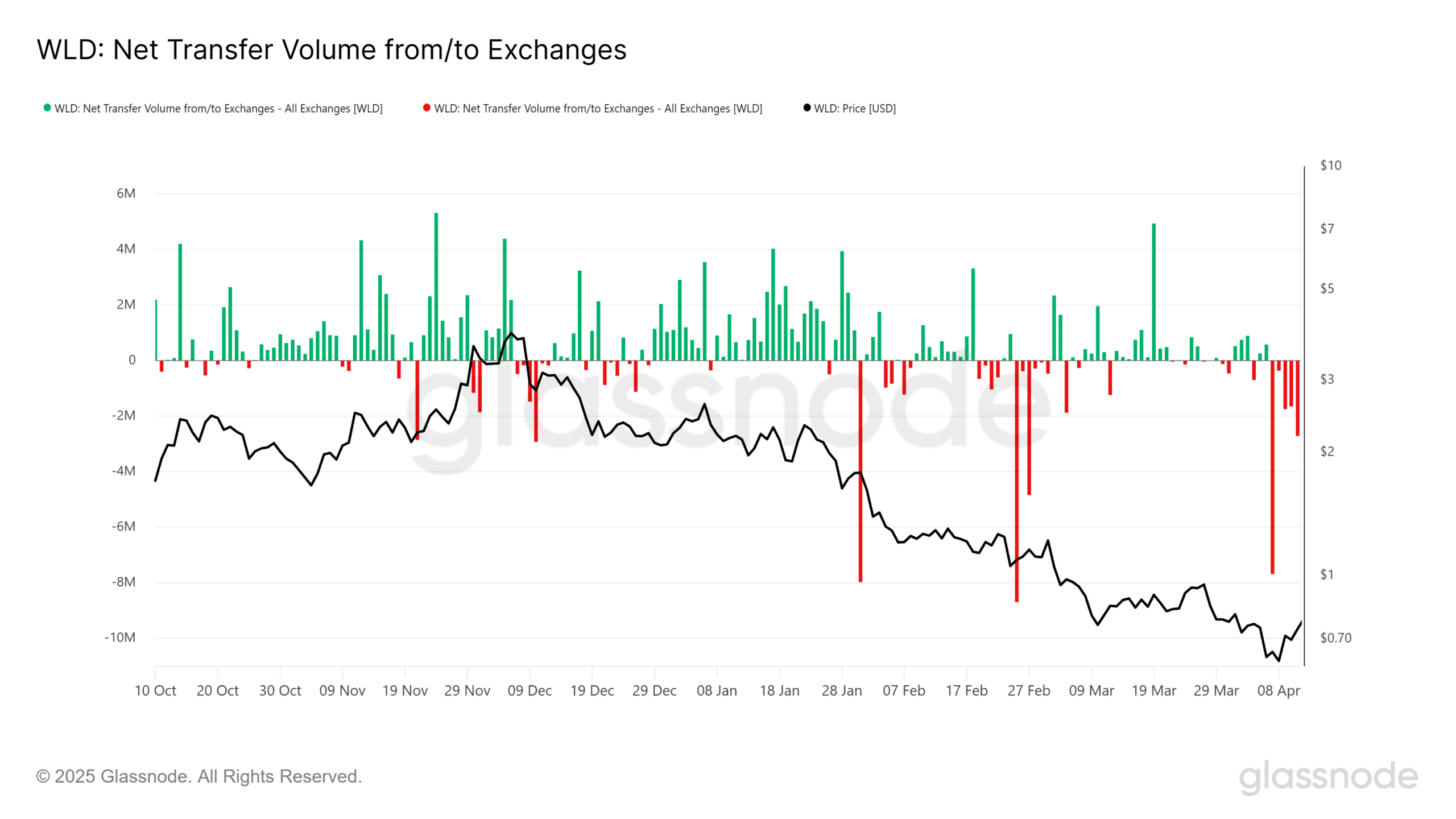

In particular, the exchange outings reached a four -day peak on April 11, with 2.78 million Absorbed WLD tokens. This was alleged with macro developments, while Trump interrupted the prices on electronics based in China.

Source: Glassnode

Short liquidation data strengthened the trend: on April 12, around 206,000 short positions were destroyed, which suggests that the bears were captured out of game as defended key levels.

In addition, the recent wick at $ 0.64 during the market -scale flush has sparked a net profit / net loss rebound (NUPL).

Although still in the red (capitulation zone), the movement suggests a displacement at an early stage towards the quadrant of optimism. Traditionally, it is a potential precursor of the increase led by Fomo.

From a structural point of view, WLD has a technical and behavioral conviction. In addition, macro catalysts, the rotation of intelligent money and the increase in momentum collectively point out that this can be more than a simple reflexive rebound.

Key level to monitor Fomo

As a general rule, a naked rebound often marks the start of the exhaustion of the sale – a phase where the weak hands are rinsed, opening the way to an early accumulation.

Current trends on the chain, in particular the absorption of intelligent money, suggest that this fundamental step could be in progress.

However, for True Fomo to ignite, which means attracting both the capital and encourage long -term holders to delay the realization of the profits, WLD must recover the psychological level of $ 1.

According to Ambcrypto analysis of the graph below, the previous inputs in the FOMO / HOPE zone on the NUPL metric have always been aligned with the price of prices which go the threshold of $ 1.

Source: Glassnode

Until WLD erases the barrier at $ 1, the probability of liquidation – both low and strong – remains high, making the current drop in a higher risk area for new entries.

Thus, NUPL becomes a pivot indicator to monitor the potential optimistic continuation. Monitor a decisive change.