A version of this article appeared in our The decentralized September 10th newsletter. Sign up here.

DG, Tim here.

Here’s what caught my attention in DeFi recently:

- Trump’s DeFi project is valued at $1.8 billion.

- Is blockchain choice important for the success of a DeFi protocol?

- DeFi degenerates are taking advantage of a new Ethereum exchange.

Trump’s new cash cow?

The Trump family’s World Liberty Financial company could provide the former president with hundreds of millions of dollars through the token sale.

This is according to code testing which reveals that the project plans to sell 30% of its WFLI token at a valuation of $1.8 billion.

The sale, if it finds buyers for the 30 billion tokens on offer, would raise $537 million.

The project’s white paper clarifies that even though the platform is not owned, managed, operated or sold by Trump, he and other members of his family may still receive compensation from it.

The project’s disproportionate allocation of 70% of tokens to insiders, along with other concerns, has divided opinions.

Join the community to receive our latest stories and updates

Onchain sleuths were quick to point out the project’s connection to Dough Finance, a legacy DeFi protocol that was hacked for $2.1 million in July.

A spokesman for World Liberty Financial declined to comment.

The Biggest Question in DeFi

Blockchains are often touted as being best for different use cases, from preserving privacy to offering super-fast transactions.

But is this statistically the best way to launch new DeFi protocols?

A new analysis by Juuso John Roinevirta of the euro stablecoin EUROe attempts to get to the bottom of this persistent question.

Roinevirta examined the launches of the largest protocols in several categories, including decentralized exchanges and lending protocols, on six blockchains:

- Ethereum

- Solana

- BNB Channel

- Arbitration

- Base

- Blast

He found that after a year, BNB Chain protocols attracted the most deposits, while Arbitrum protocols attracted the least.

The differences between the chains have, however, diminished as the protocols surrounding them have matured.

But there are other factors that might be even more important.

Arbitrum, Roinevirta noted, launched during crypto winter, while BNB Chain launched near the peak of the 2021 crypto bull run.

It may be that When launching a protocol is more important for its success than Or.

“I would like to see a more in-depth analysis of the role that timing plays relative to other factors,” Roinevirta said.

Degens crowd into Ethervista

Savvy DeFi traders have been busy making millions on a booming new Ethereum exchange called Ethervista.

In its first five days of operation, the exchange’s top 10 VISTA token traders earned a total of $5.4 million.

Launched on August 31, Ethervista is a decentralized exchange similar to Uniswap, where users launch their own tokens and create liquidity pools, allowing other users to swap tokens without needing to trust a custodian.

The excitement around Ethervista has led many to compare the new exchange to memecoin creation platforms like pump.fun on Solana.

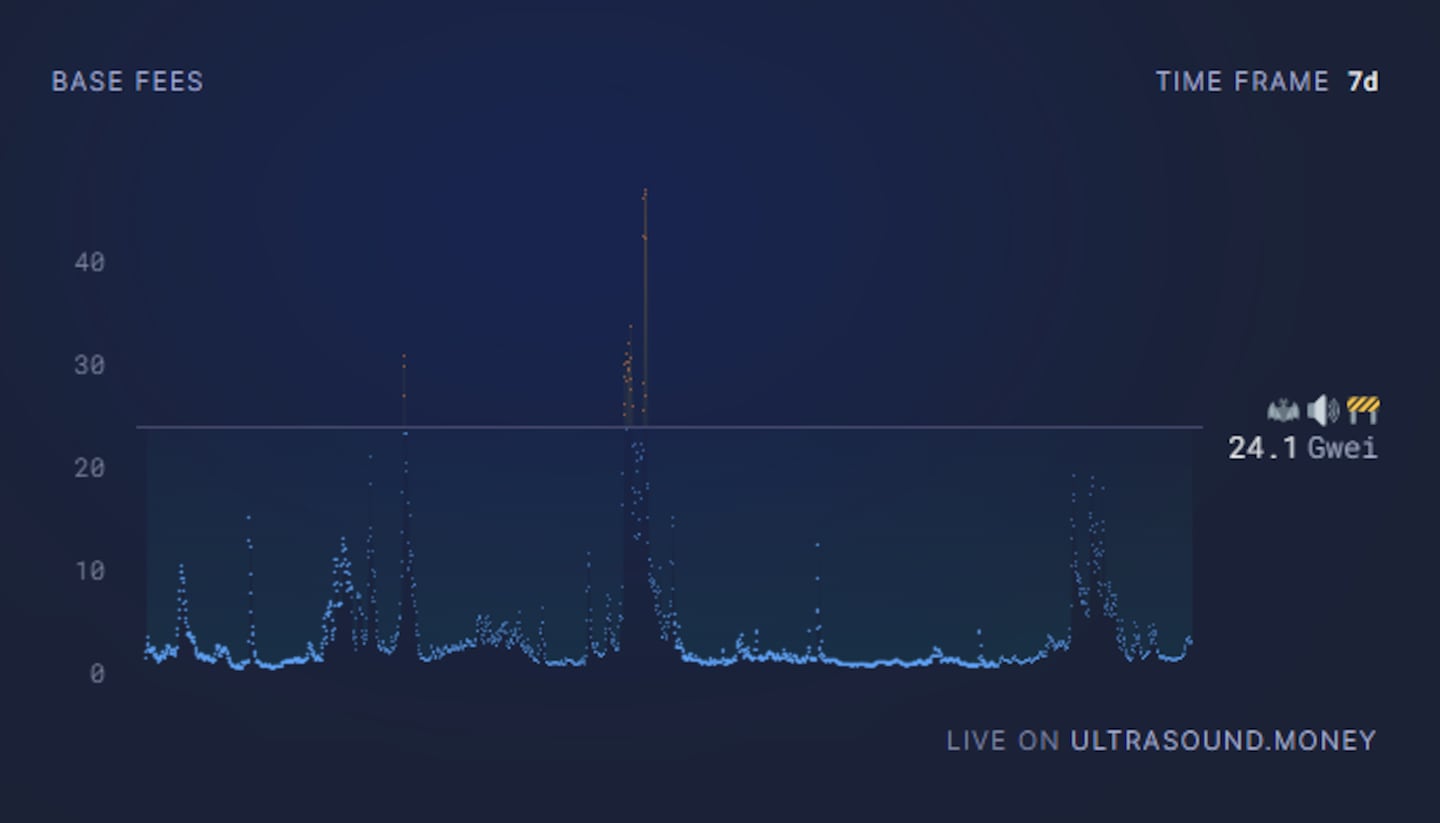

Intense trading activity has pushed Ethereum transaction fees to their highest level in weeks.

However, the subsequent fee increase was not enough to make Ethereum sustainably deflationary again.

Data of the week

The surge in Ethereum activity over the past week briefly pushed fees above the 24.1 gwei threshold where the network burns — or destroys — more Ether than it creates.

Gwei is a denomination of Ether used to price transactions. One gwei is one billionth of an Ether.

This Week in DeFi Governance

VOTE: Uniswap DAO Votes on New Fee Levels for Baseline Deployment

PROPOSAL: Aave Chan Initiative Proposes Partnership with Crypto.com Earn

VOTE: Jupiter DAO decides the future of the Jup and Juice podcast

Article of the week

Meet LlamaFeed, the latest product from our friends at DefiLlama.

We are excited to share with you our latest product: LlamaFeed

It is designed to be your landing page for up-to-date crypto information.

LlamaFeed is updated every minute and allows you to organize and select the sections that interest you most.

Try it on: https://t.co/DPRL9upWeT

— slasher125 (@takeoffXY) September 9, 2024

What we are looking at

The proposed code that makes Uniswap v2 resistant to sandwich attacks has generated buzz in DeFi circles.

Sandwich attacks are a malicious form of maximum value extraction. Such attacks, similar to front-running in traditional finance, can cost users millions.

I made Uniswap V2 resistant to sandwich attacks with only 19 lines of code.

This solution preserves atomic composability, has no dependencies, and requires no additional infrastructure or off-chain computation.

Here’s how it works 👇 pic.twitter.com/1QxfyS3Ops

—diego (@0xfuturistic) September 3, 2024

Got any DeFi tips? Contact us at tim@dlnews.com.