The native token of hyperliquid, $ hype, is negotiated below, even if its parent platform records historical growth and Ethereum is continuing its net rally.

At the time of the drafting of this document, media threshing is down 3.3% in the last 24 hours and 1.1% in the last seven days. It is currently at a price of $ 45.13, at around 8.5% below its $ 49.75 summit, reached earlier this week.

The negotiation volume remains high, reaching more than $ 570 million in the last 24 hours, an increase of 13.4% compared to the day before.

Hyperliquid hits the volume of perps recorded while Ethereum overvoltage bursts $ token of media threshing

Ethereum’s explosive rally resumes capital flows on the cryptography market. Now at $ 3,609, ETH has jumped 43% in the last 30 days and exceeded $ 3,280 for the first time since February, just 9.6% of its historic summit of $ 4891 in 2021.

Source: Eth Daily Chart \ Cryptonews

This clear ascent seems to be liquidity of smaller altcoins, the $ media token seeing a drawback after a solid two -month rally which saw it climbing 80%. Chain analysts cite profit as the main engine of recent correction.

Technical indicators confirm a loss of momentum. The daily RSI of the Token has gone from a peak of 73 (overwhelmed) to 60.6, which suggests that buyers cool.

Despite the drop in prices in the planking media, the hyperliquid ecosystem is experiencing an unprecedented activity. On July 16, the platform recorded a new higher of all time in daily perpetual volume of $ 18.99 billion, showing the massive pivot of traders to the new platform.

Open interests also reached a record of $ 13.8 billion, Ethereum leading the charge. The ETH represented $ 5.92 billion in volume, exceeding Bitcoin at $ 5.11 billion, while ETH’s open interest reached $ 2.84 billion, fed by bull traders to continue the current rally.

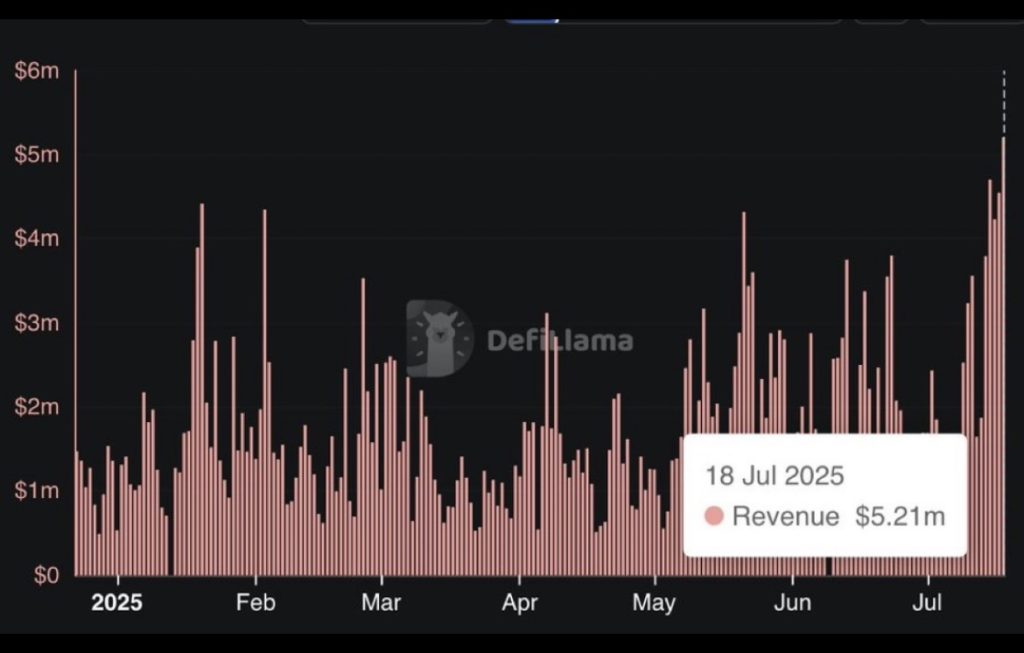

Adding to the bull panels of the platform, Hyperliquid also displayed a level of all time in daily income of $ 5.06 million, according to Defilma.

Source: Defiliama

In the past 30 days, the hyperliquid has treated more than $ 243 billion in perpetual volume. The volume of the platform during the same period has reached nearly $ 10 billion. The annualized income is now about $ 828 million, the same figure distributed to holders. The annualized costs total approximately $ 890 million, reflecting regular growth through the platform.

Adding to momentum is increasing institutional confidence in the token. In early June, Tony G Co-Investment Holdings deployed $ 438,000 in a media threw, becoming the first public company to add it to its treasure.

On June 18, Eyenovia listed at the NASDAQ became the first US company listed on the stock market to establish a dedicated media treasury reserve, raising $ 50 million thanks to a private placement to accumulate more than a million media threshing tokens.

Recently, recently, the Biotechnology Company listed at Nasdaq Sonnet Biotherapeutics has announced its intention to launch a treasure of digital assets built around the $ media token. The agreement includes a planned treasure of 12.6 million media threshing tokens, worth 583 million dollars at the time of the agreement, as well as 305 million dollars in cash for future purchases, which brings total recovery to $ 888 million.

Although Ethereum’s strength has moved away from the attention and liquidity of altcoins like $ hype, the hyperliquid platform itself is booming. The key question is whether $ hype can resume the momentum in the middle of the domination of Ethereum.

$ Hype Price Action shows consolidation as bulls and jockey bears for control – $ 60 in short

The price of media threshing has entered a consolidation phase after a net rally, reflecting what analysts describe as a healthy break after steep gains driven partly by a momentum through the wider Ethereum ecosystem.

On Monday, $ hype withdrew from the main psychological resistance nearly $ 50. Despite the decline, the increase trend remains intact because the price continues to respect the lower limit of its ascending channel.

Source: tradingView

The assets recently rebounded by the support of around $ 38.80 and has since trained a continuation model, suggesting the possibility of a new higher push if the resistance levels are eliminated.

The technical indicators remain largely favorable to the additional increase. The 20 -day exponential mobile average (EMA) amounts to $ 42.93, while the simple 50 -day mobile average (SMA) is nearly $ 38.86.

Source: tradingView

The two averages are always on the rise and the RSI remains close to the surachat levels, generally a sign of a strong interest in purchase. A decisive rebound in the $ 45.80 zone would confirm this level as support, increasing the probability of another attempt to cross the $ 50 mark.

If the bulls manage to push the price above this threshold, $ hype could target the level of $ 60 afterwards.

However, non-compliance with $ 45.55, a Fibonacci support level, may indicate a deeper correction to $ 42.89. A decision supported below $ 38.80 would invalidate bullish prejudices and increase the risk of broader retracement.

Source: tradingView

The action of short-term prices on the 4-hour graph indicates a control battle near the 20 EMA, the RSI hovering just above the neutral territory. This suggests that none of the games has won a clear edge in the immediate term.

Analysts take care of a break above the continuation model as a potential trigger for upward renewal. Conversely, a fence below the 50 -day SMA could tilt the momentum in the short term in favor of the Bears and open the door to a movement around $ 41.

The hype $ hype slides when Ethereum goes up and hyperliquid reaches $ 19b – can it bounce? appeared first on Cryptonews.

The perpetuates are booming – and the hyperliquid advances. We unpack its rapid increase, the jelly stress test and why CEX users change. Find out why an expert calls him “undervalued considerably at current levels”.

The perpetuates are booming – and the hyperliquid advances. We unpack its rapid increase, the jelly stress test and why CEX users change. Find out why an expert calls him “undervalued considerably at current levels”.