Join our Telegram channel to stay up to date with the latest news

The Hyper Foundation has submitted a proposal to confirm that $1 billion worth of HYPE tokens held in the Hyperliquid Support Fund system address are permanently inaccessible or burned.

According to the project team, the Support Fund is a protocol-level mechanism built into the Layer 1 network execution. This mechanism automatically converts trading fees into HYPE and then routes them to a designated address.

The Hyper Foundation is proposing a vote of validators to formally recognize the HYPE Support Fund as burned, permanently removing the tokens from the total and circulating supply.

For context, the Support Fund converts trading fees into HYPE in a fully automated manner as part…

– Hyper Foundation (@HyperFND) December 17, 2025

The system was designed without any control mechanisms, meaning funds cannot be accessed or retrieved without a hard fork.

Data from Hypurrscan shows that the address “0xfefefefefefefefefefefefefefefefefefefefefefe” contains nearly $1 billion in tokens as of 6:29 a.m. EST.

If the community votes yes on the proposal, it would permanently remove the tokens from the total and circulating supply.

Validators are required to signal their intent during the governance forum by December 21 at 4:00 UTC. To vote, users can bet on a validator that matches their view before December 24 at 4:00 UTC. The Hyper Foundation said the outcome will be based on issue-weighted consensus.

The distinction between HYPE’s circulating supply has become more relevant

Although the team’s proposal is to recognize that support fund tokens are “burned”, this does not actually remove the tokens from HYPE’s effective supply. Rather, the proposal aims to reduce the ambiguity around this offer.

This distinction has become more relevant as more institutions move towards the Hyperliquid ecosystem, primarily due to its fee-based model.

In a research note covering digital asset treasury (DAT) companies HYPE, financial services firm Cantor Fitzgerald introduced Hyperliquid as a protocol that returns almost all of its fee revenue to token holders via automated purchases.

The company also estimated that Hyperliquid has generated approximately $874 million in year-to-date (YTD) fees as of 2025. Cantor added that 99% of protocol fees are currently routed through the HYPE Buyback Assistance Fund mechanism.

The company also said that these repurchases contributed significantly to the decline in HYPE’s circulating supply. However, Hyper Foundation clarified in its recent proposal that Relief Fund balances were never intended to be spent or recouped.

Hyperliquid remains one of the best perpetual decentralized exchanges

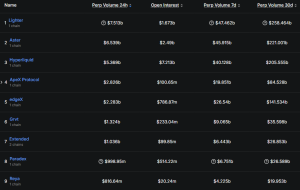

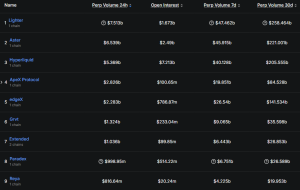

Hyperliquide has maintained its position among the leading decentralized perpetual exchange platforms. According to data from DefiLlama, the protocol recorded a trading volume of over $205 billion over the last 30 days.

Top perp decentralized exchanges in volume (Source: ChallengeLlama)

HYPE price in a downtrend

The proposal comes as HYPE is moving in a medium-term downtrend. Over the past month, the altcoin’s value has fallen by more than 30%, according to CoinMarketCap. The crypto saw an uptick over the past 24 hours to trade at $27.11 as of 5:52 a.m. EST.

Daily chart for HYPE/USD (Source: GeckoTerminal)

The daily chart of HYPE shows that the token has been in a descending channel for the past few weeks. Technical indicators such as Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and short-term exponential moving averages (EMA) show that sellers have the upper hand over buyers.

Until the HYPE price rises above the 9 EMA, which acts as dynamic resistance and confluences with the upper boundary of the bearish channel, the crypto is likely to remain in its downtrend. However, a break above this barrier could see the altcoin rise to $35.98.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news