Key points

-

Bitcoin lost $ 87.8 billion of market value over the weekend, while Ethereum lost $ 46.4 billion.

-

Despite the sharp drop in the weekend, Bitcoin is still up 77% and Dogecoin earned 122% in the last 52 weeks.

-

It looks more like a healthy correction after recent gains than the start of a cryptographic winter.

- 10 actions that we love better than Bitcoin ›

Bitcoin lost $ 87.8 billion of market value over the weekend, while Ethereum lost $ 46.4 billion.

Despite the sharp drop in the weekend, Bitcoin is still up 77% and Dogecoin earned 122% in the last 52 weeks.

It looks more like a healthy correction after recent gains than the start of a cryptographic winter.

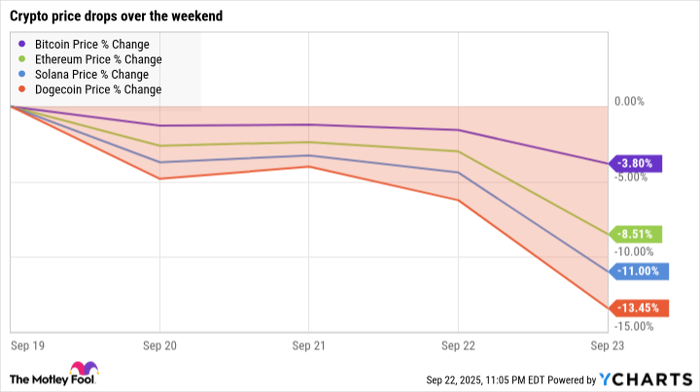

The cryptography market passed out during the weekend. From Friday morning to Monday evening, Mastiff (Crypto: Doge) dropped by 13.5% and Solara (Crypto: soil) took a blow of 11%. More stable names have suffered still; Ethereum (Crypto: ETH) lost 8.5% in this four -day period while Bitcoin (Crypto: BTC) Given a price drop of 3.8%:

Where to invest $ 1,000 now? Our team of analysts has just revealed what they believe 10 Best Actions To buy now. Continue “

Bitcoin Prix Data by ycarts

In a way, the smaller movements of Ethereum and Bitcoin made larger waves. The prolonged weekend slide from Ethereum has erased $ 46.4 billion from its total market value – more than the total value of all Dogecoin. Bitcoin market capitalization landed at 87.8 billion dollars, almost reaching the entire value of Solana.

Crypto’s broad retreat was fed by two intertwined events.

-

Many Crypto traders have collected profits after significant gains in recent months. Last Thursday, the announcement of lower federal interest rates increased parts prices, but also inspired the idea that it could be a temporary gain and therefore an ideal moment to sell.

-

The growing sales have led to numerous margin calls for many cryptographic investors making uptills with borrowed funds. Data from the Crypto Coinglass option trading platform show a massive peak of the Crypto-based options on Sunday, September 21. The volume of forced liquidation sales in a wide range of different cryptos has almost set a 5 -year record.

Does this widespread price drop the start of the next winter of cryptography, or just another unexpected drop in a generally volatile market? Discover.

Here we take up the four -year cryptography cycle

The cryptography market has tended to rise and slide into cycles of four years so far, centered around the rate of events in half Bitcoin. It is the fourth round of the wheel, initiated by the fourth Bitcoin Prix Ball in April 2024.

The last cycle began in the darkest days of COVID-19, led to an increase in cryptography prices in 2021 and ended with another crypto winter in 2022. Of course, the slowdown in this case coincided with a crisis in the fight against large-scale inflation. In addition, the world of cryptography has been shocked by several economic crises, such as the collapse of the stablecoin Terra Luna and the bankruptcy of the FTX Crypto Exchange. So maybe you shouldn’t expect the next market cycle to copy this unique situation.

Returning to the second cycle of reduction by half, around the wandering in July 2016, the Bitcoin prices went from $ 660 per room at this stage to $ 17,760 in December 2017. This extreme gain was short -lived, supporting $ 6,300 in the next 11 months, then there was a deeper drop to around $ 4,000 which lasted up to 2020 months.

I also looked at the first cycle, but it was in 2012. Bitcoin was still the only cryptocurrency that counted, most people did not know what a digital play was, and I do not expect to learn useful lessons from this old digital story.

This gives me a very small sample with which to work with. Assuming that this fourth cycle has fundamental qualities in common with the previous ones, we could expect the prices of Bitcoin soar (and other cryptos follow) at the end of 2025 and most of 2026. The next winter of Crypto should come after that and last until the next Bitcoin in 2028.

Why this cycle could be different

The basis of market predictions on older price graphics models is a form of technical analysis – and I have never seen much value in this approach. Half and winter cycles in cryptographic industry would have the very different air if the pandemic never occurred, or if the first ETF Bitcoin had been approved in 2022 instead of 2024, etc. The events of the real world often put an inch on market scales, which includes the prices of cryptography.

So what else happens? Well, there are a lot of potentially optimistic cryptographic price catalysts in the air at the moment:

-

Thanks to the long operating stories and the arrival of Bitcoin or Ethereum negotiated funds exchanged (ETF), institutional investors are more likely to have an exposure to cryptography today.

-

The same goes for companies, following the example of Michael Saylor Strategy (Nasdaq: MSTR) To put Bitcoin and Ethereum on their balance sheets.

-

Several other cryptocurrencies should obtain FNB later this year, unless Securities and Exchange Commission (SEC) denounced their approval in 2026.

-

A handful of web3 applications increases eyebrows in 2025. Examples include several legendary game popular games, the courageous browser and a surprisingly web3-ish travel application of the credit card giant American Express (NYSE: AXP). If and when the privacy web3 concepts, decentralization and the more personal property of online content really takes off, demand will increase for a plethora of cryptocurrencies.

I could continue, but these are the main boosters on the crypto market at the moment.

Image source: Getty Images.

Let’s not forget the risks

These are not all digital roses and encrypted rainbows, of course. For example:

-

Cryptocurrencies are still new and generally not proven as a class of investable assets.

-

Legendary investors like Warren Buffett see no real value in these digital parts.

-

Quantum computers will one day be able to break the encryption that maintains Ethereum and Bitcoin in safety today – will they go to quantum safety algorithms before the barbarians storm proverbial doors?

There are therefore potential drawbacks, but these risks have one thing in common. These are long -term concerns, not sudden threats that did not exist last week.

Lower prices for weekends in perspective

In my eyes, the weekend crypto cuts were a fairly healthy price correction after the start of the first instance of this fourth cycle. Ethereum won 54% in 52 weeks, September 23. Bitcoin increased by 77% in the same period. Dogecoin? Up 122%. Solana is a relative delay with “only” price gains of 49% in one year.

And in the coming months, I see more reasons to be optimistic than crypto in general. Unexpected price reductions come with the territory to invest in volatile asset classes. And in the long term, coins like Bitcoin, Ethereum and Solana should do more than well, as long as they can dodge the risks mentioned above.

In short, I can never really promise there No A massive slowdown in crypto just at the corner of the street, but it would be a surprise in the fall of 2025. It is too early to call it a crypto winter, or even a cryptographic fall. It’s more like someone left the crypto-refrigerator door.

Should you invest $ 1,000 in Bitcoin now?

Before buying Bitcoin actions, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what they believe 10 Best Actions So that investors are buying now … and Bitcoin was not part of it. The 10 actions that cut could produce monster yields in the coming years.

Inquire Netflix Make this list on December 17, 2004 … if you have invested $ 1,000 at the time of our recommendation, You would have $ 661,910! * Or when Nvidia Make this list on April 15, 2005 … if you have invested $ 1,000 at the time of our recommendation, You would have $ 1,2504! *

Now it’s worth noting Stock advisor The total average yield is 1,079% – an outperformance of grinding of the market against 191% for the S&P 500. Do not miss the last list of the best 10, available when you join Stock advisor.

See the 10 actions “

* Return shares advisor since September 22, 2025

American Express is an advertising partner of Motley Fool Money. Anders Bylund has positions in Bitcoin, Ethereum and Solana. The Motley Fool has positions and recommends Bitcoin, Ethereum and Solana. The Motley Fool has a policy of disclosure.

The opinions and opinions expressed here are the opinions and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.