- Kaspa’s emerging ascending triangle pattern at press time suggested bullish sentiment.

- KAS could surpass the previous peak of $0.201.

Kaspa (KAS) has remained stagnant over the past month, with the token seeing only a small market movement: a 0.95% price increase over the week.

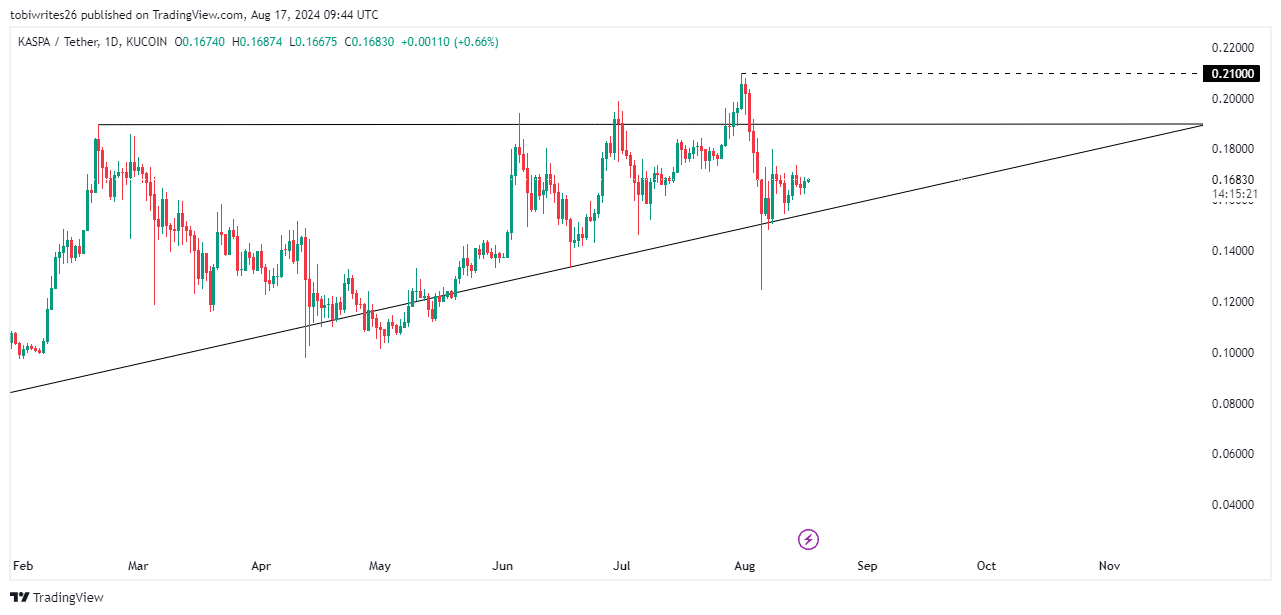

The chart’s formation at press time of an ascending triangle suggested that KAS was positioned for a rally that could propel it to a new all-time high above $0.21.

An ascending triangle is a bullish chart pattern characterized by a flat upper line acting as resistance and an ascending lower line acting as support. This pattern often leads to a potential breakout to the upside.

KAS in ascending triangle

KAS recently broke above the upper resistance of the triangle, reaching a new high at $0.21. However, it failed to hold this level and fell back into the pattern, breaking the base line support.

This price action, often referred to as a “wick,” is generally considered stop hunting, a strategy used to manipulate the market in favor of major players.

Source: TradingView

In this case, the stop hunt was aimed at benefiting buyers, by driving the price down to activate the stop-loss orders of bullish traders.

This allowed large investors to accumulate at lower prices before pushing the price back up to book gains.

Although the upward trajectory has been gradual, this pattern of accumulation followed by a sharp rise is common and suggests potential accumulation for a significant upward move beyond the current high.

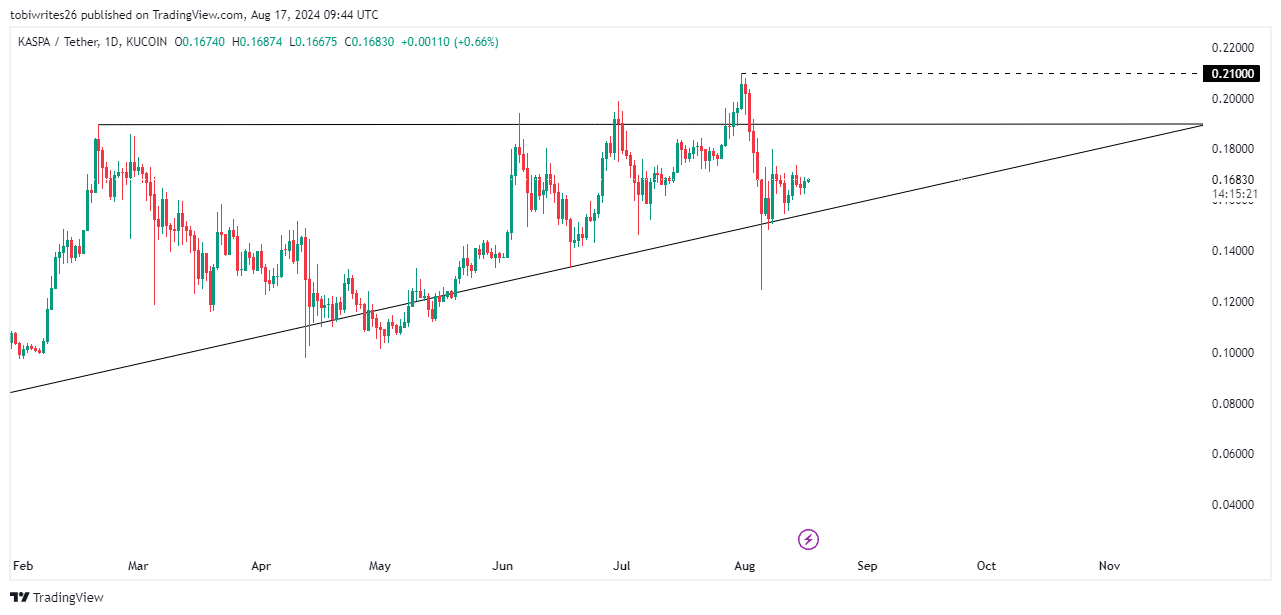

As this scenario plays out, AMBCrypto’s technical analysis shows that indicators like the MACD and RSI are leaning towards bullish momentum, reinforcing the potential for an upcoming rally.

More bullish trends are emerging

Using the Moving Average Convergence Divergence (MACD) method, there are signs that the anticipated rally within the ascending triangle could soon be triggered, as the indicator gradually moves out of negative territory.

The MACD is a trend-following momentum indicator that displays the relationship between two moving averages of an asset’s price.

A close look at the chart reveals a move towards positive territory, with the blue MACD line approaching a cross above the orange signal line, signaling a potential bullish turn.

Source: TradingView

Moreover, a faster crossing of the blue line above the orange line strongly confirms the growing dominance of the bulls.

Meanwhile, the Relative Strength Index (RSI), another key momentum indicator that ranges from 0 to 100, supported this bullish outlook.

The RSI measures overbought conditions above 70 and oversold conditions below 30.

With an RSI of 46.39, this suggests that the bullish momentum is gaining strength, which could push the price of KAS higher. This indicates an imminent presence of buyers ready to push the market higher.

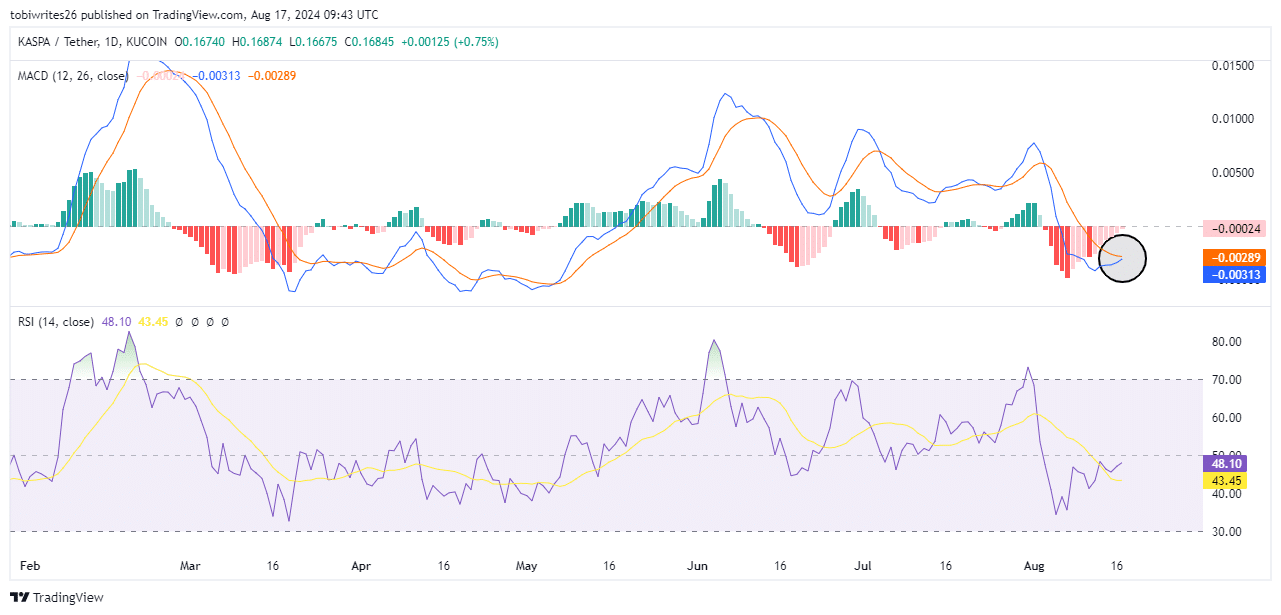

Mixed feelings about the channel

An analysis by Kaspa transaction volume via Santiment revealed a significant drop: from $552.44 million on August 5 to just $66.82 million on August 7.

This notable reduction suggests waning interest in the market, potentially leading to further declines in KAS’s price.

Source: Santiment

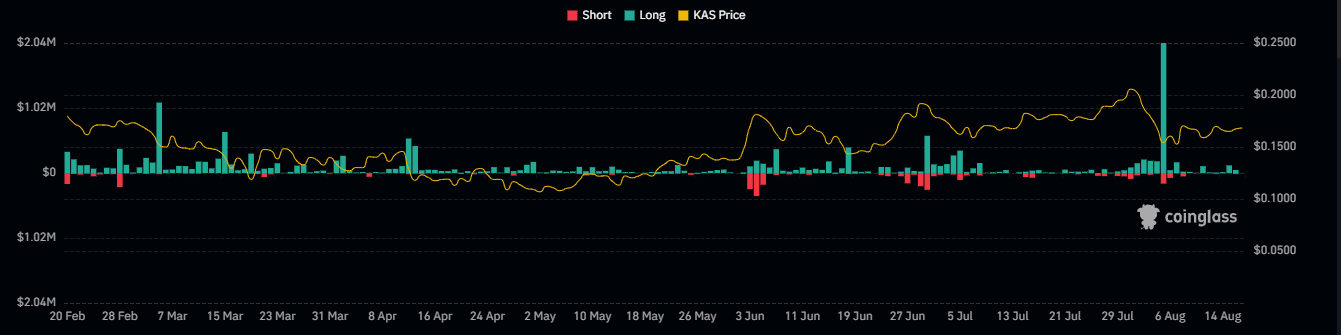

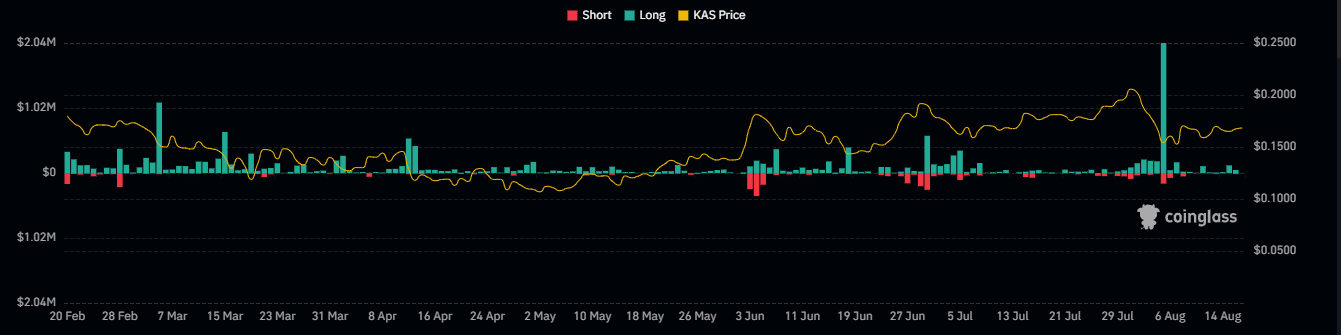

In addition, the liquidation Coinglass statistics pointed out that an increasing number of traders with long positions on KAS were liquidated from August 7 to 14.

This usually indicates a notable price drop, causing these long positions to be automatically closed due to insufficient margin to cover losses – a clear sign of a downtrend.

Source: Coinglass

The simultaneous decline in volume and price indicates bearish sentiment and a possible prolonged downtrend, reflecting reduced trading activity.

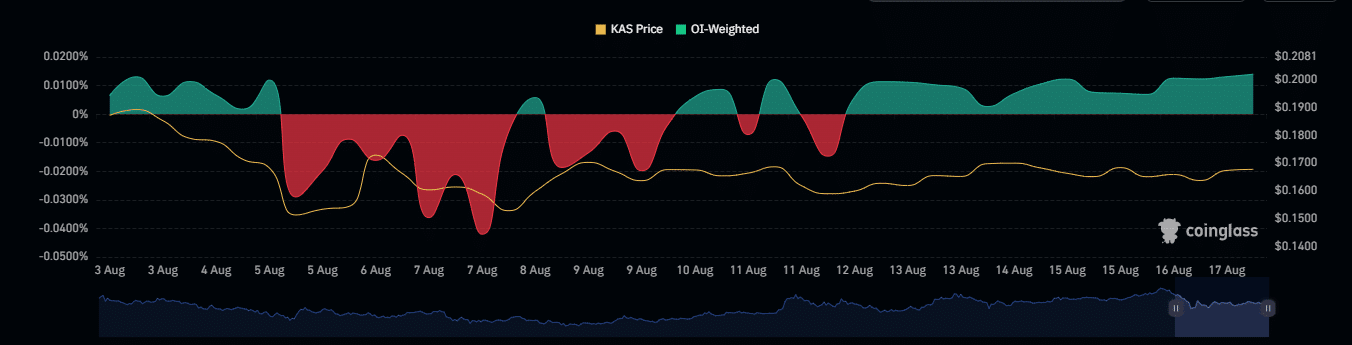

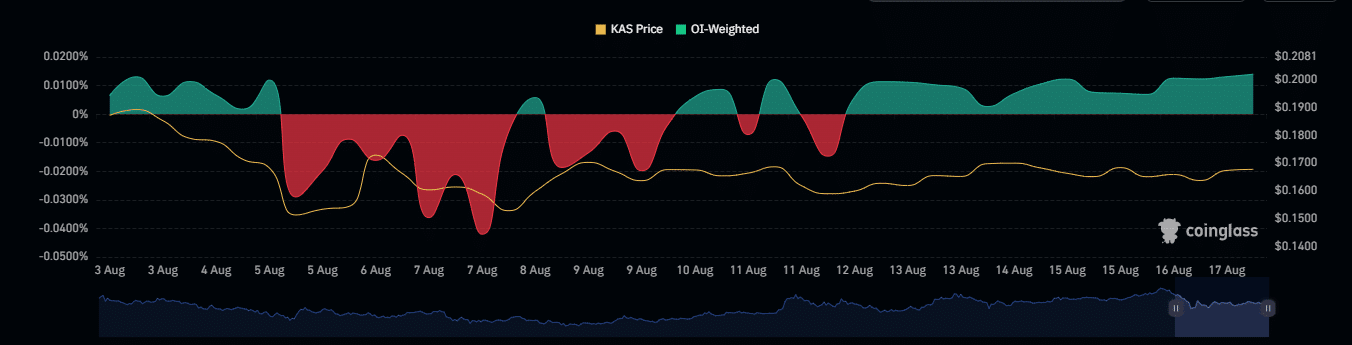

On the other hand, the open interest (OI)-weighted funding rate offered a bullish outlook, remaining positive at 0.0140% and showing an increase.

This rate suggests that long position holders are paying premiums to those holding short positions, indicating stronger demand and a bullish outlook for the asset.

Source: Coinglass

Read Kaspa (KAS) Price Prediction 2024-25

With these mixed indicators, the market is likely poised to gain clarity and adjust to either a bullish or bearish bias in the near future.

If the market is bullish, KAS could potentially break its previous all-time high of $0.21, setting a new record high.