- The LDO’s exit from a descending wedge, with an increase in volume and market capitalization, indicates a potential uptrend.

- Strong DAA price divergence and growing support from open interest continued the bullish momentum of the Lido DAO.

Lido DAO (LDO) surged 32% in the last 24 hours, bringing its market capitalization to $1.22 billion, an increase of 19.3%. Additionally, trading volume jumped 188.65% to $306.58 million, reflecting increased investor interest.

This spike in volume indicates strong buying pressure that could support further gains. At press time, Lido DAO is trading at $1.36, indicating solid bullish sentiment that could fuel continued bullish momentum.

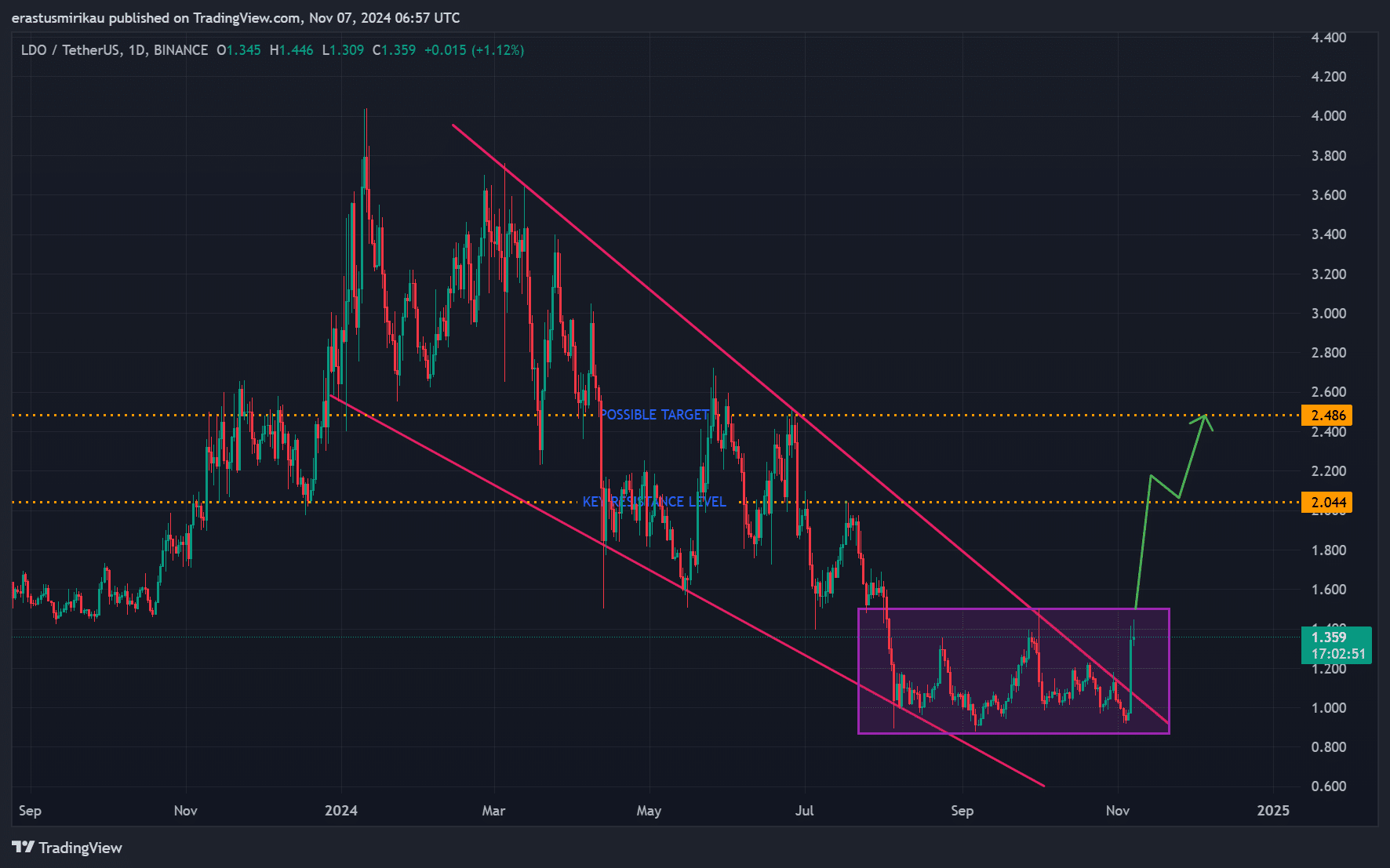

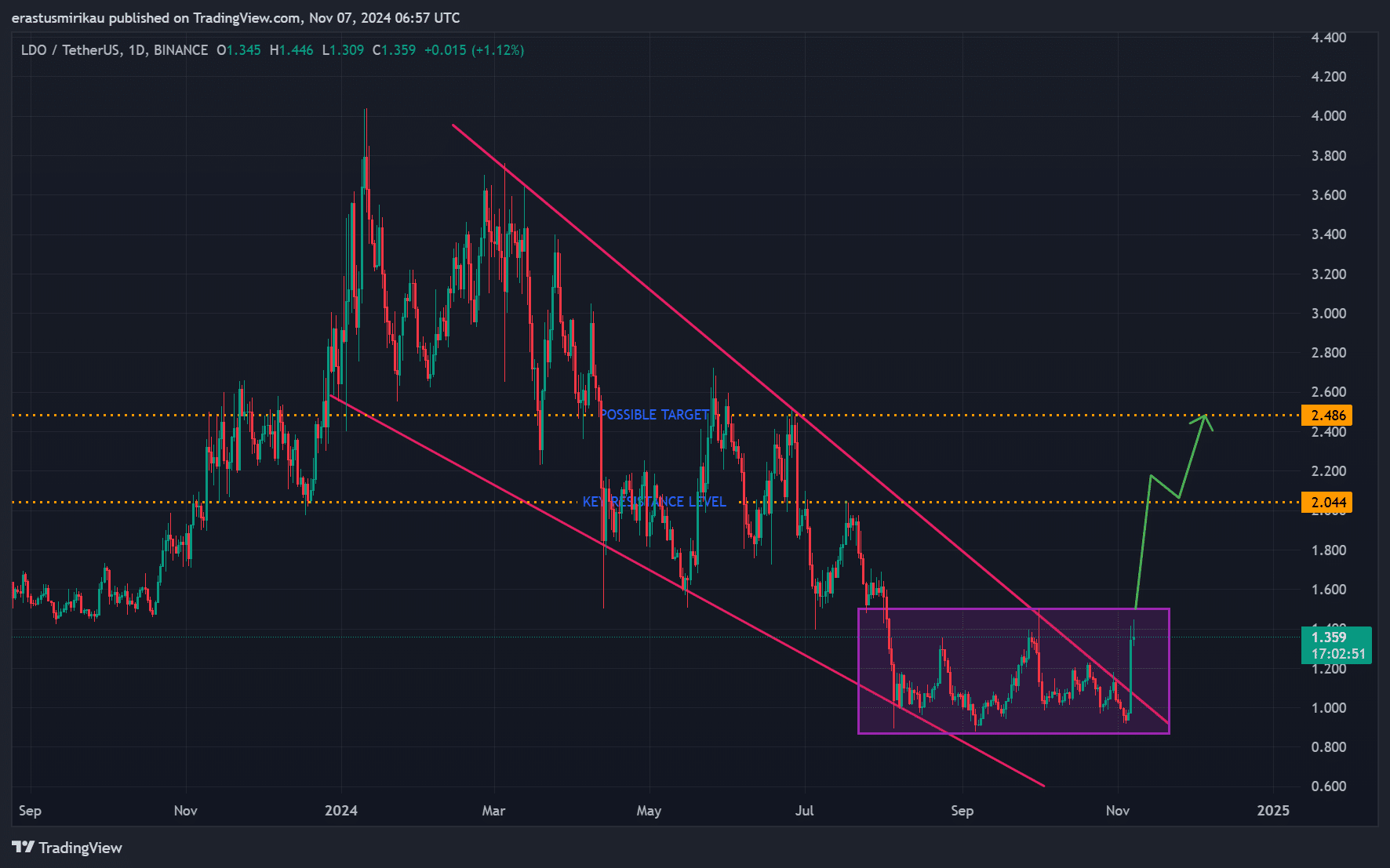

Chart Analysis: Breaking Out of a Falling Wedge and Price Prediction

Recent price action on the LDO chart shows a breakout from a descending wedge pattern, generally signaling a bullish reversal. Therefore, this breakout suggests a potential upward trend.

LDO broke above a crucial resistance level at $1.36, aiming for higher levels. The next important resistances are $2.04 and $2.48, levels which could serve as key price objectives.

Therefore, if Lido DAO continues this breakout, a sustained rally could be on the horizon.

With current momentum, the $2.04 level appears to be within reach. Additionally, if Lido DAO maintains its upward pace, breaking above $2.04 could lead to a push towards $2.48. This resistance point, if breached, could trigger an even stronger upward move.

However, to achieve this goal, buyer interest must be maintained. Consistent volume and pricing strength will be key for LDO to reach these ambitious levels.

Source: TradingView

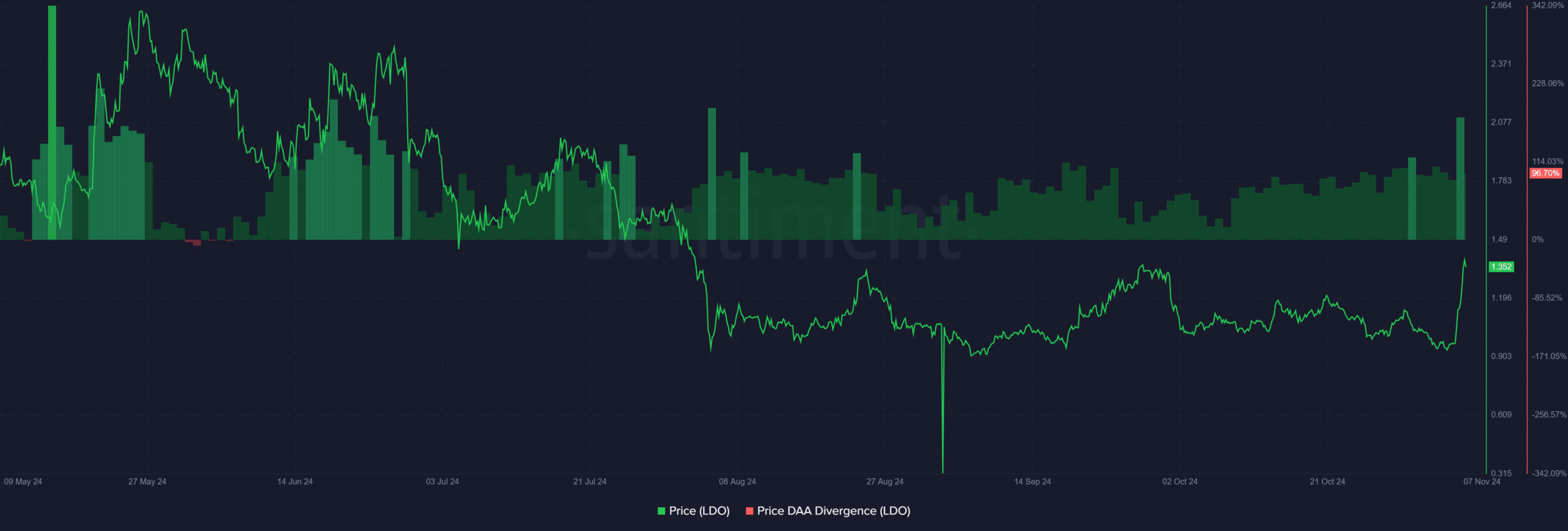

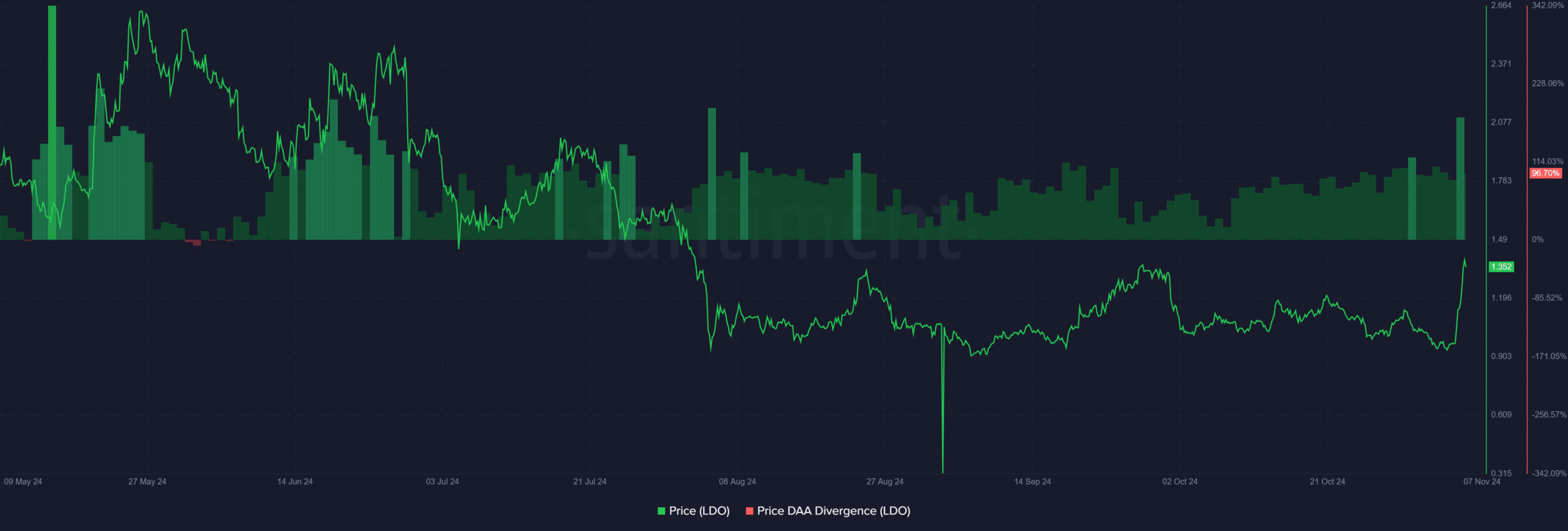

DAA divergence of LDO prices: bullish confirmation?

The DAA price divergence chart shows a positive divergence of 96.7%, indicating that on-chain activity is aligning with the recent price surge. This divergence usually precedes further gains, signaling strong support from user activity.

This channel strength builds confidence in a sustained rally, adding weight to the bullish scenario.

Source: Santiment

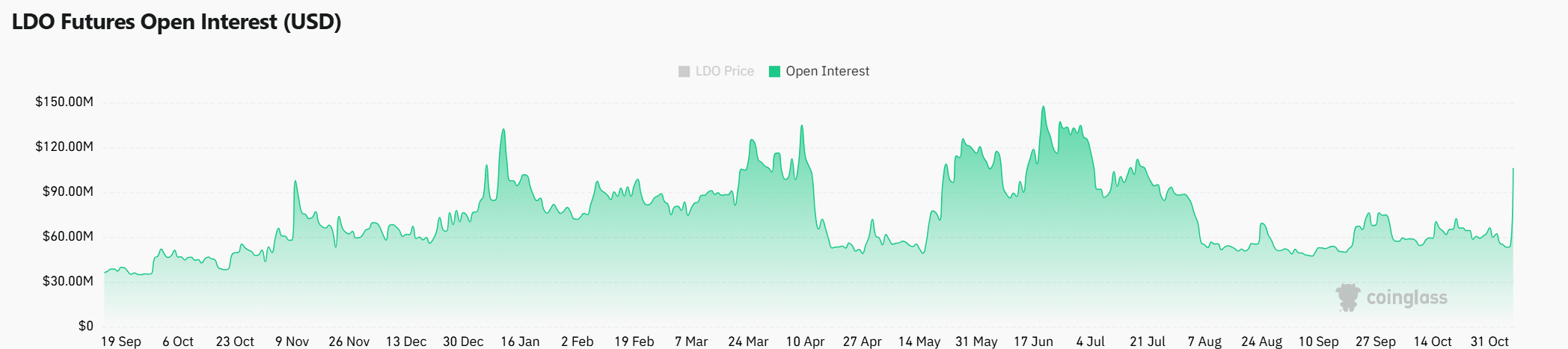

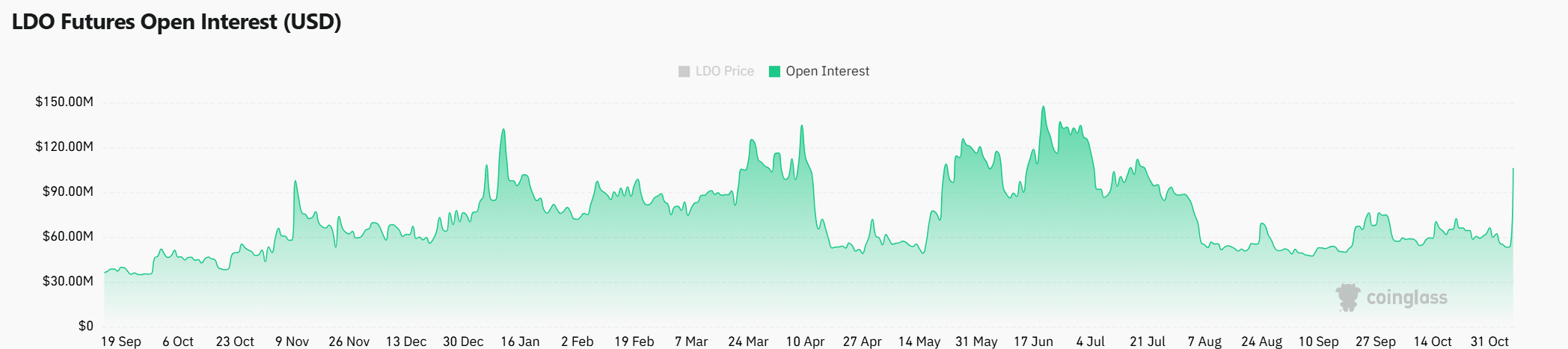

Market Sentiment: Rising Open Interest Rates Strengthen Outlook

Additionally, open interest jumped 47.4% to $112.97 million, indicating that traders are increasingly engaged with LDO.

This increase in open interest, along with increased volume, highlights bullish sentiment in the derivatives market, suggesting growing confidence in the LDO’s rally potential.

Source: Coinglass

Read the Prie de Lido DAO (LDO) forecast 2024-25

Can LDO support the rally?

The LDO breakout, combined with increasing volume, positive DAA price divergence, and rising open interest, suggests potential for continued gains. Therefore, if Lido DAO holds above $1.36 and approaches $2.04 and $2.48, a sustained rally could materialize.

However, maintaining this momentum will require continued buying pressure. As it stands, the LDO’s bullish setup could reward investors willing to capitalize on this breakout.