Key notes

- Litecoin Price was held stable at $ 110 on August 30 despite the weekly losses close to 10%.

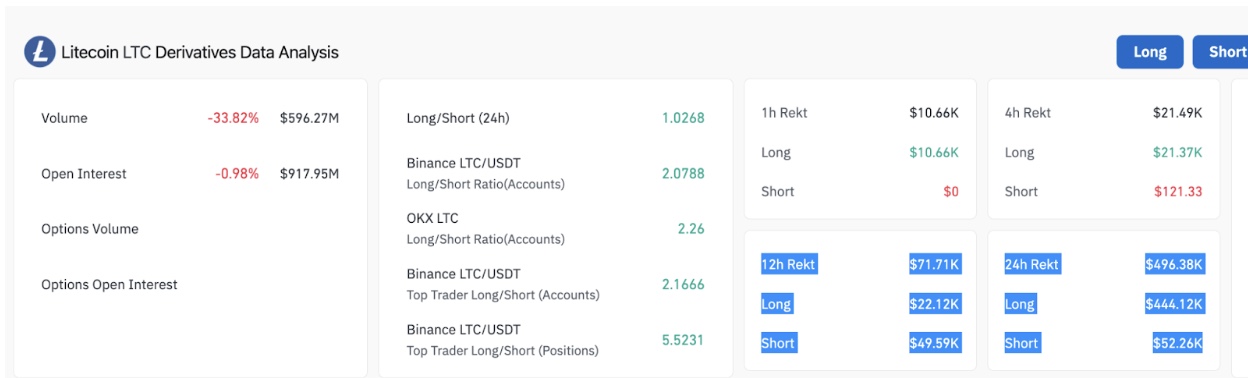

- Data on derivatives show that short -term short -term pressure because LTC -long negotiating volumes dropped by 33.8% to 596 million dollars, with open interests with $ 917 million.

- Golden Cross support at $ 109 suggests a potential recovery basis if current liquidation trends continue during weekend negotiations.

Litecoin Price finds regular support at $ 110 on Saturday August 30, with Bulls fighting to contain weekly losses just below 10%. Profitance supported after approaching the LTC price approached $ 120, and the net retreat of Bitcoin at hollows of $ 107,000, were two key catalysts that triggered a lower action this week.

However, market metrics in the last 24 hours report a potential directional swing in the Litecoin price dynamics, because bears take caution after failing the psychological level of $ 110.

Co -Coin derivative data shows that LTC -long negotiation volumes have decreased from $ 33.8% to $ 596 million, while open interest has remained stable at $ 917 million. The flattening of open interests reflects the reluctance of grasping new positions, a feeling reinforced by the significant decline in daily negotiation volumes.

Litecoin derivative market analysis | Quince, August 30, 2025

The liquidation data put more emphasis on the prudent position among the short boxes. On a 24 -hour basis, long liquidations totaled $ 496,380, against $ 444,120 in shorts, which indicates that buyers still absorbed downward pressure. But the momentum has changed in the last 12 hours, with short liquidations at $ 49,590 more than long liquidations of $ 22,210.

This trend indicates that bears end the positions at a faster rate, signaling a potential market of market BOTHING.

If this dynamic persists during weekend exchanges, the bulls could resume momentum and pour prices to safer levels around $ 115, to avoid the risk of ventilation below $ 110.

Litecoin Price Forecast: Can Bulls stage $ 115 rebounds like Golden Cross Anchor of $ 109?

Litecoin intraday resilience above $ 109 aligns with the golden cross model formed on August 4, where the 5-day mobile average has crossed the 8 days and 13 days. In addition to reporting the start of a bull market cycle, Golden Crosses also provides anchor support during short -term sales.

Litecoin technical price analysis (LTC) | TradingView | Ltcusdt table 24h

The intra -day background formation and short traders, the quick closure of short positions could trigger an instant recovery to a price range from $ 115 to $ 118. However, decisive ventilation of less than $ 109 would invalidate the golden cross signal, exposing Litecoin to a deeper retirement to $ 100.

Momentum indicators remain neutral, with RSI hovering at 49, suggesting that LTC are neither onboux nor occurred. A sustained purchase activity around $ 110 could tilt the momentum upwards, but a lack of trading volume suggests that the price action laterally in September is a more likely scenario.

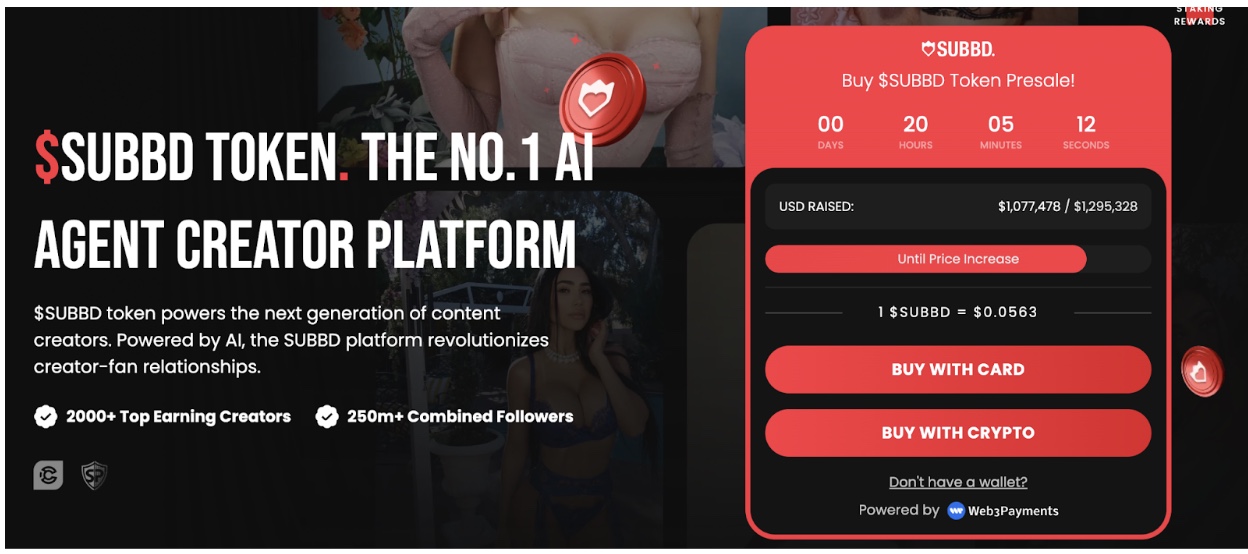

The presale sub-obsco is gaining momentum while Litecoin traders are looking for alternatives

Litecoin’s dull performance this week could encourage merchants to start turning capital in new innovative projects such as SUBBD ($ subbd) with high increase potential. The newly launched AI platform for content creators has crossed $ 1 million in presale, attracting a strong early adoption of retail investors.

Subbd presale

Currently, Subbd has raised $ 1.05 million in its target of $ 1.26 million, with tokens at 0.05625. The project aims to transform the commitment of creators-faans using the functionalities of improved public services in AI, including premium access to content approved by influence, advantages linked to exclusive live dissemination and discounts on subscriptions to the platform.

With remaining limited reduced input levels, investors can secure tokens directly via the official SUBD platform before filling the presale.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn