- Terra Luna Classic has been rejected from the highs of the range but could soon see a price rebound.

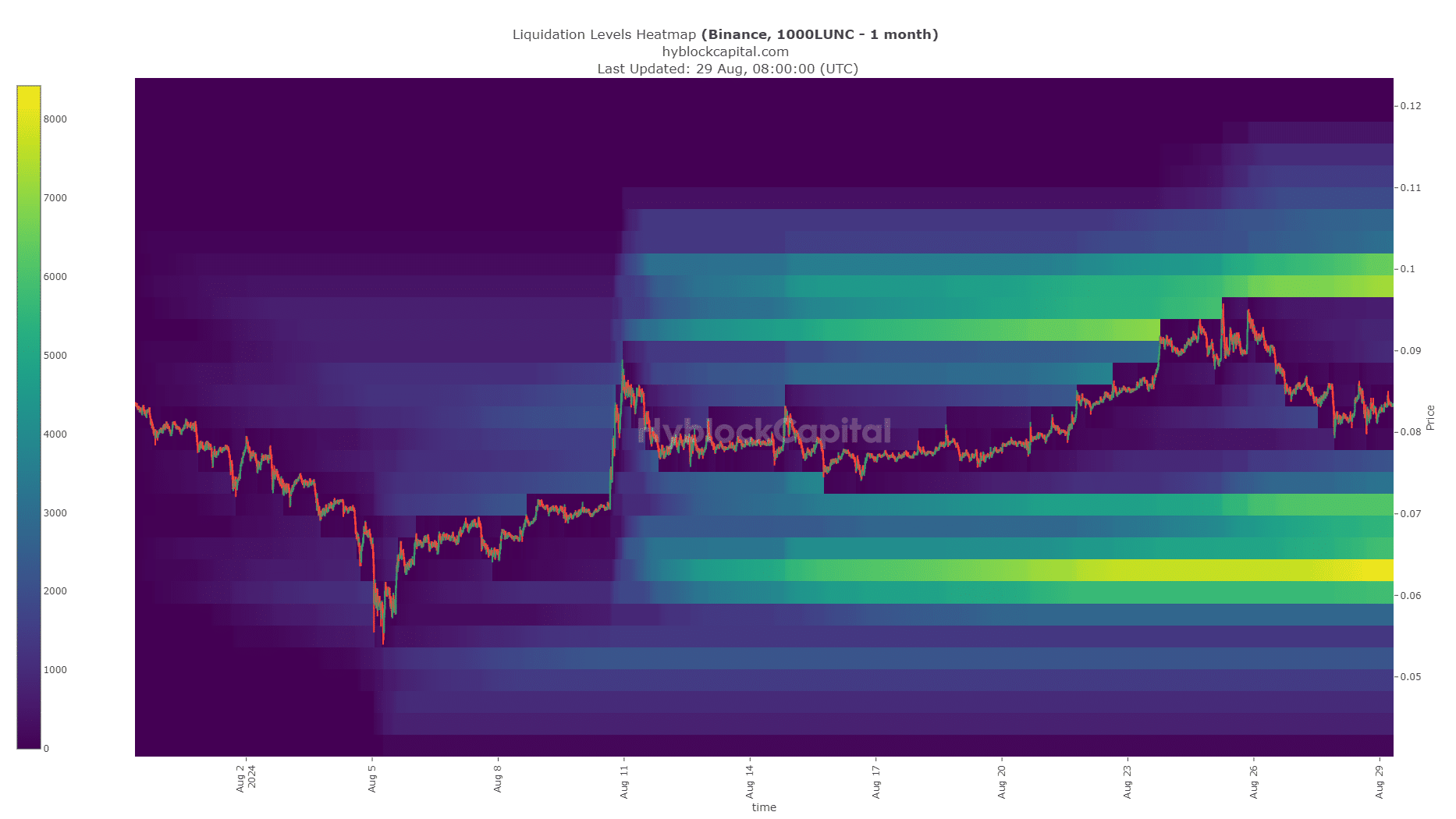

- Liquidity levels indicated that the token could see a double-digit percentage decline over the next two weeks.

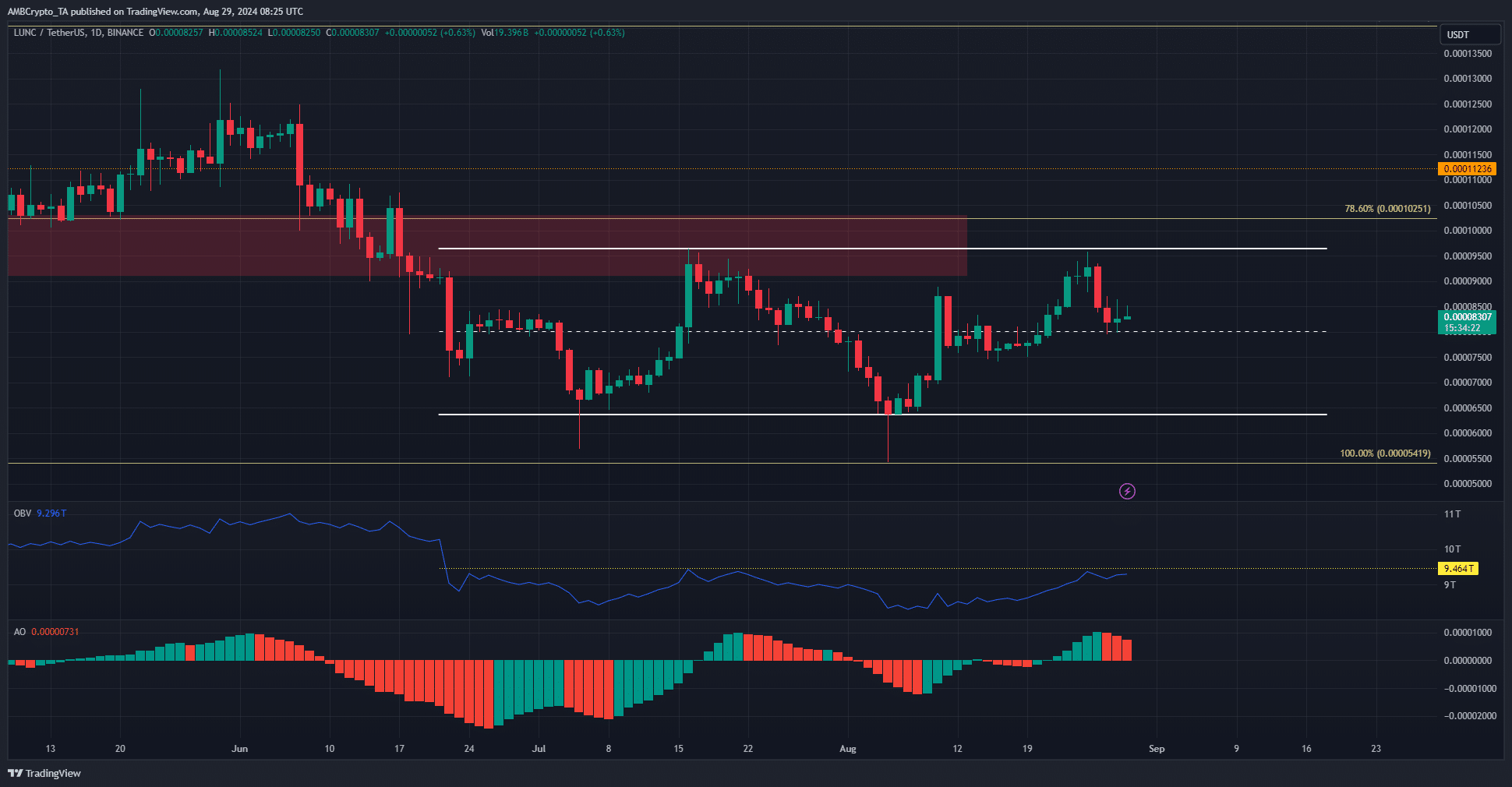

Terra Luna Classic (LUNC) retested the highs of the two-month-old range during the recent rally but failed to break the resistance level. It broke above the mid-level on August 21 when Bitcoin (BTC) surpassed the $60,000 mark.

The court’s bankruptcy order in the Terraform Labs case has allowed the opening of the Shuttle Bridge to facilitate token movements between Terra and other blockchains. This could help in the company’s restructuring efforts.

Range-bound price action continues

Source: LUNC/USDT on TradingView

Luna Classic has been trading in the $0.0000637-$0.0000964 range since early July. Its last attempt to break above the range highs ended in failure. According to the Awesome Oscillator, the momentum was bullish but weakening.

The OBV failed to break the July highs, meaning that buying volume was not significant enough to increase the chances of a LUNC breakout.

The current market price is still above the average support level. It is unclear whether prices can hold this level or are heading for a deeper decline. Liquidity charts have given some clues.

LUNC Could Head Towards Lower Lows, But Bears Should Be Patient

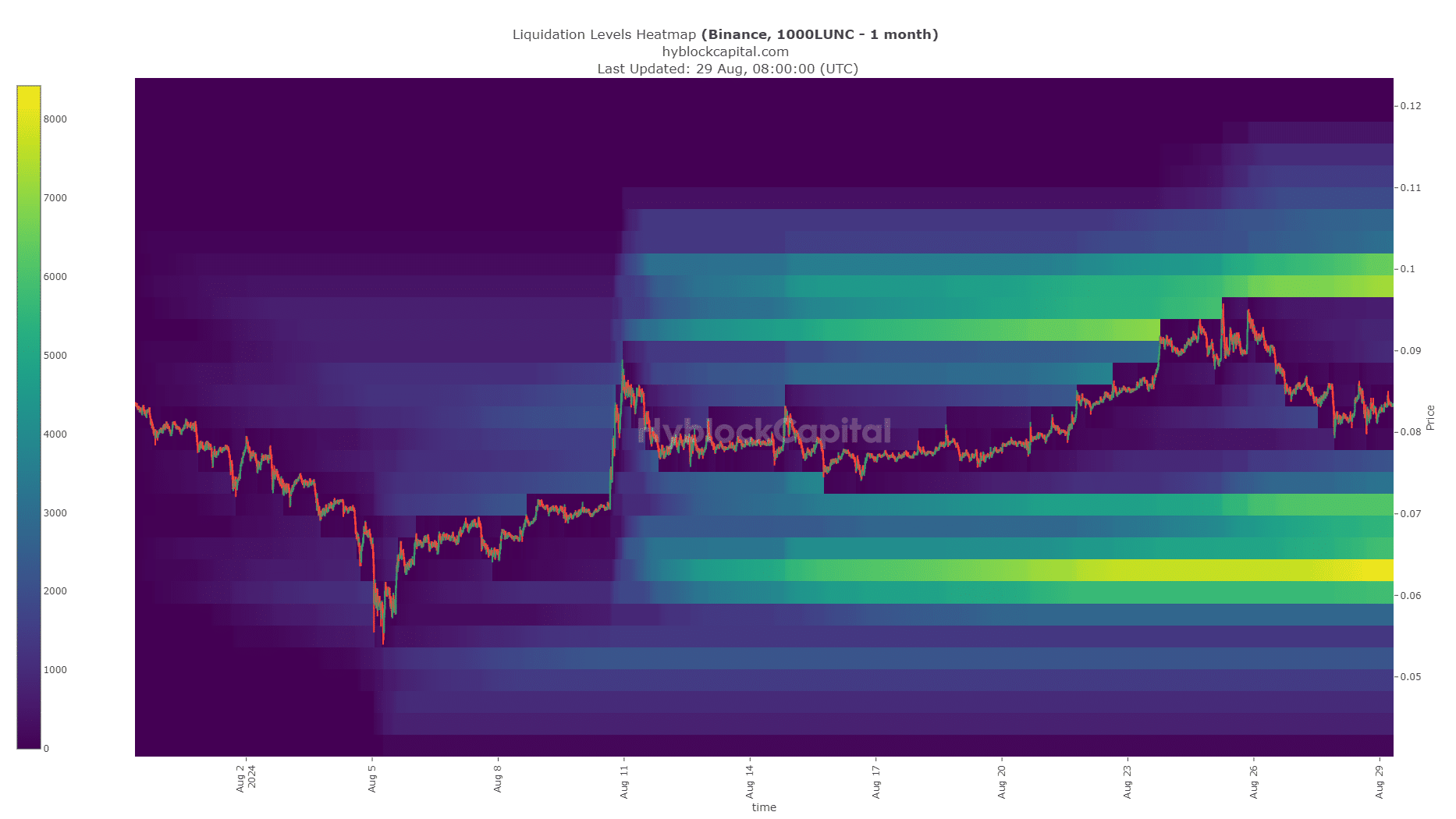

Source: Hyblock

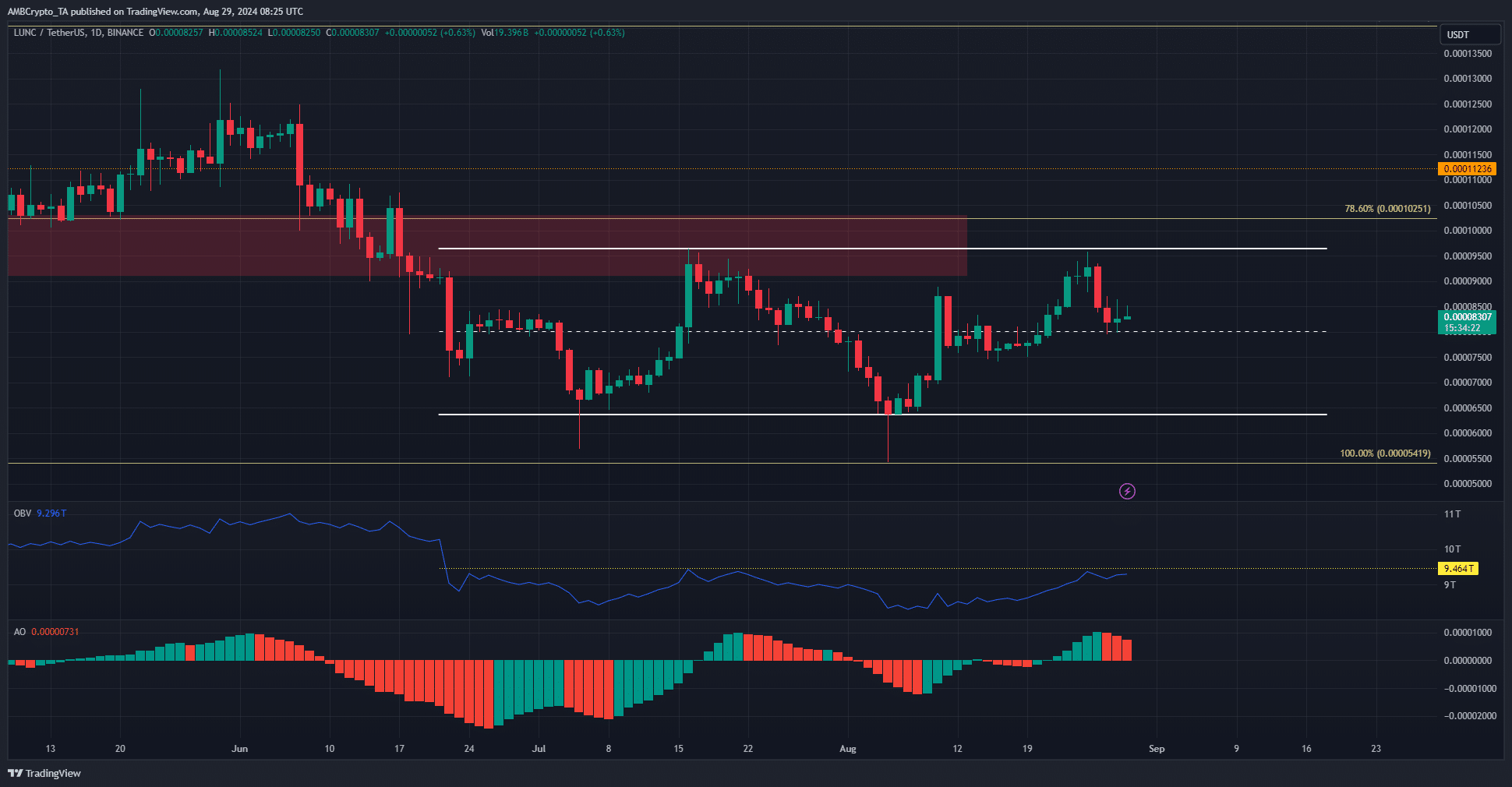

The liquidation heatmap showed that the $0.0001 and $0.000063 to $0.000071 areas were the next magnetic zones for the price.

Given the high level of rejection, AMBCrypto concluded that a downward move was more likely over the coming weeks.

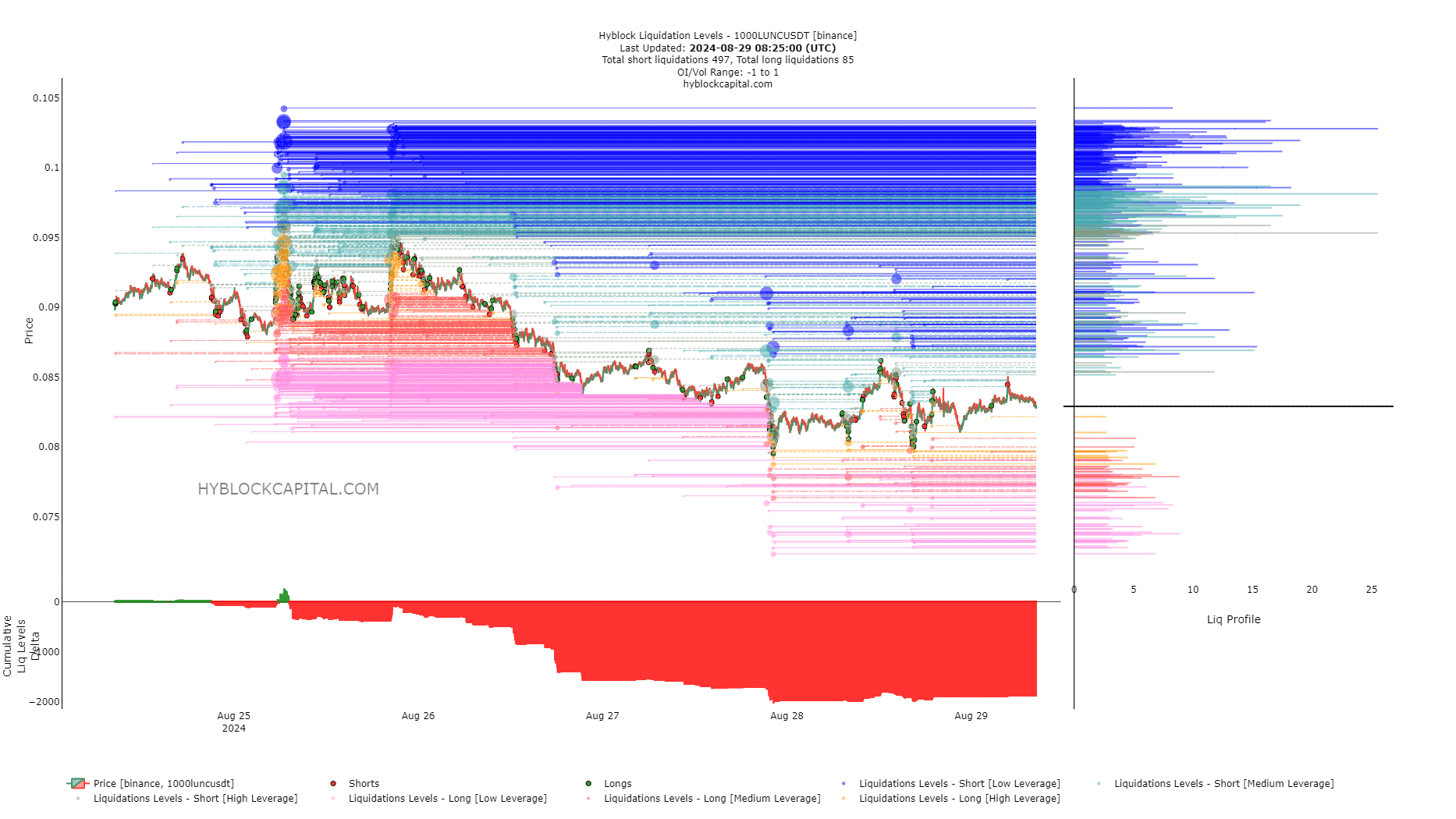

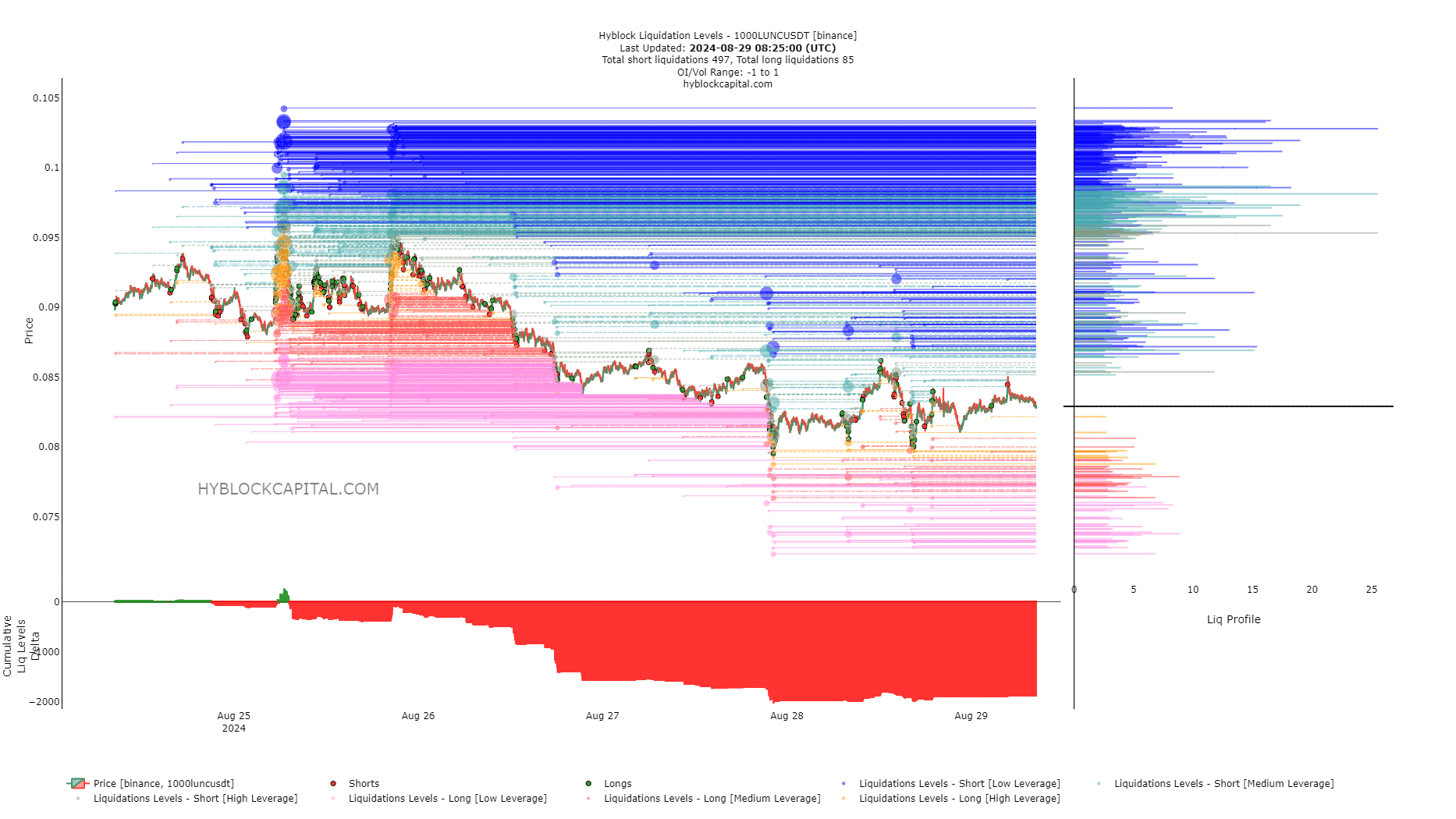

Source: Hyblock

The cumulative delta in liquidity levels over the past few days has been extremely negative. The conclusion here is that a short squeeze is likely before the move to the range lows can begin.

Is Your Portfolio Green? Check Out the Terra Luna Classic Profit Calculator

The $0.000087 and $0.000091 levels were the short-term upside targets. Swing traders could use a price rebound to look for selling opportunities in LUNC.

Disclaimer: The information presented does not constitute financial, investment, trading or other type of advice and represents the opinion of the author only.