Key notes

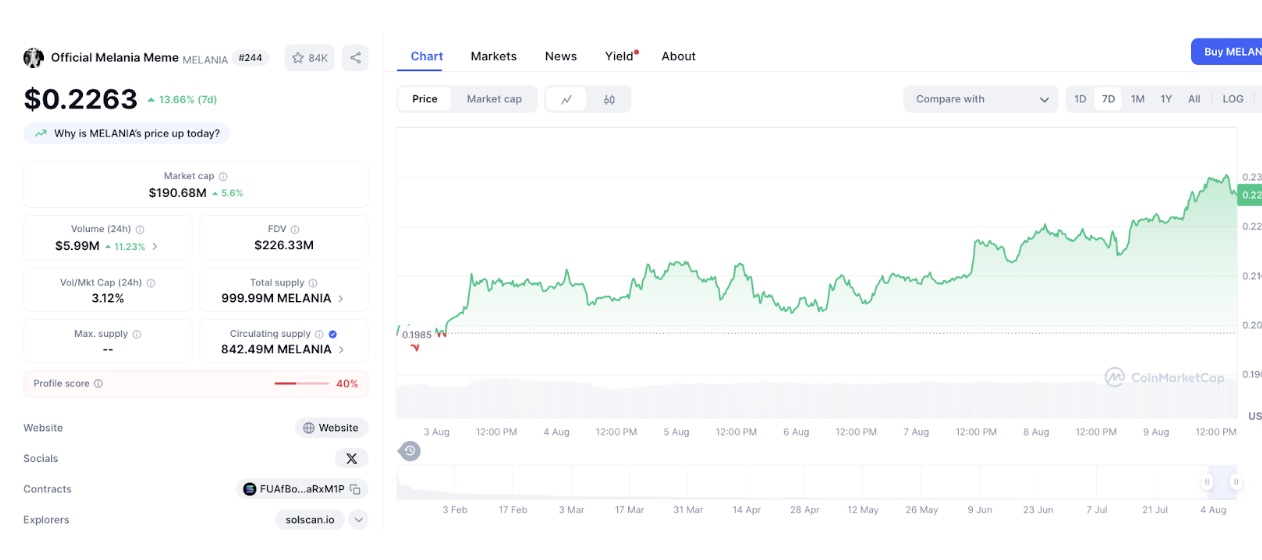

- Melania’s official price (Melania) jumped 14% this week, briefly reaching $ 0.22 and pushing its market capitalization over $ 190 million.

- Rally fueled by the announcement of the WLFI loyalty loyalty program and fundraising plans of $ 1.5 billion.

- World Liberty Financial supported by Trump continues to develop with stablecoin, token and loans products. .

The momentum of the Melania Token market intensified this week, climbing 14% to $ 0.22 on Saturday August 9 and raising its market capitalization more than $ 190 million for the first time this month. The latest recovery was motivated by two major update developments by World Liberty Financial (WLFI), the DEFI company affiliated to Trump behind Melania Memecoin and the Stablecoin USD1.

Token Melania’s price rally started earlier in the week after WLFI announced the upcoming launch of a USD loyalty point program designed to reward users who actively support Stablecoin growth.

Thanks to partnerships with certain cryptocurrency exchanges, eligible USD holders will soon earn points for activities such as USD pairs trade or the maintenance of token sales.

Each participating exchange will determine its own specific rules for punctual distribution, introducing a competitive and customizable award environment comparable to traditional loyalty programs in consumer finance.

A few days later, the bullish feeling intensified on Friday when Bloomberg said WLFI was in advanced talks to launch a $ 1.5 billion cash fund dedicated to his native WLFI token. According to the first reports, this fund is managed in a new listed business, with the aim of attracting the main institutional investors in the crypto and technology sectors.

The WLFI token, originally created as a non -transferable governance, should become publicly negotiable following a governance vote last month.

The Treasury Plan is based on the success of WLFI funds, which saw $ 550 million raised during a private token sale in March. The company also advances other DEFI initiatives, including a next cryptography loan platform powered by USD1.

This loan application will allow users to borrow, lend and exchange digital assets in a transparent manner in the WLFI ecosystem, putting more emphasis on the long -term levels to extend domination in the DEFI market.

Can Melania Memecoin Price forecasts: Can bulls drop to $ 0.258?

From a technical point of view, Melania Token broke the key resistance to her mobile average at 50 days almost $ 0.224, closing three consecutive sessions in the green. Price Action is currently testing the Upper Bollinger group around $ 0.23, with a daily RSI at 52.7, still below the exaggerated territory, suggesting room for new gains.

Melania’s official price action (Melania), August 9, 2025 | Source: CoinmarketCap

If the bulls guarantee a daily closure greater than $ 0.23 with a strong volume, the next target up is $ 0.258. This marks the upper limit of the July rally beach. A decisive break could then open the way to $ 0.285. Which is a level of psychological resistance aligned with previous volume peaks.

On the other hand, not containing $ 0.224 could trigger a withdrawal to the support area of $ 0.191. Then coinciding with the lower Bollinger strip and the previous consolidation base. A daily fence of less than $ 0.19 would invalidate the short -term bullish projection and potentially see Melania Price Retester $ 0.165.

Melania price forecasts | Tradingview

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn