- Bonk has formed a key technical model on the graph, referring to an upcoming bullish reversal.

- The purchase activity and the bullish feeling of the derivative market currently contribute to the Bonk rally potential.

Bonk (Bonk) remained one of the most impressive tokens on the market in the last month. In the last week only, the assets won 44.63%, with a monthly decision of 21.22%.

This decision suggests that there is an increasing interest in the same and a tendency to record other market gains, because the feeling of the market moves largely in favor of buyers.

A bullish pattern could add to the rally

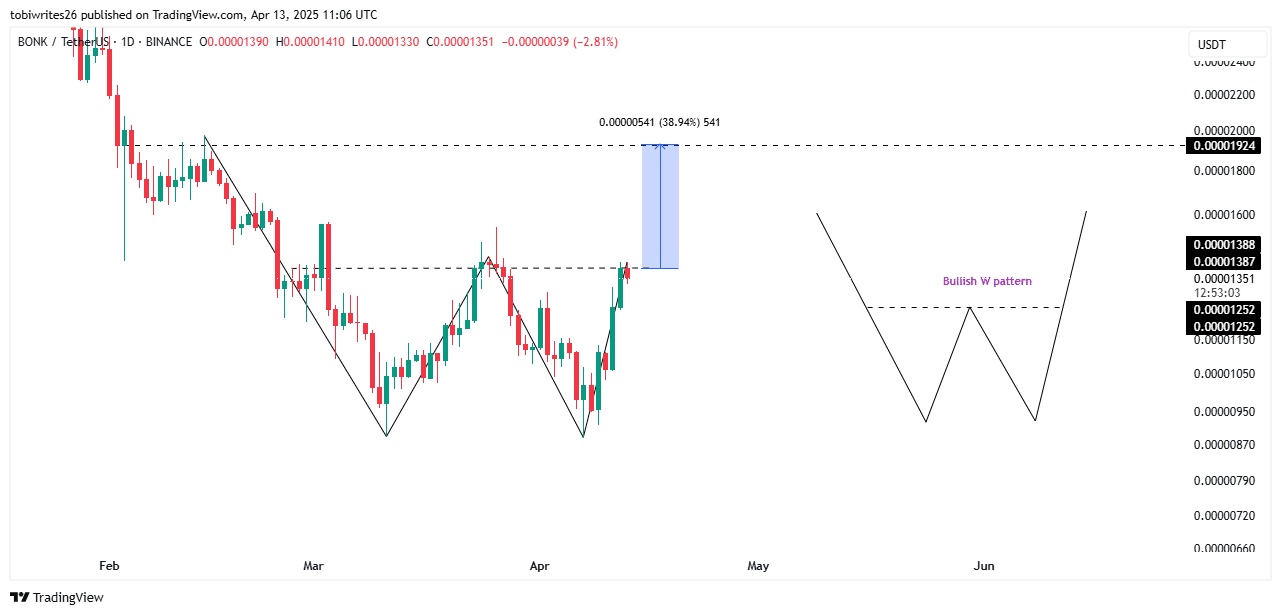

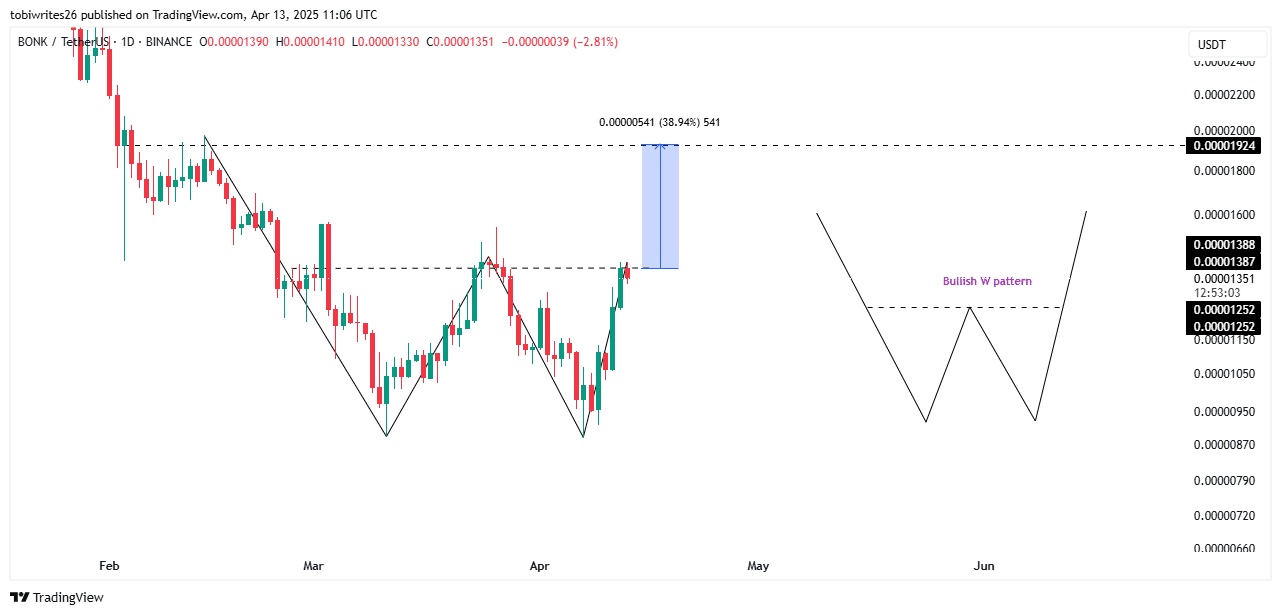

Bonk formed a bullish model known as the “W” model, known to act as a catalyst so that assets can recover and record other market gains after a structure rupture.

This structure rupture occurs when the asset strikes a resistance line, leading to the start of a rally. In the case of Bonk, the extended dotted line marks the level which must be violated.

Source: tradingView

Once this violation has taken place, Bonk could make a major price jump, winning around 38% and gathering at $ 0.0000,1924 on the graph.

Above this price objective, the differences in fair value not marked, which are known levels of liquidity on the graph, which suggests that the price could record other gains by negotiating at these points.

The indicator and market demand add to the bullish feeling

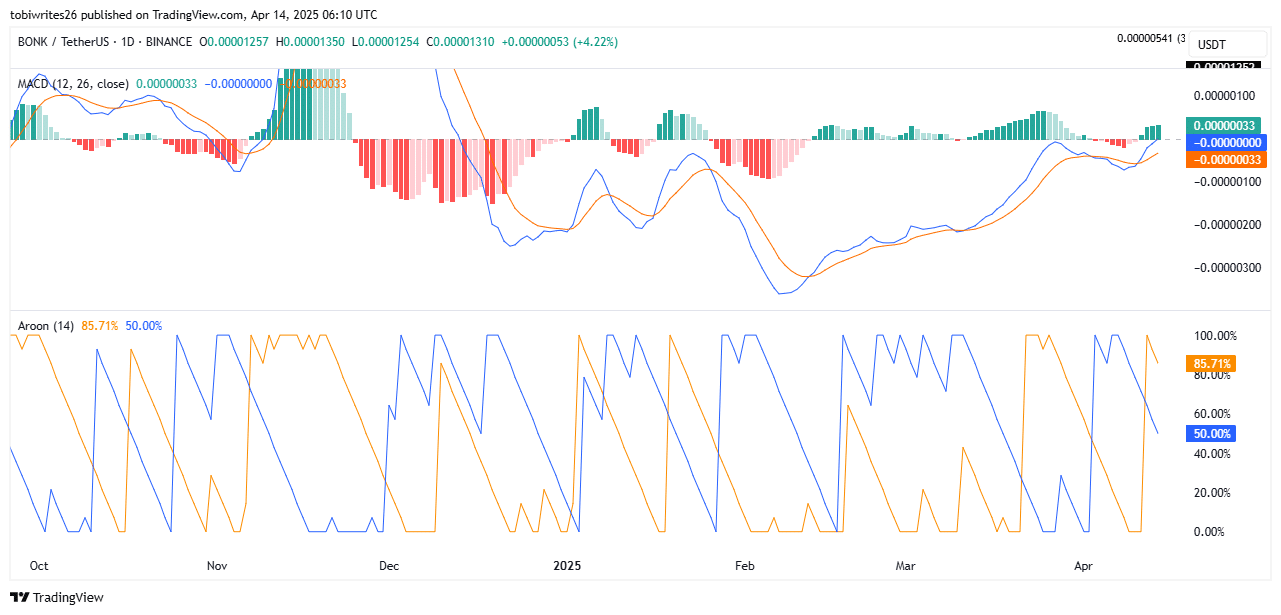

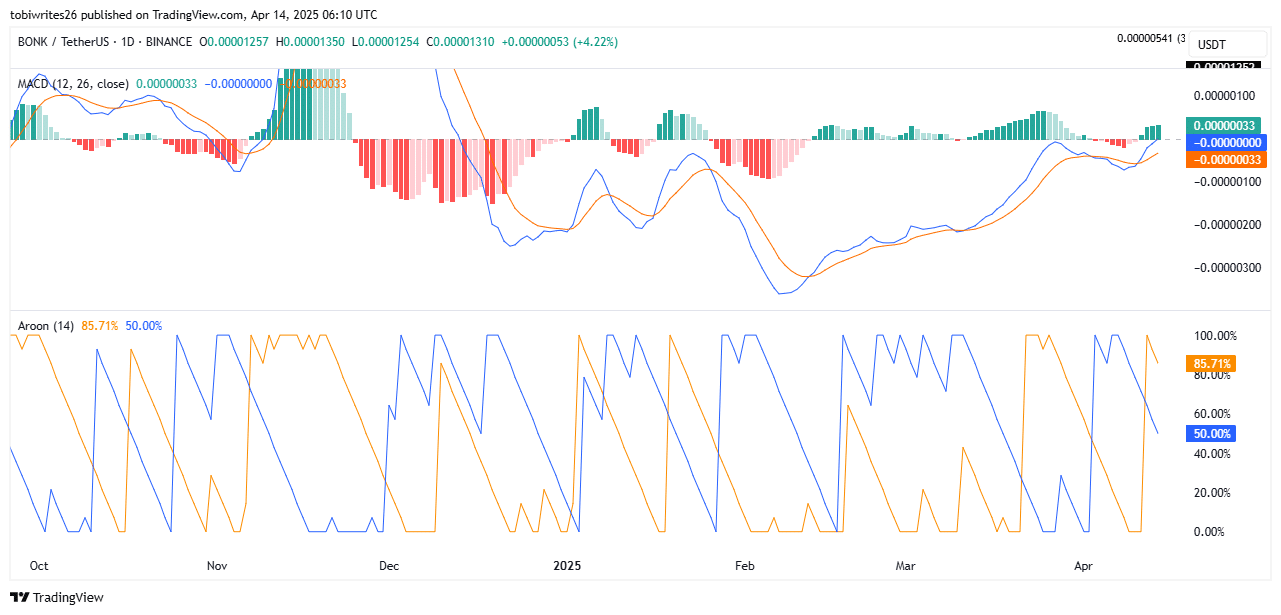

The technical indicators suggest that a break in this level of resistance is imminent. Mobile average convergence and divergence (MacD) indicate that the rally could soon take shape.

At the time of the press, the blue MacD line was positioned at the level of 0.00 and stretched upwards. The volume histogram displays exponential growth.

If the MacD line enters the positive region and the histogram continues to increase, it will confirm the increase in the momentum among the traders who actively buy Bonk.

Source: tradingView

The Aroon indicator analyzes market trends and their strength using two lines – Aroon Up (Orange) and Aroon Down (blue).

A bullish feeling is confirmed when the Aroon line at the top remains above the descending line of Aroon. Current readings show the orange line at 85.71% and the blue line at 50.00%. These readings align with the story of the dominant market.

On the cash market, buyers have actively acquired Bonk. They bought a value of $ 2.6 million in the assets and transferred it to private wallets to hold.

This passage from exchanges to private wallets indicates increasing confidence in the long -term potential of the assets.

If the trend continues in the coming week, Bonk could see a new price appreciation. This scenario increases the possibility of a major movement movement in future trading sessions.

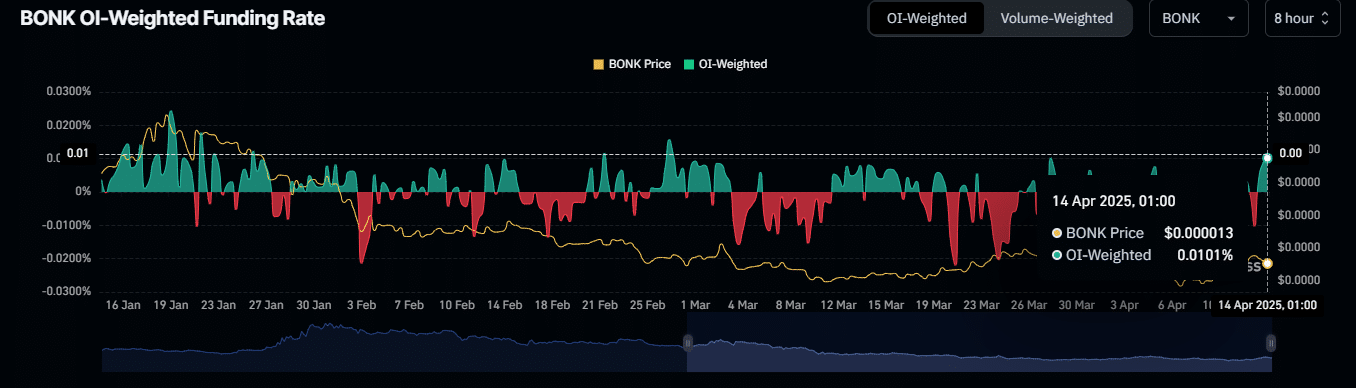

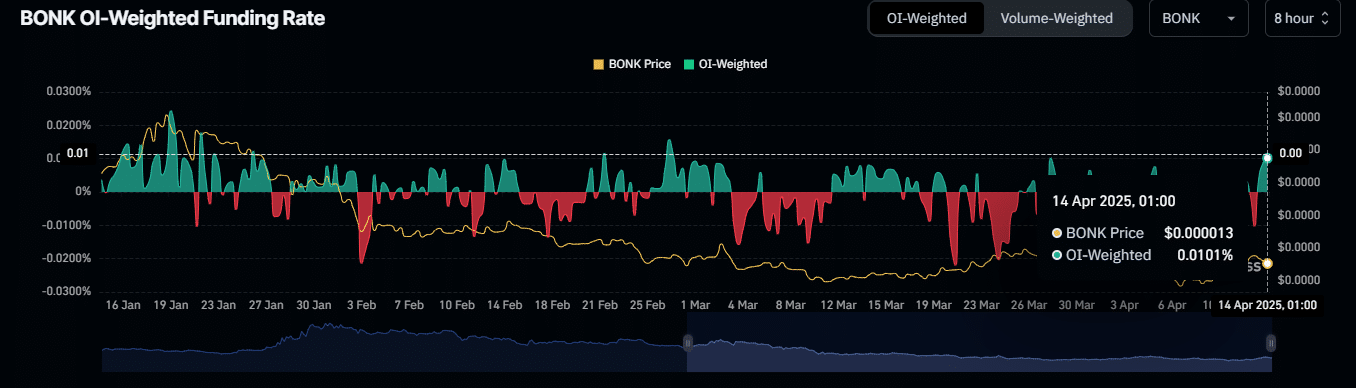

Source: Coringlass

The weighted financing rate according to the OI combines the funding rate and open interest to assess the potential market orientation.

This indicates that the market is favorable to long traders. At the time of the drafting of this document, the weighted funding rate was 0.0101%.

This reading confirms a high purchase activity on the market, which could support a break in the level of resistance. If the level of resistance is violated, it can lead to another rally, which potentially leads to new heights for Bonk.

Overall, the Bonk rally seems likely, the market should increase and assets exceeding marked targets.