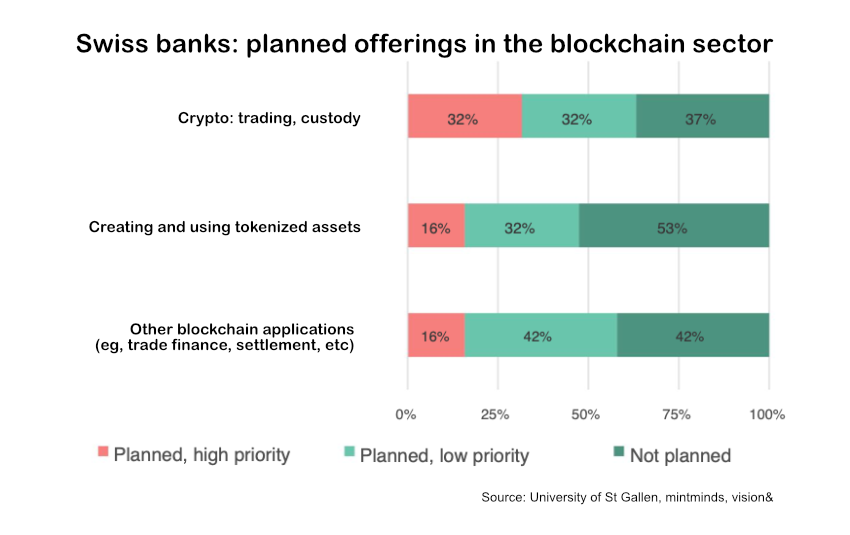

According to a survey conducted by the University of St. Gallen, mintminds and vision&, 48% of Swiss banks are planning or already implementing tokenization use cases. The adoption figure for cryptocurrencies is much higher, at 64%. Beyond tokenization and crypto, 58% of banks are considering other “advanced” blockchain use cases, such as trade finance or settlement.

The consensus among the 19 banks that participated in the survey is that blockchain’s potential will be realized within two to five years, with greater impact beyond five years. However, beyond five years, only 37% of bankers believe that the impact of DLT will be significant, compared to 63% who consider its importance to be moderate. Over the next two years, 11% of banks (both private banks) believe the impact will be significant

Just over a quarter of banks have at least ten full-time employees dedicated to digital assets. Another 21% have between two and five employees.

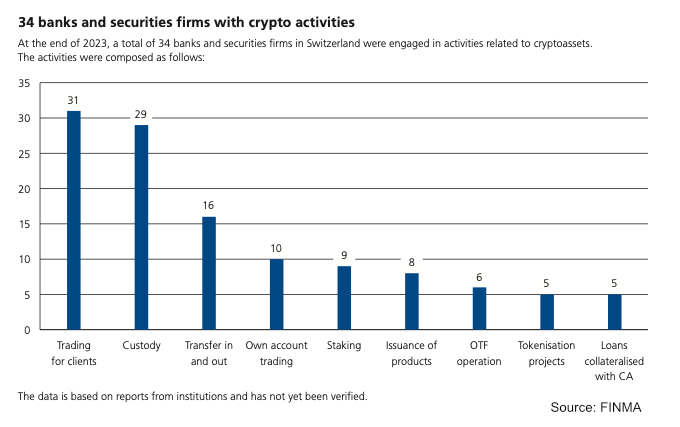

Interest in tokenization appears to have increased since last year, when Swiss regulator FINMA surveyed 34 institutions. He found that trading and custody of cryptocurrencies dominated, with tokenization far behind.

Challenges of tokenization

When asked about the challenges of tokenization, some responses were concerning. More than half (53%) said the company was not prioritizing tokenization or lacked a business case. The second biggest challenge was lack of know-how, while the third concern was lack of customer interest. The issues often discussed among experts fall quite far down the list, with 11% citing high costs and 5% citing lack of secondary trade and the same number emphasizing the need for standards.

Regarding their own level of expertise, the majority consider themselves beginners in both crypto (60%) and tokenization (58%). For tokenization, only 8% consider themselves experts compared to 20% for cryptocurrency. The remaining group feels they have a limited level of experience.

Banks also allocate part of their portfolios to cryptocurrencies, which represent just over 0.5% of assets under management. Some other notable statistics are that Swissquote, one of the largest brokers in Switzerland, generated 11% of its revenue via crypto in the first half of 2024. Since 2019, PostFinance has transferred over a billion francs to crypto exchanges.