- Nearly was a critical position on the graph as she was trying to recover a level of support that could determine her rally.

- The metrics on the channel suggested mixed market signals, placing nearby at a crossroads concerning its next movement.

Near the protocol (close) decreased by 3.80% in the last 24 hours, with its valuation of press time at $ 3.38.

This lower movement continued the downward trend near the end of the month, with a drop of 36.94%.

The analysis has shown mixed signals on several market measures, which could delay a possible rally or cause new market cuts.

Attempts close to recovering higher levels

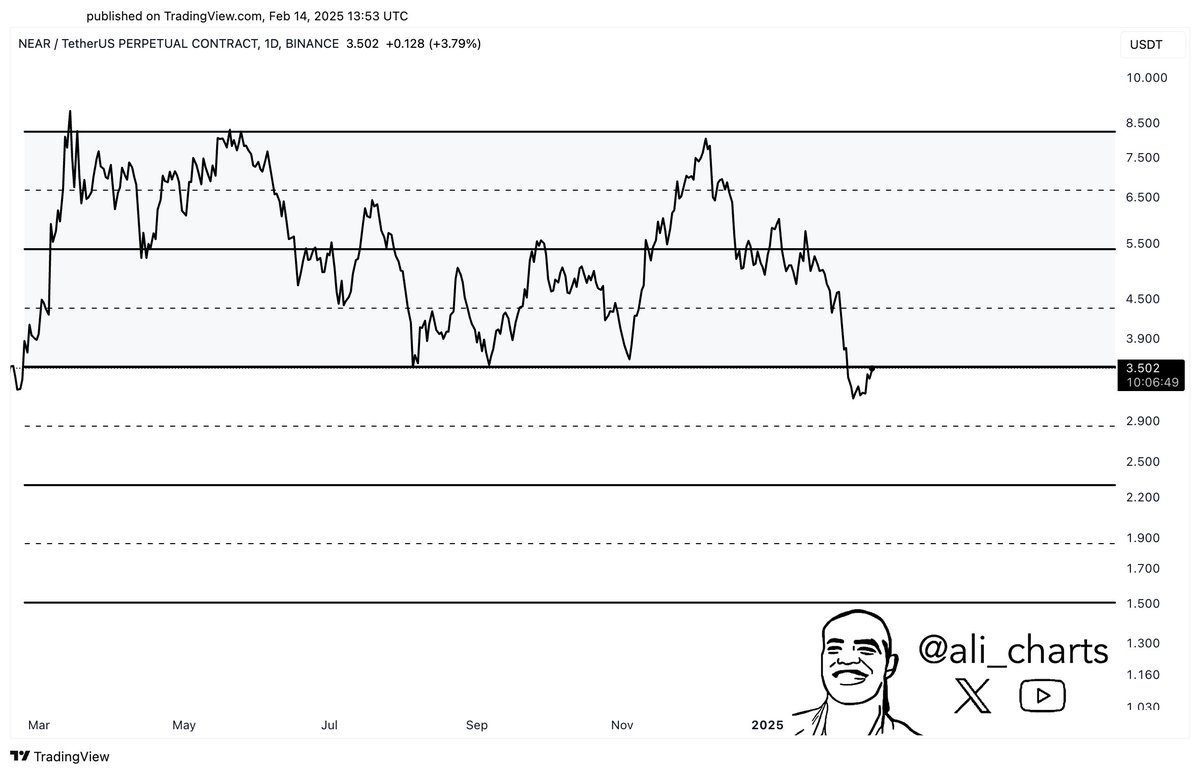

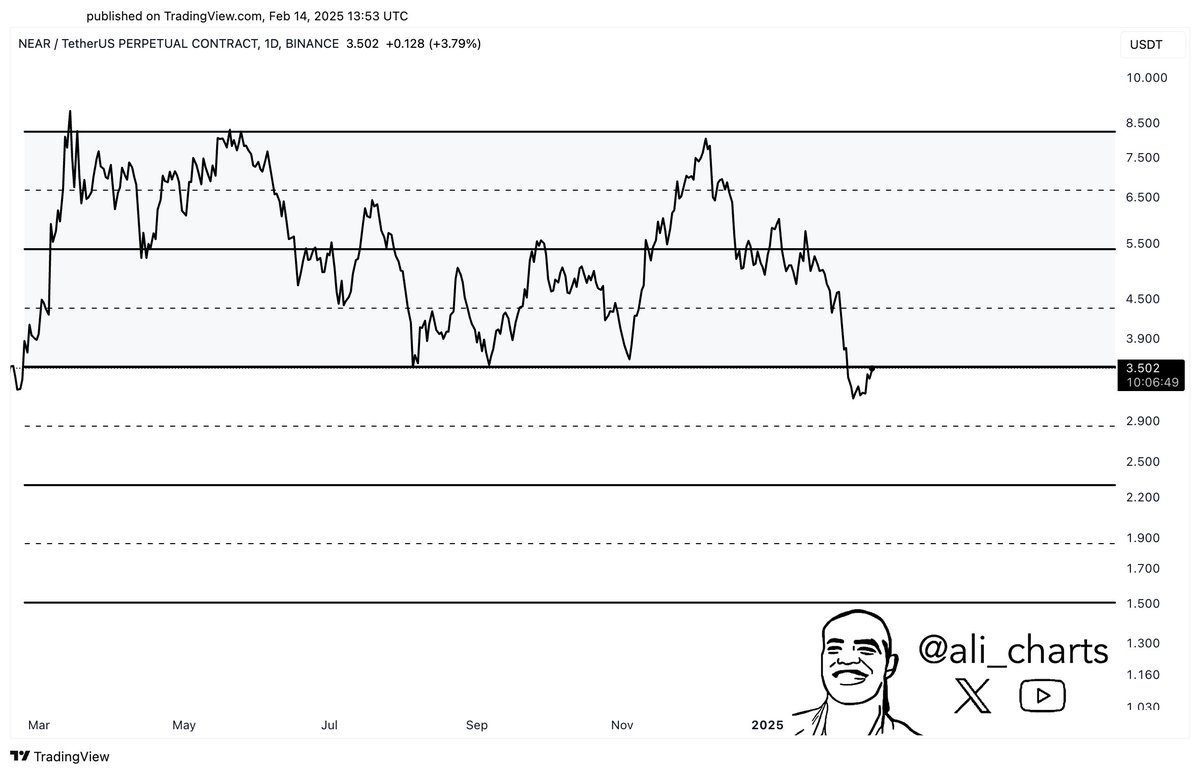

After exchanging for an extended period of one month in a consolidation channel – where the price has oscillated between a support at $ 3.50 and a resistance level of $ 8.30 – recently did not cross this level of support and was lower.

However, the asset tried to recover this support at the time of the editorial staff, to get back into the consolidation channel and to form a new summit.

Source: tradingView

Another possibility is that this slight withdrawal of prices constitutes near a lower summit before continuing its downward trend.

Ambcrypto has analyzed additional factors that could influence the price trend – whether up or down – and found a mixed feeling on the market.

The feeling of the mixed market creates an uncertainty

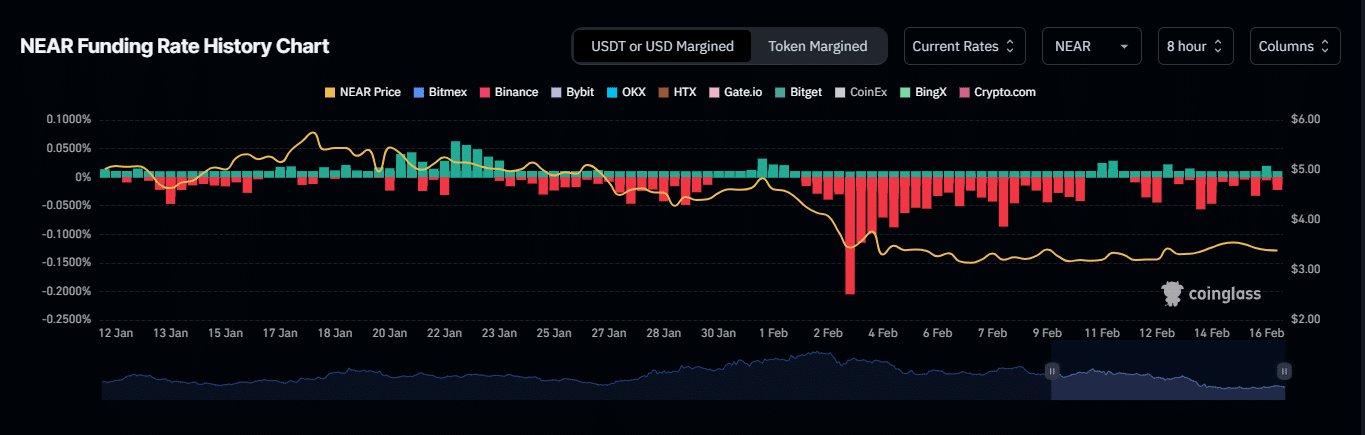

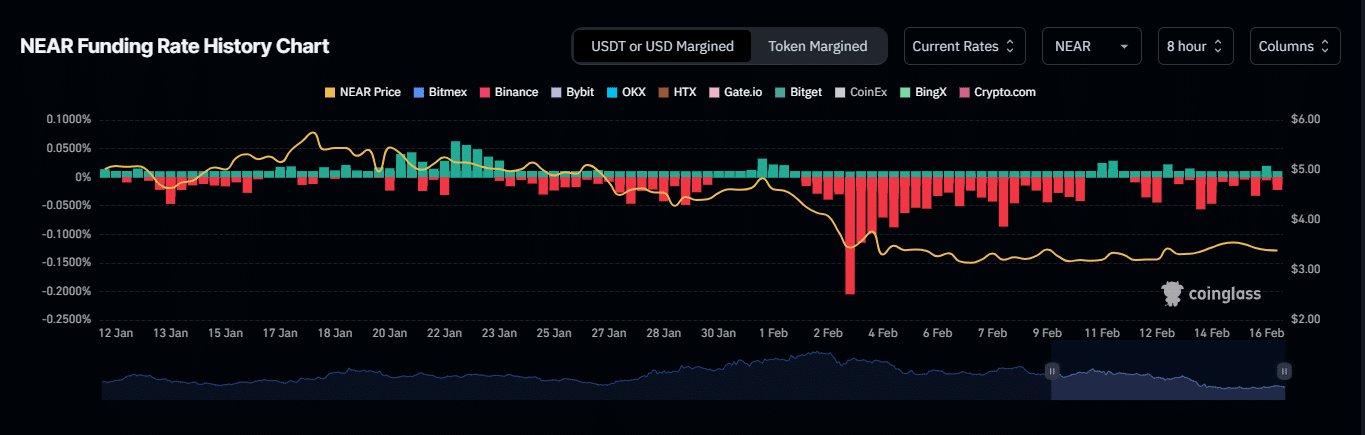

Several market indicators suggest a mixed feeling. At the time of writing the editorial staff, the financing rate showed that the sellers were funding the market.

This is based on the negative financing rate of -0.0170. Negative reading indicates that sellers are very convinced that the price of Narch will decrease shortly.

Source: Coringlass

Likewise, there have been more long liquidations on the market on all time. In the past 24 hours only, a total of $ 137,140 of long contracts was closed with force, against $ 24,170 in short liquidations.

This high disparity suggests that near bears are in control, increasing the probability of an additional drop in prices.

However, the buyer’s purchase ratio indicates that the bulls remain active, as the volume of purchase has exceeded the sales volume in the last 24 hours.

This report is measured on a scale where 1 represents a neutral zone. A reading greater than 1 suggests that buyers are more active, while reading below 1 indicates the domination of the seller.

The current ratio of the purchase of Nérarange lessee was 1.004, which means that the market has been slightly optimistic in the past 24 hours.

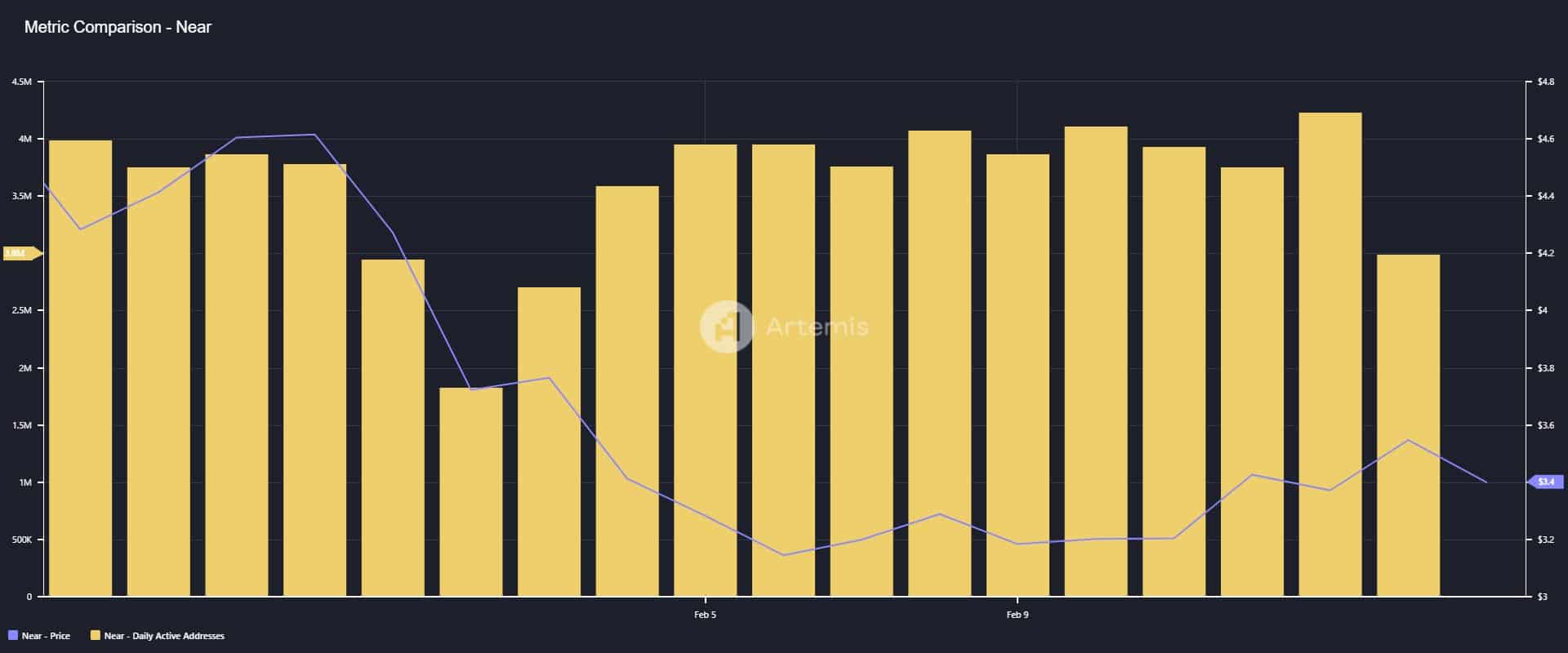

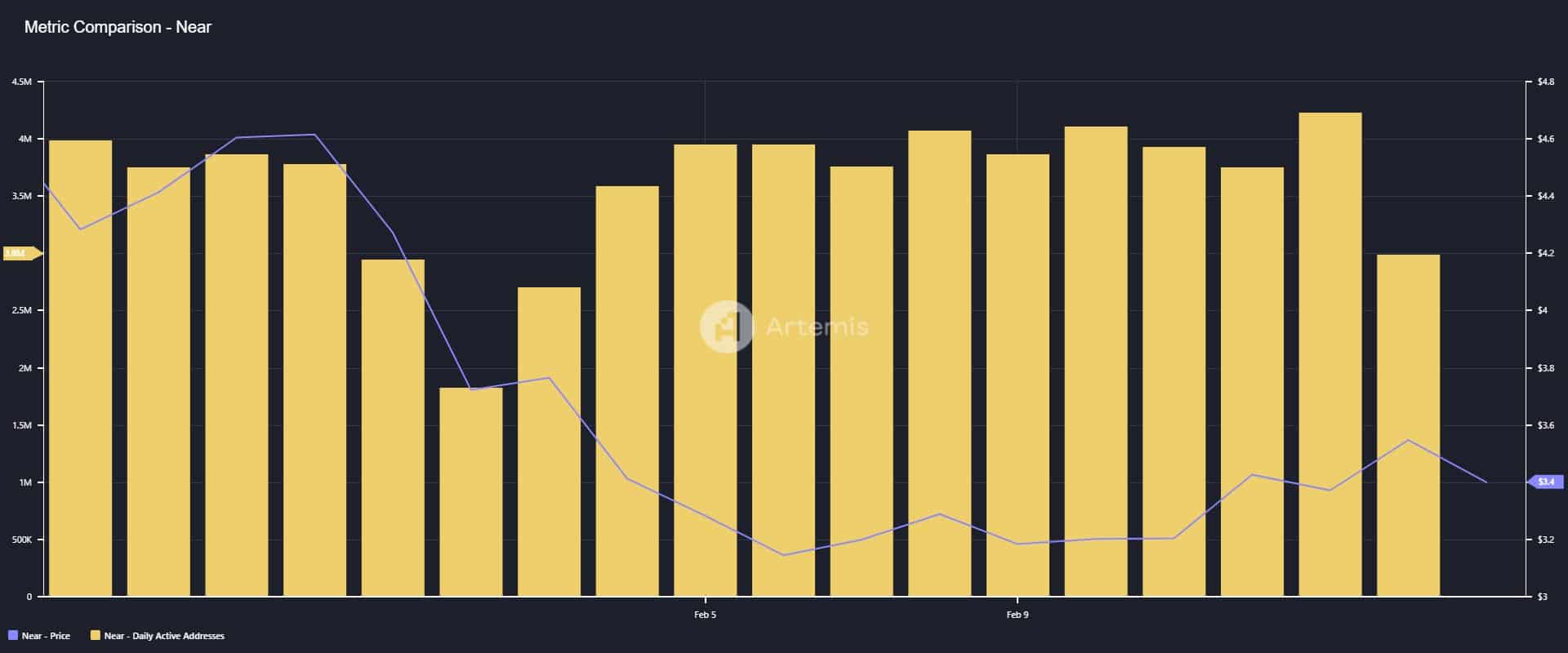

The drop in active addresses adds to pressure

There was a significant drop in the number of active addresses daily on the nearby chain.

A drop in active addresses, especially when the price of the asset is down, suggests a reduced network activity because traders probably leave their positions.

According to Artemis, between February 13 and the latest data at the time of the press, active addresses dropped by 1.2 million, from 4.2 million to 3.0 million.

This suggests that a notable part of this drop comes from sellers leaving the market.

Source: Artemis

If the active addresses continue to drop, this could add more pressure downwards to assets as more and more sellers are entering the market.