Join our Telegram channel to stay up to date with the latest news

Intercontinental Exchange (ICE), owner of the New York Stock Exchange (NYSE), plans to take a stake in crypto company MoonPay at a valuation of around $5 billion.

According to Bloomberg on December 18 report Citing sources familiar with the matter, ICE’s potential investment in the company comes as MoonPay nears the end of its latest funding round.

MoonPay went on an expansion spree this year

MoonPay was founded in 2019 and offers software that helps users switch between crypto and fiat currencies more easily. Its last funding round, worth $3.4 billion, took place towards the end of 2021, right around the time the crypto space’s bull market was at its highest.

MoonPay’s latest stock sale comes after the company embarked on an expansion drive this year, which saw the company acquire at least four startups before launching a stablecoin business. This follows the passage of the GENIUS Act by the US Congress and President Trump’s decision to sign the bill, paving the way for the wider use of stablecoins.

In addition to acquisitions, expansion and the latest funding round, MoonPay also announced this week that Caroline Pham, acting chair of the U.S. Commodity Futures Trading Commission (CFTC), will join the company after Mike Selig is sworn in as the agency’s new leader.

I look forward to a successful confirmation of Mike Selig as @CFTCand a smooth transition once he takes the oath of office. The future is bright. Onwards and upwards 🚀

– Caroline D. Pham (@CarolineDPham) December 17, 2025

ICE expands into crypto markets

ICE’s reported interest in MoonPay is not the NYSE owner’s first move into the crypto space. Earlier this year, the exchange owner announced that it had made a strategic investment in decentralized prediction markets platform Polymarket.

Under the terms of the agreement, ICE will invest up to $2 billion in the company. This capital injection valued Polymarket at a pre-investment of approximately $8 billion. This also positions ICE as a major institutional backer of what was previously a largely crypto-native market.

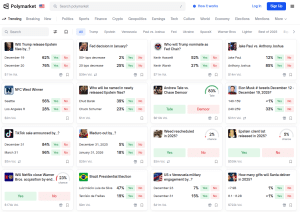

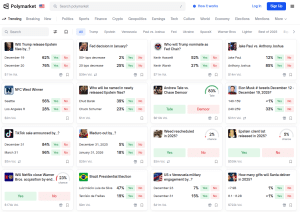

Platforms like Polymarket give users the opportunity to bet on the outcomes of a variety of real-world events. These events cover politics, sports and much more.

Polymarket home screen (Source: Polymarket)

ICE said its investment aims to integrate Polymarket’s event-driven probability data into traditional financial workflows. As such, the deal will enable ICE to become a global distributor of Polymarket data to institutional investors.

The two companies also plan to collaborate on future tokenization initiatives.

2025 was a big year for crypto deals and venture capital funding

This year has seen several large deals announced by crypto companies and has also been a strong year in terms of venture capital (VC) funding.

So far, crypto and blockchain companies have raised nearly $19 billion in venture funding. That’s the most since 2022, according to PitchBook data.

Ripple successfully raised $500 million from investors in November in a round that included funds affiliated with Fortress Investment Group and Citadel Securities. This increase was achieved at a valuation of $40 billion.

On the acquisition front, Ripple has made several strategic purchases. Its purchases included prime brokerage and cash management firms. Meanwhile, US crypto exchange Coinbase has led the charge as the company aims to create an “app for everything” crypto.

This is likely due to the more favorable regulatory climate around the digital asset space in the United States, as President Trump strives to make the United States the crypto capital of the world.

Since entering the White House for a second term, Trump has appointed pro-crypto leaders to key agencies such as the Securities and Exchange Commission (SEC), the Office of the Comptroller of the Currency (OCC), and the US Treasury.

Yesterday, the Senate approved Trump’s picks for the Commodity Futures Trading Commission (CFTC) and the Federal Deposit Insurance Corporation (FDIC).

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news