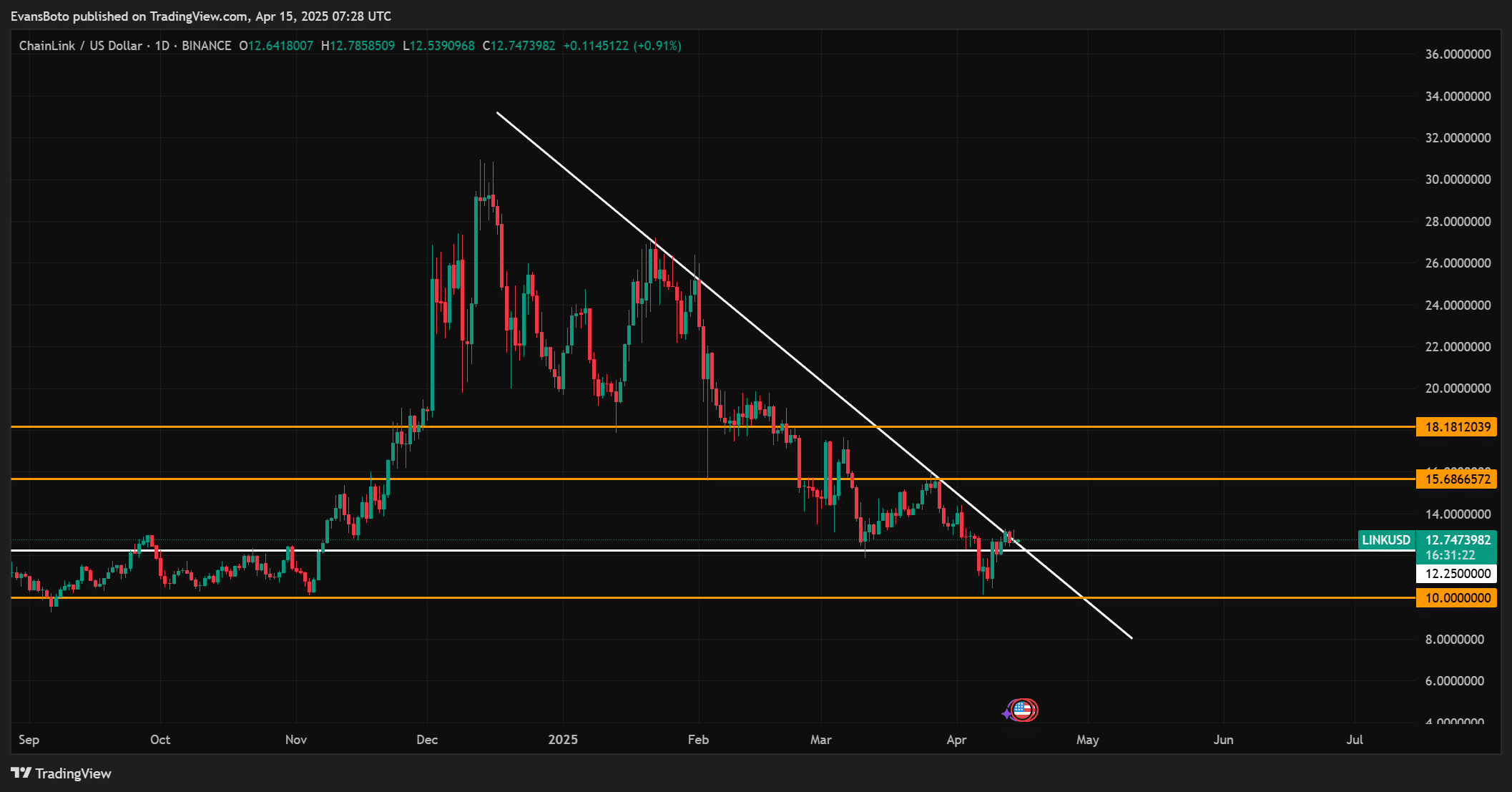

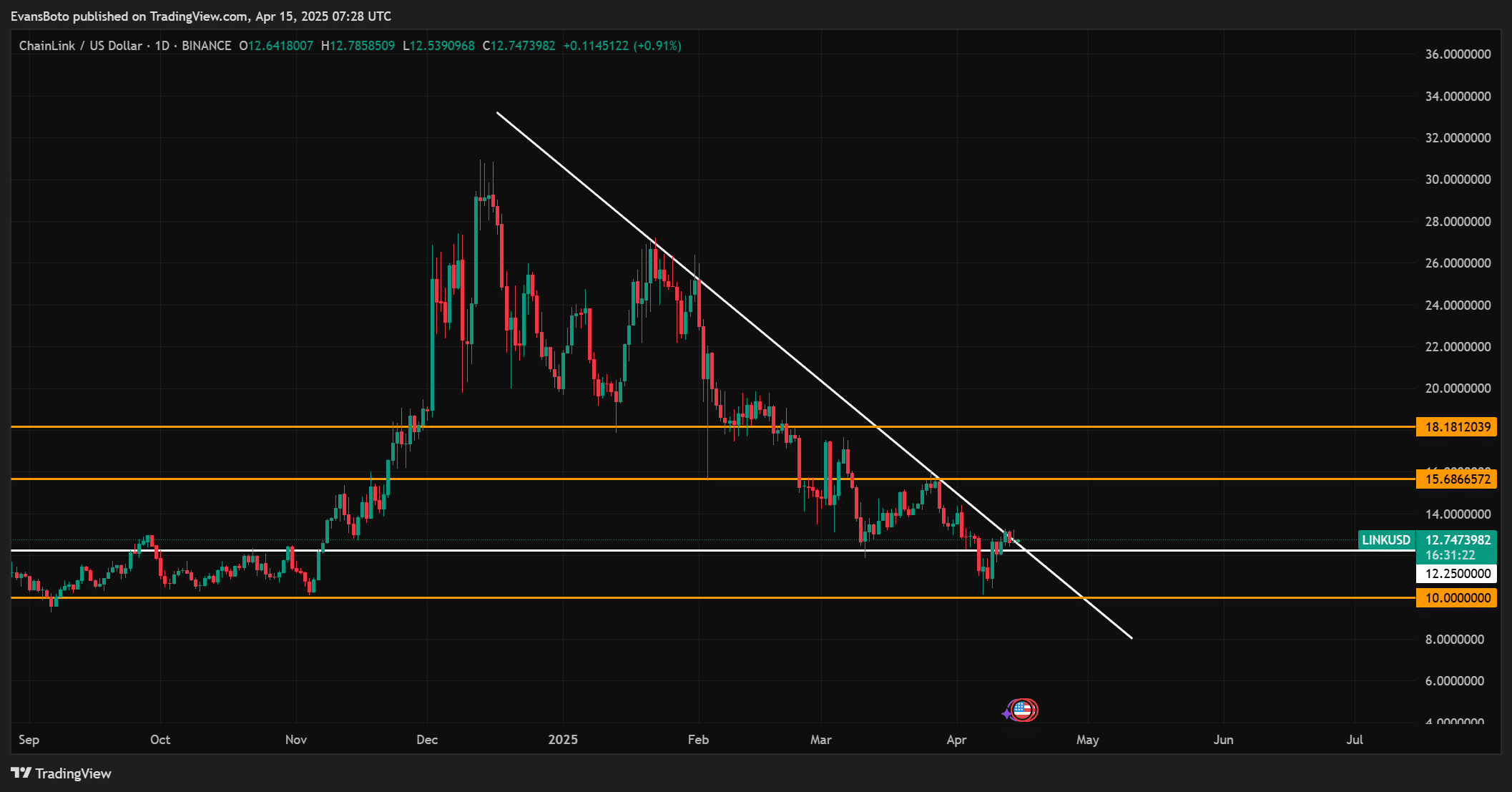

- Link recovered his daily trend line while the bulls defended $ 12.25 in the middle of a slight rise up

- Chain activity has dropped sharply, but fundamentals and reserves alluded to the recovery potential

ChainLink (link)At the time of writing, was Read an area of crucial breakdown after breaking a one -year ascending trend line. It seemed to allude at a decisive moment for the short -term management of Altcoin.

In fact, despite a momentary rebound, the level of $ 12.25 emerged As a key battlefield for bulls aimed at finding domination. If this medium does not hold, decrease targets to $ 10 and $ 7.50 can be developed.

On the technical front, the link recently broke out above a descending trend line on the daily graph – alluding to a potential change in trend. However, the momentum was low and the price could still flirt with the key support area.

At the time of the press, Link was negotiated at $ 12.67 after 0.41% gains in the last 24 hours. Bulls must maintain pressure over $ 12.25 to confirm a lasting reversal.

Source: tradingView

New partnerships and declining reserves – will the fundamentals arouse a recovery?

ChainLink recently announced a strategic collaboration with PI Network, aimed at improving decentralized applications through real -time data integration. This movement strengthens the intelligent contract capacities of Chainlink and could serve as a long -term bullish driver.

However, the market reaction has been reduced so far, which indicates that traders can be more focused on technical structure than short -term fundamentals.

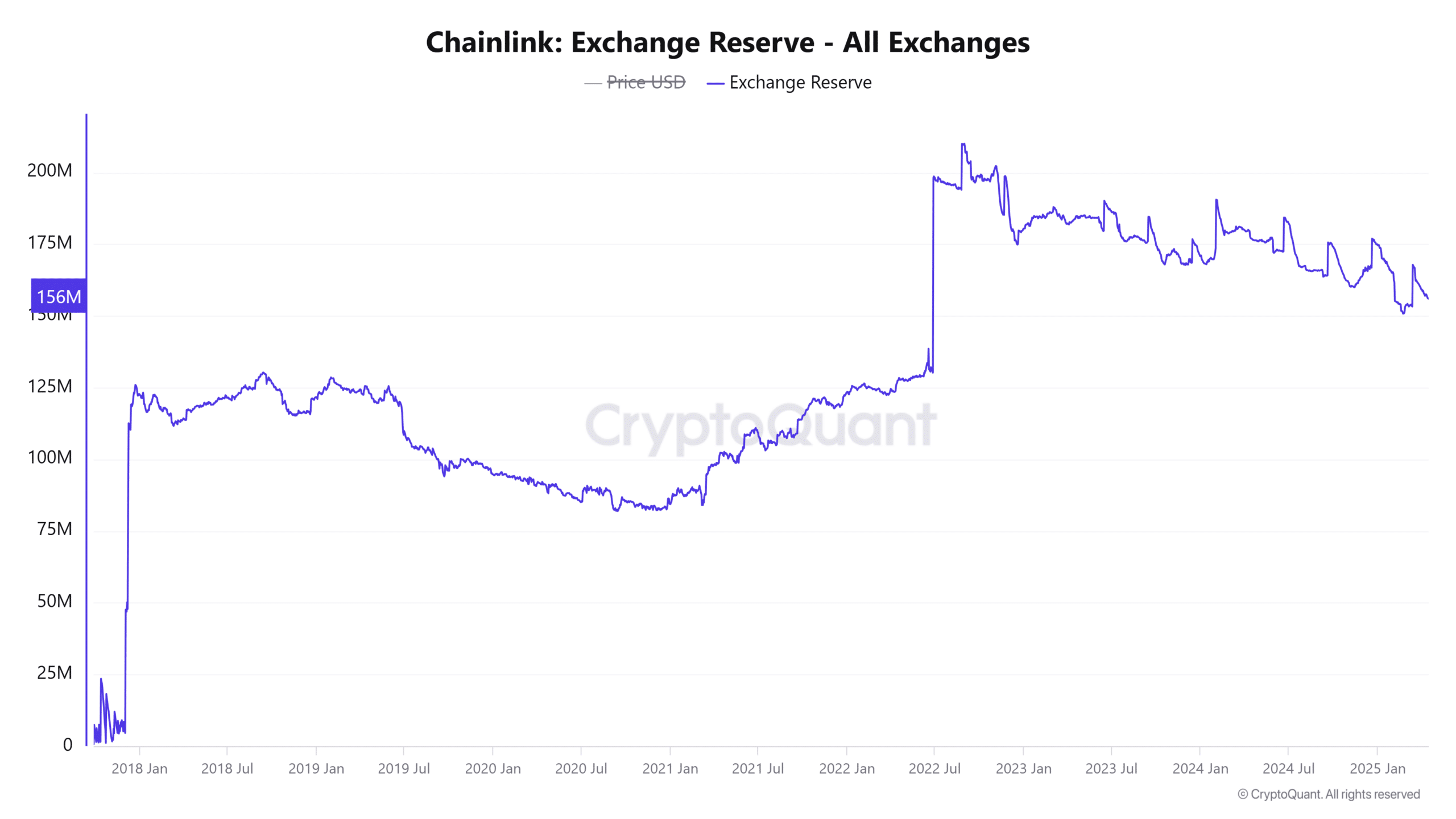

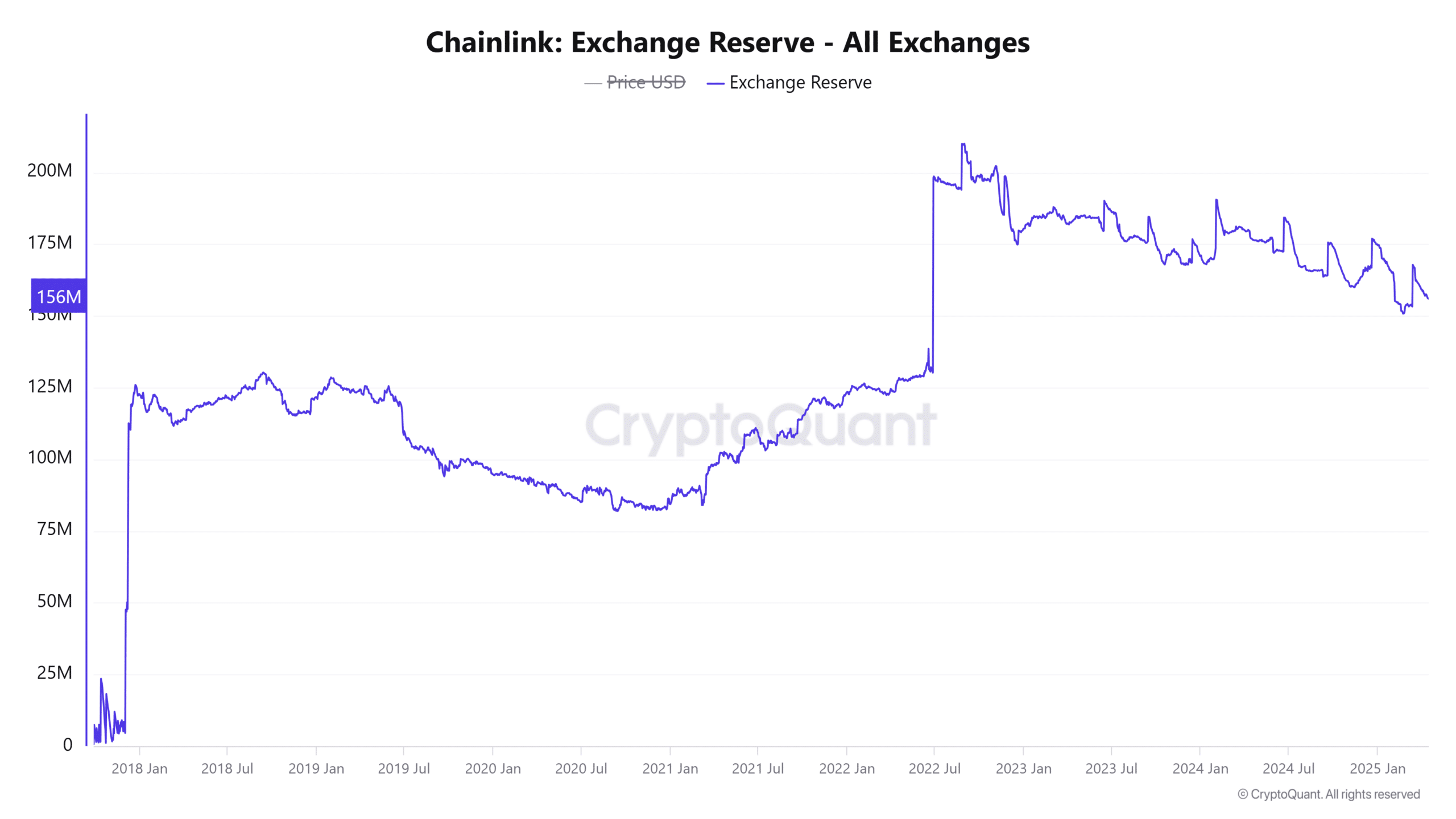

Meanwhile, the exchange reserve data revealed a drop of 0.2% in the last 24 hours, with a total link on trade now at 156 million. This fall in the supply held in exchange has alluded to the drop in sales pressure, often observed during the accumulation phases. If sustained, this trend could support higher prices, especially if demand is starting to increase.

Source: cryptocurrency

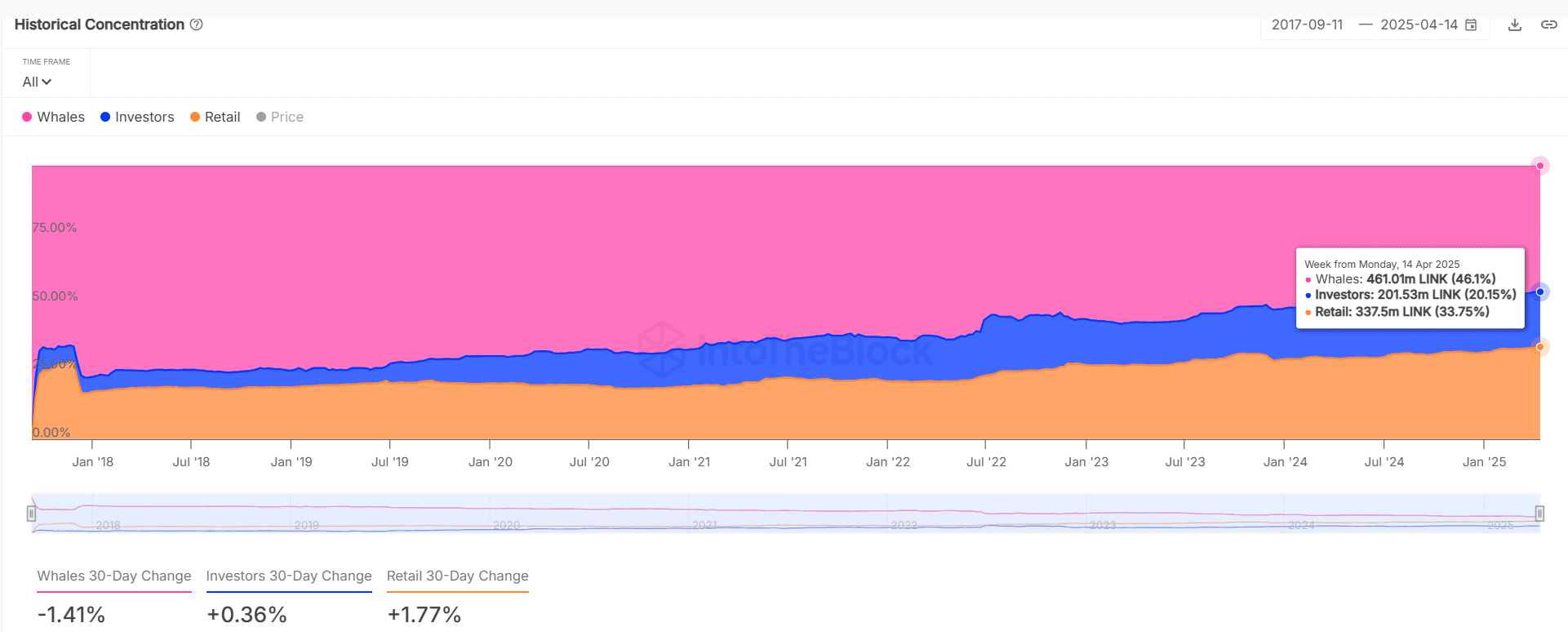

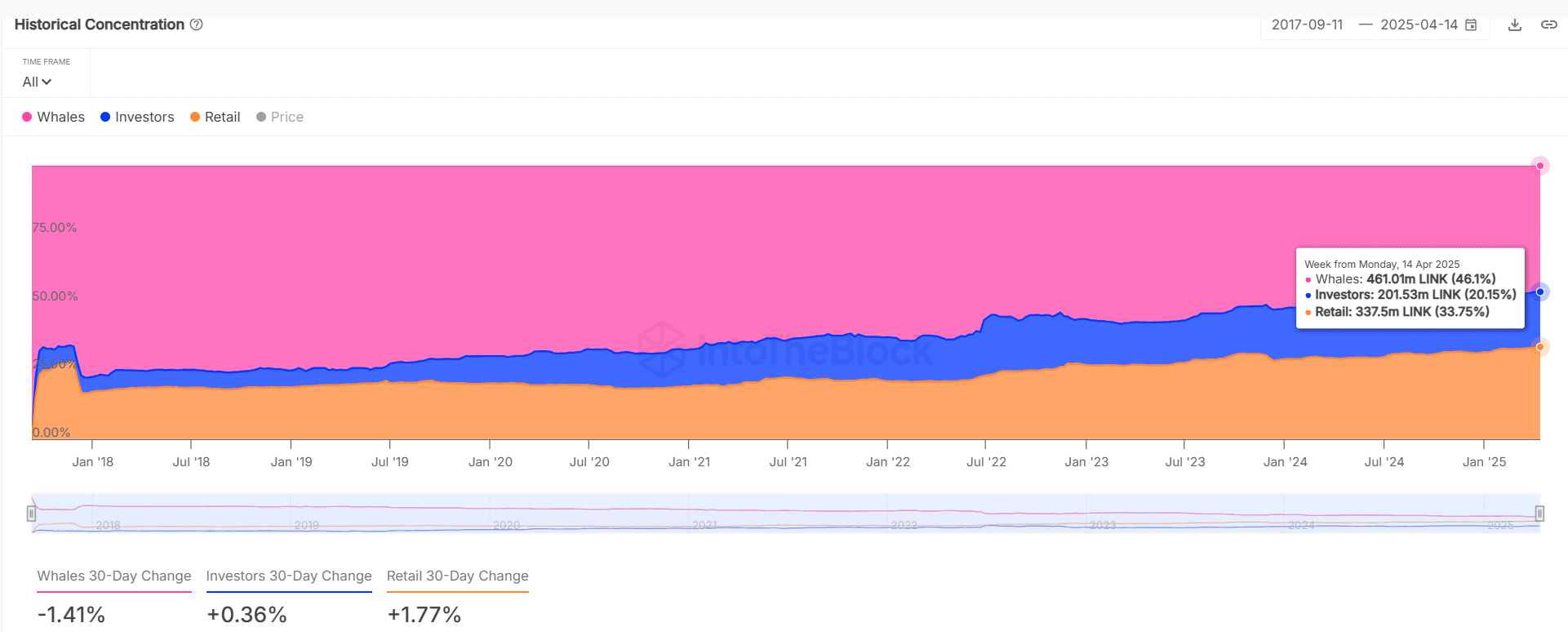

What does investor behavior suggest?

Currently, whales control 46.1% of Link’s diet. However, their assets dropped 1.41% in the last month.

Detail participation, on the other hand, climbed 1.77% and their investor assets increased slightly by 0.36%. This redistribution could indicate an increasing interest of smaller players on the market, despite slight whale outings.

Source: intotheblock

On the contrary, the activity addressed suggested that traders are still on the sidelines. New addresses fell 44.25%, 49.5% active addresses and zero-balance addresses of 56.62% in last week.

This slowdown in network activity could limit the short -term Link increase potential. Unless the volume and participation return to the market.

Conclusion

Chainlink’s current configuration reflects a market in limbo – captured between promising structural changes and the drop in chain engagement. The level of $ 12.25 remains the most immediate defense line for bulls, supported by lower exchange reserves and positive developments such as Pi Network partnership.

However, the discoloration of user activity and a decrease in the participation of whales are presented to caution. A decisive rebound above press time levels could arouse momentum, but non-compliance can lead to the link to a deeper correction territory.