The data show that the Bitcoin financing rate remained negative during the last price rally, a sign that the short behavior is dominant.

Bitcoin financing rates are red at the moment

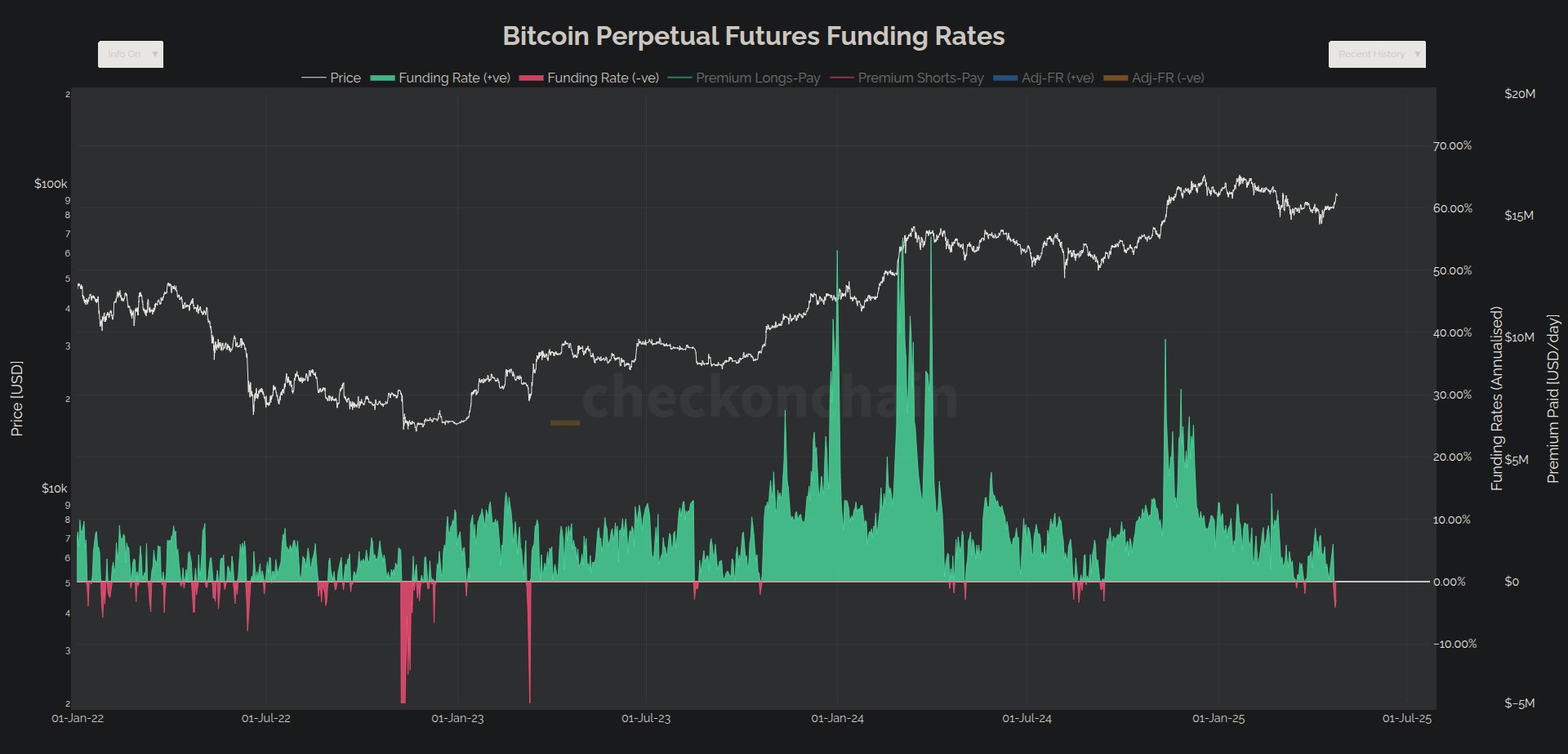

In a new post on X, the CheckMate chain analyst spoke of the trend of the Bitcoin financing rate. The “financing rate” refers to an indicator which maintains a trace of the amount of periodic costs that the merchants of the long -term market are exchanging between each other at the moment.

When the value of this metric is positive, this means that the long holders of contracts pay a premium to short -term contracts in order to keep their positions. Such a trend suggests that a bullish feeling is shared by the majority of investors on derived platforms.

On the other hand, the indicator being under the zero brand implies that the short holders prevail over long and a lower feeling is the dominant.

Now here is the graph shared by the analyst who shows the trend of the rate of Bitcoin financing in recent years:

The value of the metric seems to have dipped into the negative region in recent days | Source: @_Checkmatey_ on X

As it is visible in the graph above, the Bitcoin financing rate has recently slipped into the negative territory, which suggests that short behavior has become more dominant on exchanges.

This trend came in an interesting way while BTC crossed a recovery gathering. This would naturally suggest that users of the long -term market do not think that this race will last.

This downward mentality can really play in favor of cryptocurrency, however, as if the request maintained the rally, these shorts would end up finding the liquidation, thus acting as fuel for the race.

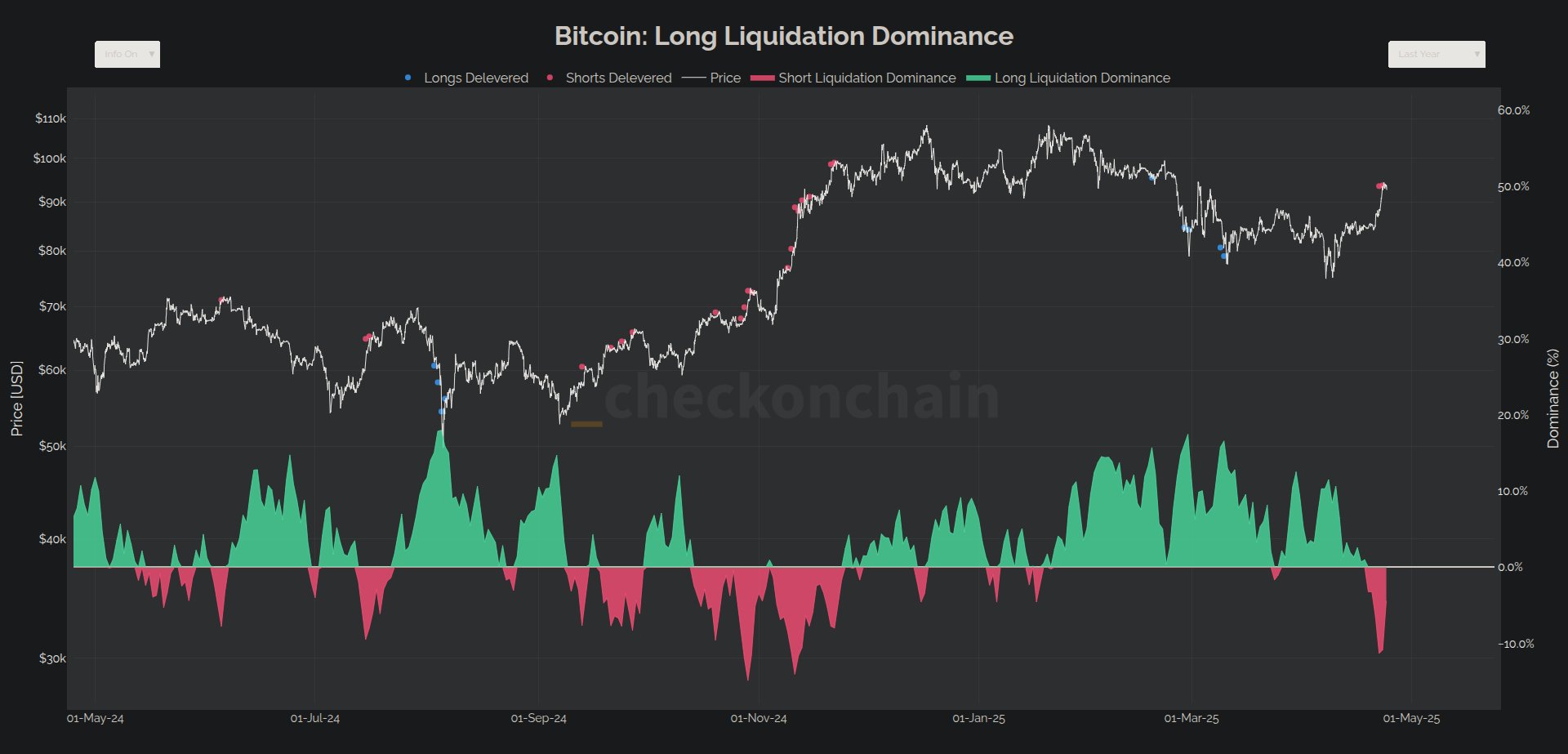

As Checkmate noted in a response position, the market has already experienced significant short liquidations recently.

The trend in the long vs short liquidation dominance over the past year | Source: @_checkonchain on X

It now remains to be seen whether this short pressure trend would continue in the coming days, potentially allowing the Bitcoin price recovery rally.

While users of the long-term market can increase low-hand bets, the global feeling of the cryptocurrency sector has become optimistic after prices overvoltage, as the Fear & Greed index suggests.

How the Fear & Greed Index has changed during the last twelve months | Source: Alternative

The FEAR & GREED index is an indicator created by alternative which uses various market factors to determine the feeling present among Bitcoin investors and other digital assets. The metric is currently seated at a value of 63, which implies that a gourmet mentality is dominant among the traders.

BTC price

At the time of writing the editorial staff, Bitcoin is negotiated about $ 93,200, up more than 9% in the last seven days.

The trend in the BTC price during the last five days | Source: BTCUSDT on TradingView

Dall-e star image, alternative.me, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.