Ripple is penetrating deeper into the global financial system, positioning XRP as a critical institutional settlement tool rather than just a speculative asset.

The company’s latest strategy outlines how XRP is evolving into a core infrastructure layer for payments and liquidity.

DISCOVER: Top 20 cryptocurrencies to buy in 2026

What this means for XRP and institutional adoption

If you’re new to cryptocurrencies, the term “institutional settlement” may seem dry, but it’s extremely important. Think of it as the time when money changes hands between big banks or financial companies. Currently, this process is slow and expensive.

Ripple aims to solve this problem by using XRP as a bridge, allowing the value to move in seconds rather than days.

Just in: @Ripple outlines institutional DeFi plan for XRPL with compliance-focused infrastructure positioning $XRP as a settlement and transition asset. pic.twitter.com/j7m5o4ADQy

– CoinDesk (@CoinDesk) February 6, 2026

It’s not a matter of retail investors trading coins on an app; these are regulated financial giants using blockchain technology to clear transactions. This concept is often called “Institutional DeFi” (Decentralized Finance).

It brings the speed of crypto to the security-obsessed world of traditional banking. By integrating XRP into this workflow, the network no longer depends solely on market sentiment and shifts towards essential everyday utility.

DISCOVER: Best new cryptocurrencies to invest in in 2026

How Ripple builds infrastructure

For this vision to work, the technology must be more than fast: it must be useful for complex financial products. **Ripple** recently released an overview detailing how the XRP Ledger (XRPL) is evolving to meet these needs. The strategy focuses on specific “building blocks” such as payment processing, liquidity and general ledger credit.

According to the report, new features are being rolled out to support these workflows. These include “Single-Asset Vaults” and a new lending protocol (XLS-66), which allow institutions to borrow and lend directly on the blockchain. Instead of these features acting alone, they are designed to work together.

“Each feature is not a silo, it is a building block of composable financial ecosystems, linked together by XRP.”

XRP is emerging as the backbone of real-world financial infrastructure.

Take a look at the DeFi institutional roadmap below. It explains exactly how the XRP Ledger is evolving into an everyday use layer for institutions, with XRP powering settlement, FX, collateral and on-chain…

-Reece Merrick (@reece_merrick) February 6, 2026

Furthermore, recent developments in the field underline this institutional orientation. For example, custody and security partnerships pave the way for banks to hold and use these assets securely. XRP is used to pay transaction fees and fulfill reserve requirements in this ecosystem, creating a constant functional demand for the token.

Why public services are more important than price speculation

Why should you care about settlement layers if you only hold XRP? The answer lies in sustainability. In the crypto world, prices often spike due to hype or rumors. However, the hype eventually fades. Utility: People and businesses who need the token to run their software create a floor price.

If Ripple succeeds in making XRP the standard for institutional settlement, demand for the token will be tied to global economic activity rather than investor sentiment. However, you should also be aware of the risks. Institutional adoption is a slow and bureaucratic process.

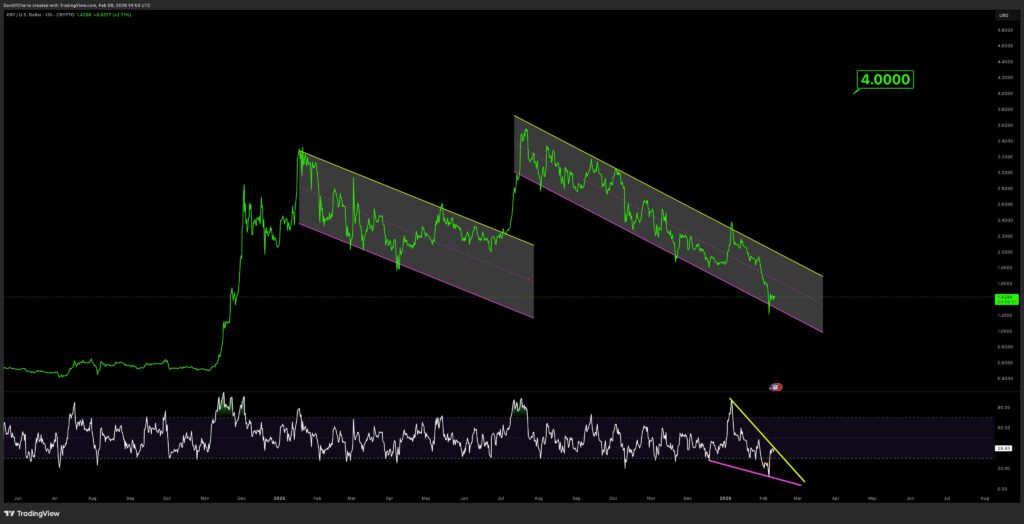

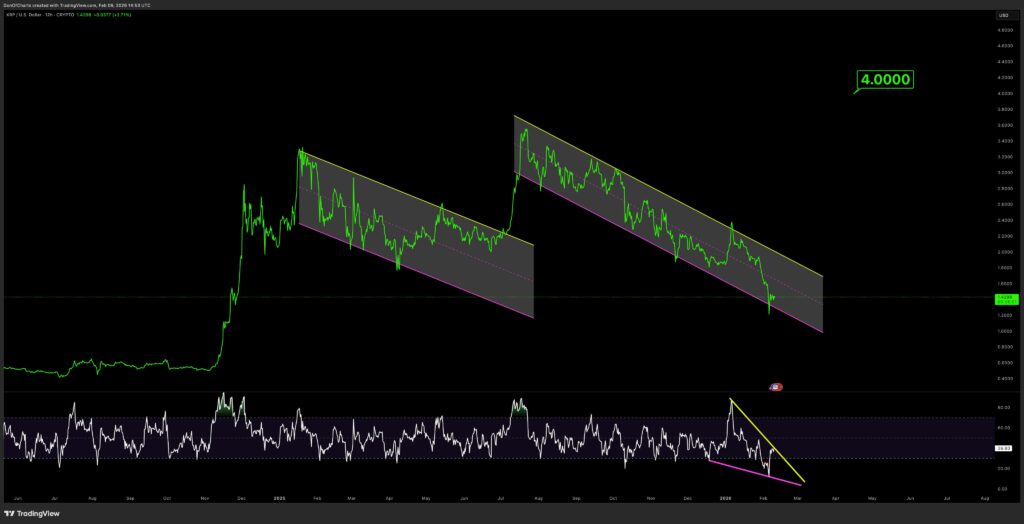

(Source: XRPUSD/TradingView)

Unlike a viral coin, this strategy takes place over years, not weeks. This requires patience and the belief that traditional finance will continue to migrate to blockchain.

DISCOVER: The Best Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts

The article Ripple Pushes XRP Toward Institutional Settlement: Why It Matters Beyond Price appeared first on 99Bitcoins.