Join our Telegram Channel to stay up to date on the coverage of information on the breakup

Michael Saylor Exhort YouTuber Jimmy Donaldson, also known as MRBEAST, to buy Bitcoin even if the strategy arrives on the brakes on his own BTC accumulation.

Saylor’s message to the megastar YouTube came after Mr.Hich, he says, constitutes a potential threat to the income of youtubers.

“When IA videos are as good as normal videos, I wonder what it will do in YouTube and how it will have an impact on the millions of creators who currently make content to earn a living,” said Mr. Rbeast. “Frightening time.”

Saylor, a longtime defender of Bitcoin, replied by saying: “Buy Bitcoin Mrbeast”.

Buy Bitcoin MRBEAST.

– Michael Saylor (@saylor) October 5, 2025

The strategy pauses its accumulation of bitcoin while the BTC is negotiated near ATH

The strategy is the largest holder of the Bitcoin company, and is well known to have the trend of the cryptographic treasure when it began to accumulate BTC in 2022. Since then, 344 entities have accumulated 3.88 million BTC collectively.

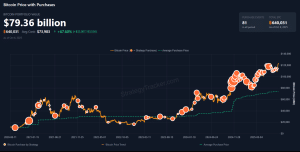

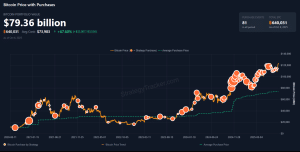

Saylortracker data show that the A 640,031 BTC strategy worth $ 79.36 billion.

Bitcoin Holdings strategy (Source: Saylortracker))

The most recent purchase of the company took place on September 29, when it bought 196 BTC. Before this acquisition, the company had bought BTC for eight consecutive weeks.

But the company takes a break in the purchase of Bitcoin, as indicated by a recent post X of Saylor.

“No new orange points this week,” wrote Saylor in an article on X, reporting that there will be no BTC purchase ad this week.

No new orange points this week – just a reminder of 9 billion dollars of the reason why we have Hodl. pic.twitter.com/p84m14wf3g

– Michael Saylor (@saylor) October 5, 2025

The decision to suspend the accumulation of the company’s BTC occurs while the main crypto has climbed to a new summit of all time (ATH) greater than $ 125,000 on October 5.

The Crypto King has since gains and exchanges at $ 123,841.96 at 7:17 am, according to CoinmarketCap data. At the current price, the unrealized gain of the year’s strategy (YTD) on its BTC position amounts to around $ 14.42 billion.

Bitcoin exchange flows fall at six years at the bottom as the FNB inputs are skyrocketing

If MrBeast decides to act on the recommendation of Saylor, this could result in additional purchase pressure on the price of BTC.

The upcoming pressure on Bitcoin is already solid, with BTC Spot ETF (Stock Exchange Fund) pulling their weekly entries second later last week. During this period, investors paid more than $ 3.2 billion in funds, data from eccentric investors shows.

Most of these entries were in Ibit, the BTC ETF spot belonging to the BlackRock active management giant. Last week, approximately $ 1.8 billion rushed into the product, representing more than half of the entries observed for Bitcoin Spot ETF during the period.

This high demand is also accompanied by a decrease in the number of bitcoins available for purchase on exchanges. Chain data De Glassnode shows that there are only 2.83 million BTC on the centralized exchange platforms, marking a six-year hollow of the available amount.

The last time there were fewer parts stored on the scholarships was in early June 2019. At the time, BTC was negotiated at $ 8,000 and was in the depths of a lower market.

“Gensive exchanges are out of Bitcoin,” wrote Vaneck, the research manager on digital assets, Matthew Sigel, “Monday 9:30 am could be the first official shortage.”

Gensive exchanges are out of Bitcoin.

Monday 9:30 am could be the first official shortage.

Not financial advice … Just: it could be logical to get it.

– Matthew Sigel, CFA Recoreing (@matthew_sigel) October 3, 2025

Mrbeast can buy aster

It is not clear if MrBeast will take the advice of Saylor and buy Bitcoin, but several follow -up companies on the channel have highlighted the purchase activity around ASTER (ASTER) which, according to them, is linked to the Youtuber.

One of these companies is Prime XWho allegedly alleged that the Youtuber had spent $ 320,000 in ASTER tokens. According to the report, the purchase brought MRBEAST’s total assets to around 1.28 million dollars.

Another chain analysis firm, Lookonchain, also revealed that the portfolios linked to MRBEAST had deposited $ 1 million in the stablecoin USDT of Tether before acquiring more than 500,000 ASTER tokens at an average price of $ 1.87.

MRBEAST (@Mrbeast) Bought 538 384 $ Aster($ 990,000) in the last 3 days.

He deposited 1m $ USDT In #Aster Using the 0x9e67 public portfolio and the new 0x0e8a portfolio, then withdrawn 538 384 $ Aster.

The average purchase price was probably about $ 1.87. pic.twitter.com/cntxz9xeqp

– Lookonchain (@lookonchain) September 26, 2025

The Youtuber quickly denied transactions in a post X.

“I have never heard of this room, and it’s not my wallet”, it wrote on X.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup