The U.S. Securities and Exchange Commission is making headlines after a report revealed that it has cracked down on the crypto industry in record fashion: fines it imposed on crypto companies reached a record $4.68 billion in 2024, an increase from 30% to 18% from the previous year.

Much of that surge comes from a settlement with Terraform Labs and its co-founder, Do Kwon, for selling unregistered securities and misleading investors.

According to Social Capital Markets’ Enforcement vs Crypto Industry Report 2024, these unprecedented actions by the SEC signal a dramatic shift in its approach to overseeing the rapidly evolving digital asset market.

Record fines

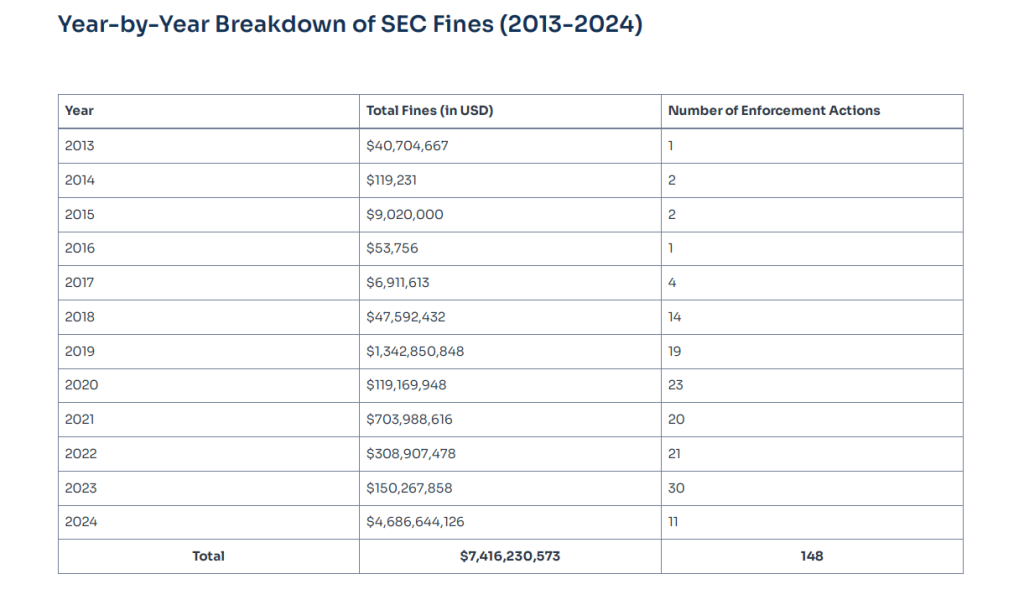

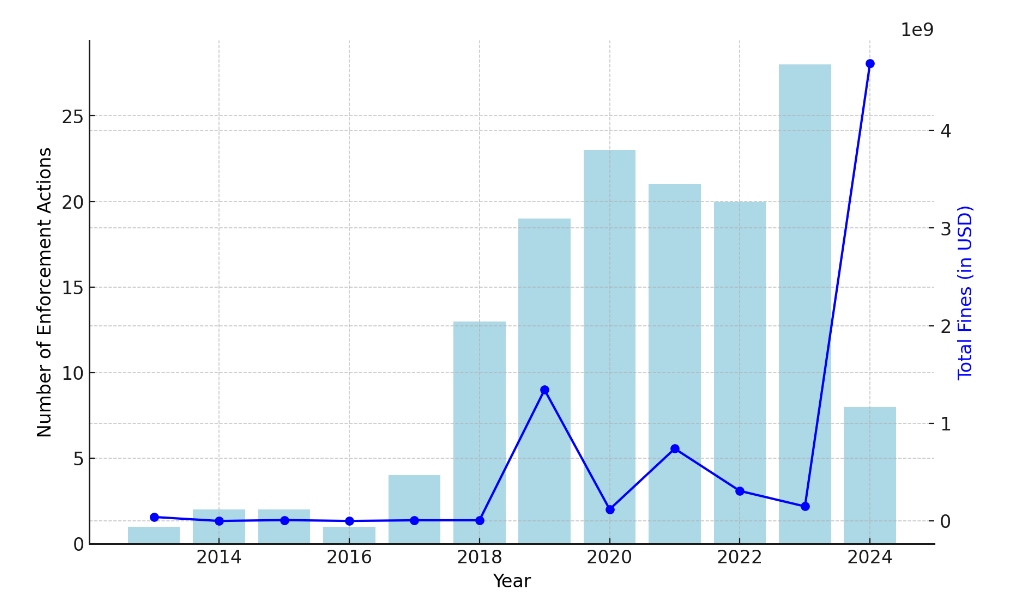

The SEC’s 2024 fines represent 63% of the total penalties imposed since 2013, bringing the cumulative total to $7.42 billion. The agency’s aggressive stance is evident in its recent enforcement actions, which have intensified since 2018, when penalties first reached double-digit amounts.

Source: Social Capital Markets

In 2023, the SEC imposed only $150.27 million in fines, a stark contrast to this year’s record-breaking figure. The move signals a renewed commitment to holding cryptocurrency companies accountable for their actions.

The nearly $4.70 billion fine imposed on Terraform Labs remains the largest imposed on a crypto company to date.

Source: Social Capital Markets

The case surpassed the previous record: a roughly $4.3 billion settlement between the U.S. Department of Justice and Binance and its founder in 2023. The SEC’s actions are not isolated; they are part of a broader trend of increasing scrutiny and enforcement in the crypto space.

Total crypto market cap at $1.97 trillion on the daily chart: TradingView.com

The Evolution of the SEC Strategy

The SEC’s enforcement strategy has evolved significantly over the past decade. Initially, fines were relatively modest, but as the cryptocurrency market has grown, so have penalties.

In 2019, for example, the SEC fined Telegram $1.24 billion for conducting an unregistered token sale. This trend of increasing fines has continued, with Ripple Labs facing a $125 million penalty in 2021 for selling XRP as an unregistered security.

Related Reading: Is ‘Green’ Bitcoin Mining the Future? Japanese Energy Giant Thinks So

The road ahead

The SEC’s stricter enforcement of the rules has sent shockwaves through the crypto community, with most companies, including Coinbase and Ripple, now locked in a legal battle with the regulator.

Most digital assets, according to SEC Chairman Gary Gensler, fall under securities rules, fueling intense debate over the direction of cryptocurrencies in the United States.

Critics say the SEC’s activities force cryptocurrency companies offshore and stifle innovation. Advocates say strict guidelines are needed to protect investors and ensure market integrity.

Featured image from Getty Images, chart from TradingView