US Senate Democrats are set to reopen negotiations with representatives of the cryptocurrency industry on Friday, according to people familiar with the project. CoinDesk.

All of this comes less than two days after the last-minute postponement of a key Senate Banking Committee hearing on sweeping digital asset legislation.

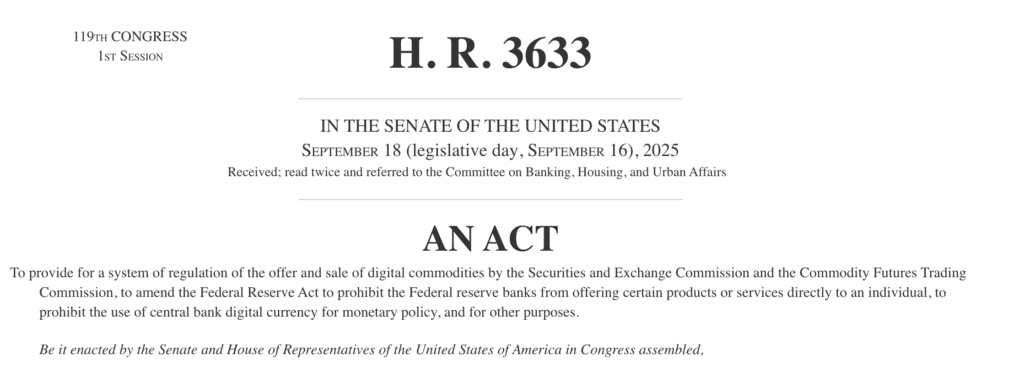

The call follows Wednesday evening’s abrupt cancellation of the committee’s planned markup of the long-negotiated Crypto Market Structure bill, which was to divide regulatory oversight of digital assets between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The delay came after Coinbase, the largest U.S.-based crypto exchange, withdrew its support for the bill, citing concerns about stablecoin rewards programs and what it saw as excessive authority granted to the SEC.

Brian Armstrong, CEO of Coinbase, said banks were trying to “kill their competitors” with crypto market structure legislation. “Crypto companies should be allowed to compete and offer loans, just like banks,” Armstrong said.

Thursday marked a pause in public activity following the cancellation, but lawmakers and industry players say negotiations are far from over.

According to reports, Democrats from the Senate Banking Committee and the Senate Agriculture Committee – which oversees the CFTC – are expected to join Friday’s call, as well as representatives from crypto policy advocacy groups in Washington.

The Banking Committee was scheduled to hold a full-day session Thursday to debate the amendments and vote on whether to move the bill forward.

That plan was canceled Wednesday evening after Coinbase CEO Brian Armstrong said the company could not support the current version of the legislation. Shortly thereafter, Senate Banking Committee Chairman Tim Scott, R-S.C., postponed the hearing.

Lummis: the Senate is closer than ever

Despite the setback, several lawmakers involved in the negotiations said discussions would continue. In an article on

“Everyone is still at the negotiating table and I look forward to partnering with (Chairman Scott) to deliver a bipartisan bill that the industry – and America – can be proud of,” Lummis wrote Thursday.

Sen. Bill Hagerty, R-Tenn., echoed that optimism, saying he remained “confident” that lawmakers could reach consensus “in the shortest possible time.”

“I am fully committed to continuing this important work with my colleagues on market structure and look forward to passing legislation to ensure that this innovative technology thrives in the United States for decades to come,” Hagerty said.

Industry reaction to Coinbase’s withdrawal has been mixed. While Armstrong’s comments intensified scrutiny of the bill, other crypto executives and advocacy groups urged lawmakers to continue moving forward.

Kraken co-CEO Arjun Sethi said immediately abandoning negotiations would increase regulatory uncertainty for US crypto companies. “Walking away now would not preserve the status quo in practice,” Sethi said in an article on X. “It would lock in uncertainty while the rest of the world moves forward.”

A major point of contention in recent negotiations has been whether stablecoin issuers should be allowed to offer rewards or yield programs — an issue that has drawn opposition from bank lobbyists and some Democrats concerned about consumer protections and competition with traditional depositories.

Even though the Banking Committee increase has been postponed, the Senate Agriculture Committee is still scheduled to hold a hearing on the bill on Jan. 27, after postponing its own previous session. Ultimately, the work of the two committees would have to be merged before the bill could go to the full Senate.

Some analysts view the delay as a strategic pause, with Benchmark’s Mark Palmer saying it could help lawmakers win broader bipartisan support and ultimately strengthen what he calls a potentially historic overhaul of U.S. financial regulation.

Others are more skeptical: TD Cowen warned that it could be difficult to reconcile the Democratic demands and Coinbase’s objections, especially since some controversial provisions were already concessions to Democrats, while the election year timing and the Senate’s 60-vote threshold add additional hurdles.