Solana increased to become the second Blockchain of DEFI TVL (exceeding Tron), while its applications revenues experienced a sharp increase of 213% of a quarter.

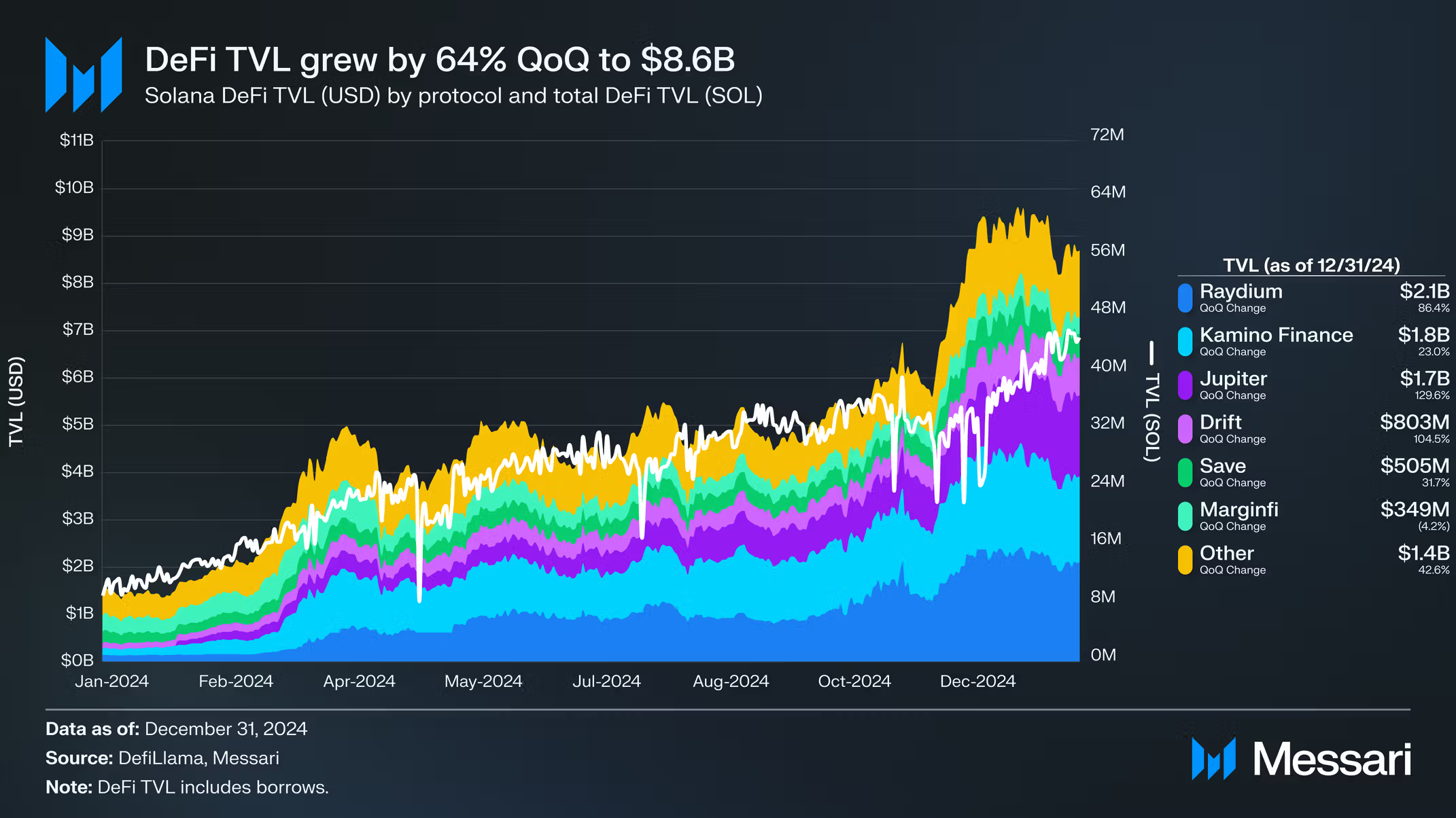

According to the State of Solana Q4 2024 report by Messari, Solana climbed to the second blockchain by TVL DEFI, increasing by 64% to 8.6 billion dollars quarter times. In addition, revenues from its application jumped 213% quarterly, fueled by an increased speculative exchange in mecoins and tokens.

The rapid ascent of Solana in the DEFI ranking was motivated by the increase in increase in its decentralized exchanges, its loan protocols and its platforms of jealous. Among the largest contributors to this growth, Raydium, which ended the quarter, such as the main protocol DEFI on Solana with $ 2.1 billion on TVL, an 86% increase in QOQ. Jupiter Perps, an exchange of decentralized perpetual, also experienced an impressive qoq of 130% in TVL at $ 1.7 billion.

In addition to its increase in DEFI dominance, Solana also experienced a 213% qoq of applications in applications (channel GDP), from $ 268 million to $ 840 million in the fourth quarter. Application income income has led the application income. The boom of speculative negotiations on mecoins and tokens linked to AI has fueled a large part of this income growth, the DAPPs benefiting from an increase in transaction fees and exchange volumes.

The main engine of the expansion of DEFI and Solana’s income was speculation around mecoins and tokens. The resurgence of memes trade, after the 2024 American elections, saw massive entries in the projects launched on Solana. Tokens like AI16Z (AI16Z) and Fartcoin (Fartcoin) have won a huge traction, leading to increased commercial activity on Dex based on Solana.

Raydium, who dominated the Solana Dex market with a share of 56% and an increase in QOQ of 242% of the volume of daily exchanges ($ 1.9 billion), played a central role in the facilitation of these transactions. Similarly, Pump.fun, a launch of the same, has become the fourth DEX larger on Solana after an qoq increase of 228% volume.