Key notes

- Solana DEX volumes reached $5.11 billion, surpassing Ethereum and BNB Chain during the weekend DeFi rotations.

- More than 2.9 million SOL, worth $475 million, have been staked since Friday, reducing active supply.

- Key technical indicators signal resistance near $180 despite strong network activity.

Solana price recorded a 5% rally on Sunday, November 9, as heavy on-chain rotations among DeFi protocol users lifted the token above the $165 level for the first time in five days. However, key technical indicators are now serving as early warning signals of a potential near-term reversal as SOL approaches key resistance near the 20-day moving average.

Solana leads #1 in DEX volume (last 24 hours) pic.twitter.com/TCf62gARzM

– Solana Sensei (@SolanaSensei) November 9, 2025

Solana price closed above $165 on Sunday, after consolidating below that level since November 5. Its performance aligned with the broader market rally that saw most of the top 10 cryptocurrencies post modest gains over the weekend. Bitcoin rose 3% to reclaim $104,000, while Ethereum advanced 6% to trade near $3,900.

Beyond price action, investors have demonstrated a preference for Solana in DeFi activity. Citing Defillama data on Sunday, a community contributor, going by the name Solanasensie, pointed out on

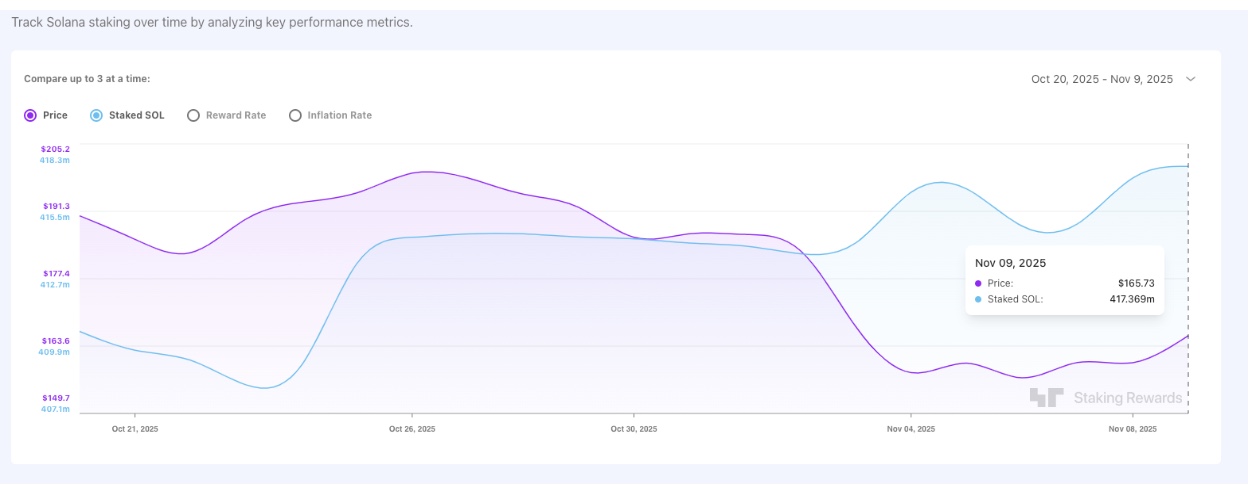

Solana’s total stake increased by 2.9 million SOL ($475 million) | Source: StakingRewards.com

Spikes in metrics such as DEX volumes during uncertain market phases reflect an intention to rotate capital within Solana’s native DeFi protocols, potentially mitigating market downturns with passive yield rather than exiting or holding stablecoins.

This helps keep capital within the ecosystem, as recent Solana staking data affirms. Between Friday and Sunday, SOL’s total stake increased from 414.5 million to 417.4 million, according to StakingRewards.

The 2.9 million SOL increase temporarily reduces short-term supply on exchanges, which could protect Solana’s price from sharp short-term declines in the coming week.

Strategic traders will look for further institutional inflows or a macroeconomic demand catalyst before betting big on a convincing Solana price breakout into the $180-$200 territories in the coming week.

Solana Price Prediction: 62% Reversal Probability Caps Rally Below $180 Resistance

Solana (SOL) saw positive performance over the weekend, reclaiming the $165 level after five days of consolidation. However, technical indicators on the daily chart suggest that even if bullish momentum develops, the rally may encounter resistance before breaking above the $180 mark.

According to the Breakout Probability Indicator (Expo), Solana currently has a 29% chance of a bullish breakout towards $180, while the downside probability remains higher at 62%, signaling a possible early pullback towards the $150 support zone.

The Bollinger Bands (BB 20 SMA) indicate tightening volatility, with the middle band at $180.06 acting as immediate resistance and the lower band at $149.58 providing short-term support.

Solana (SOL) Price Forecast | Source: TradingView

Momentum signals reinforce this cautious outlook. The RSI (14) stands at 40.36, slightly above oversold territories, suggesting that Solana is still in a fragile zone where sellers could regain control. Meanwhile, the MACD (12, 26) remains in bearish territory, printing negative histogram bars with the signal line at -9.24 and the MACD line at -10.92, confirming that the selling pressure, although reduced, has not yet convincingly reversed.

Profitability measures also reveal a moderate bias toward consolidation. The win/loss ratio of 1,307 to 733, translating to profitability of 64.07%, supports a near-term rebound scenario, but cautions that gains could be limited until increased spot volumes support Solana’s on-chain business.

If Solana closes decisively above $170 on strong daily volume, the next target lies near $180, coinciding with the Bollinger midpoint. Conversely, failing to hold $160 could trigger a retest of $150, marked by the lower Bollinger band.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with experience supporting various Web3 startups and financial organizations. He completed his undergraduate degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn