- The structure of the market for a day seemed to be lower.

- Solana’s performance against Ethereum and increased demand were bullish signs.

Solana (soil) saw an increased transaction activity on the chain and a short -term bullish momentum that has propelled prices over $ 120.

However, the presence of a solid supply area around $ 140 meant that Bulls would have a difficult task to trigger a real long -term recovery.

The Solara network has exceeded Ethereum (ETH) one in several fronts. The Sol / ETH pair has made new heights and soil has seen high entries compared to the Ethereum network, among others. Could these factors are enough to cause a sustained price rally?

Increased purchase pressure gives soil investors of hope

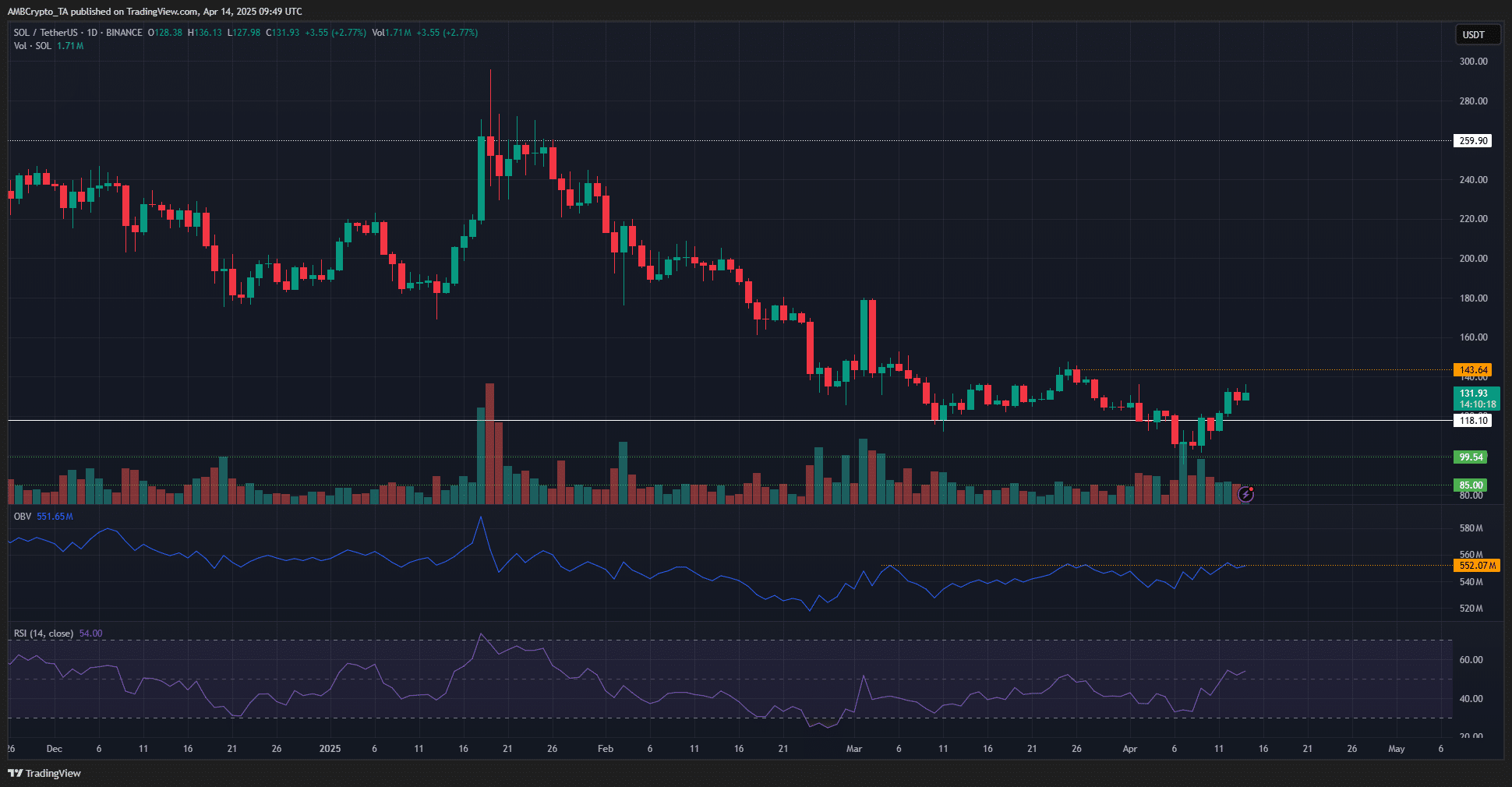

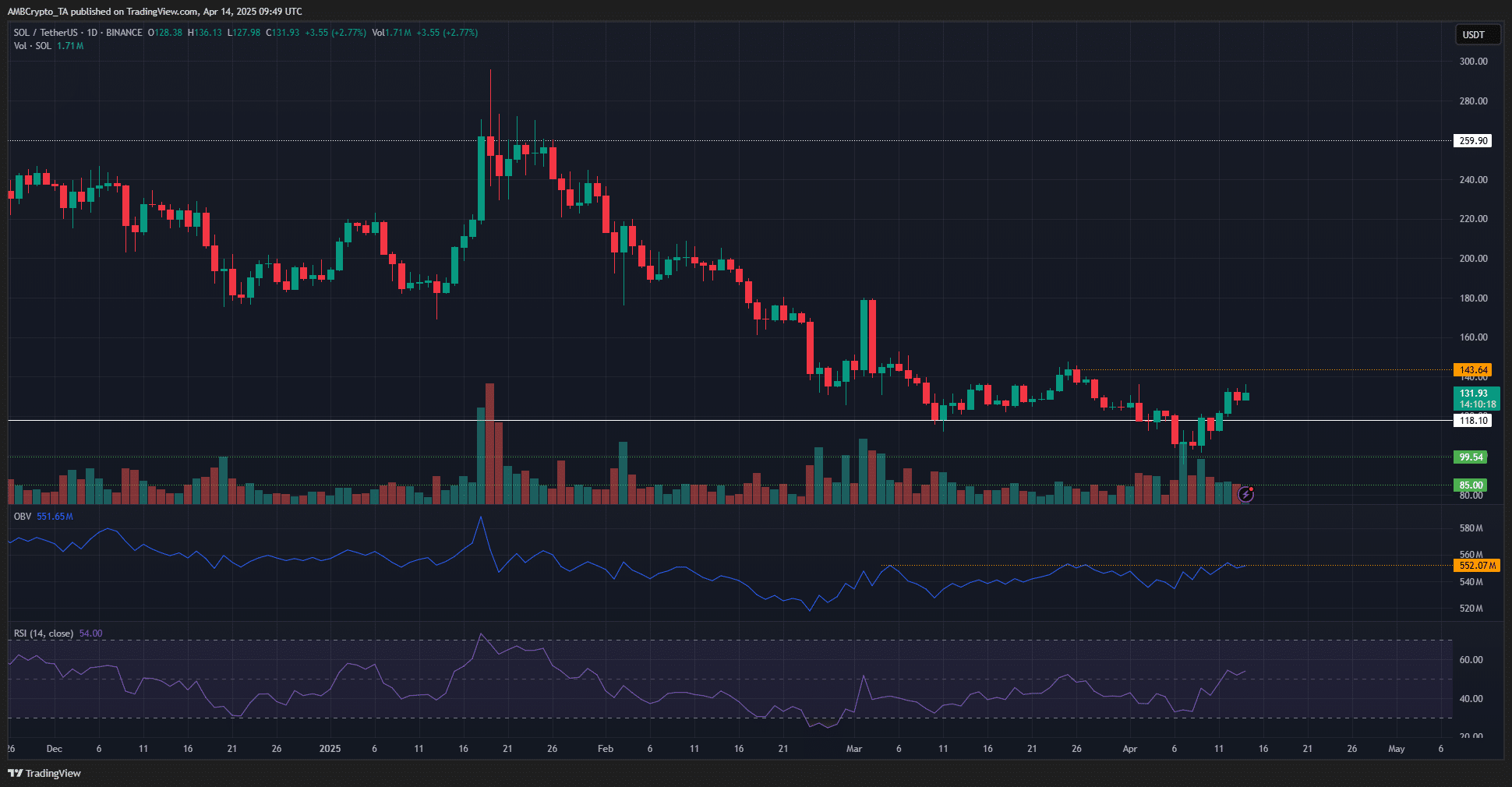

Source: Sol / USDT on tradingView

The level of $ 143 marked the lower summit of the downward trend in the last three months. It was the level that was to be raped to return the market structure for a day optimistic. There were early signs that this result would be achieved during the week or the next two weeks.

The RSI is mounted above the neutral 50 to mark a change of bullish dynamics. It was still early, but he had stayed above 50 for three days, the longest period since January. In addition, the OBR challenged the ups taking place in early March.

At the time, Solana’s price was around $ 180. Therefore, this indicated the increase in purchase pressure, which could propel prices beyond $ 143. However, until this is the case, traders and investors can remain cautious.

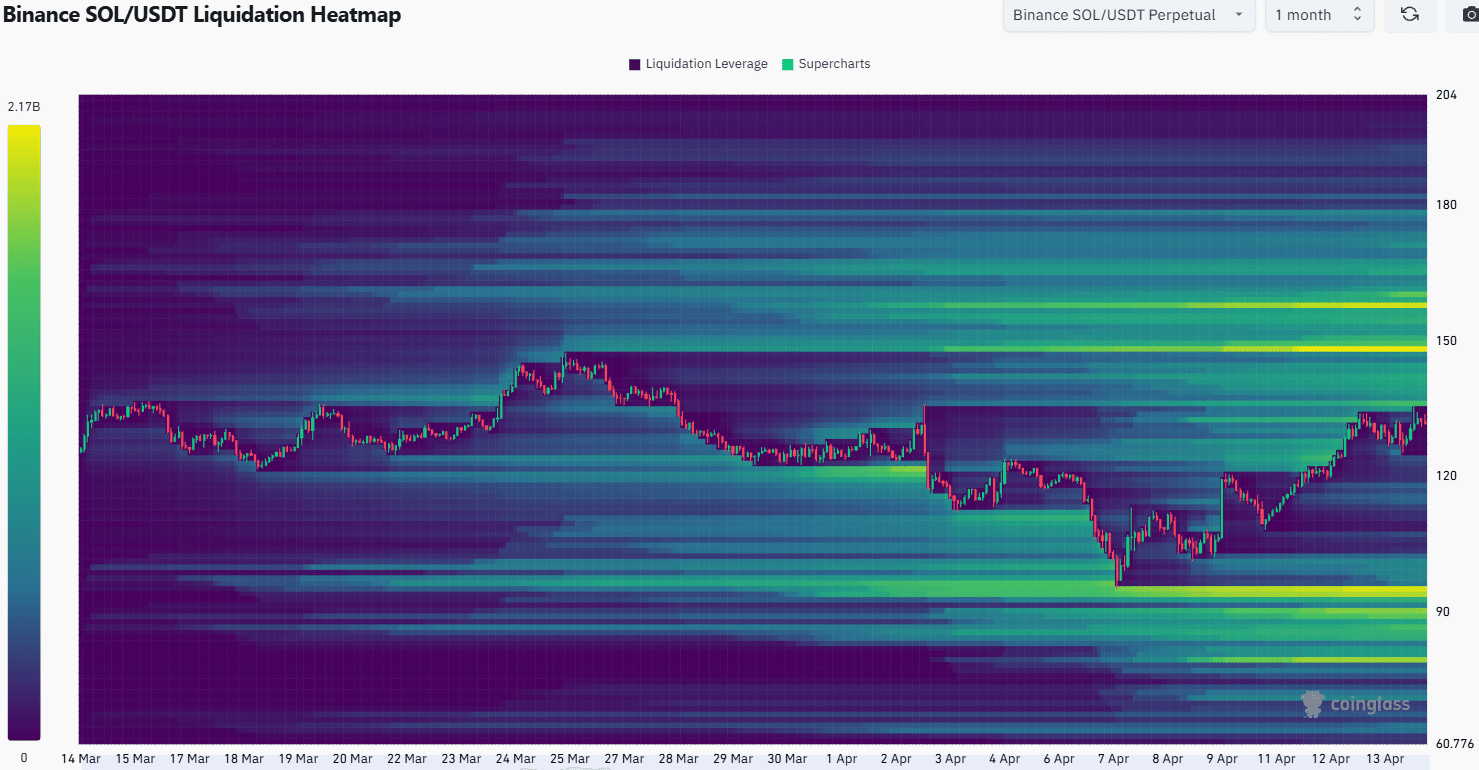

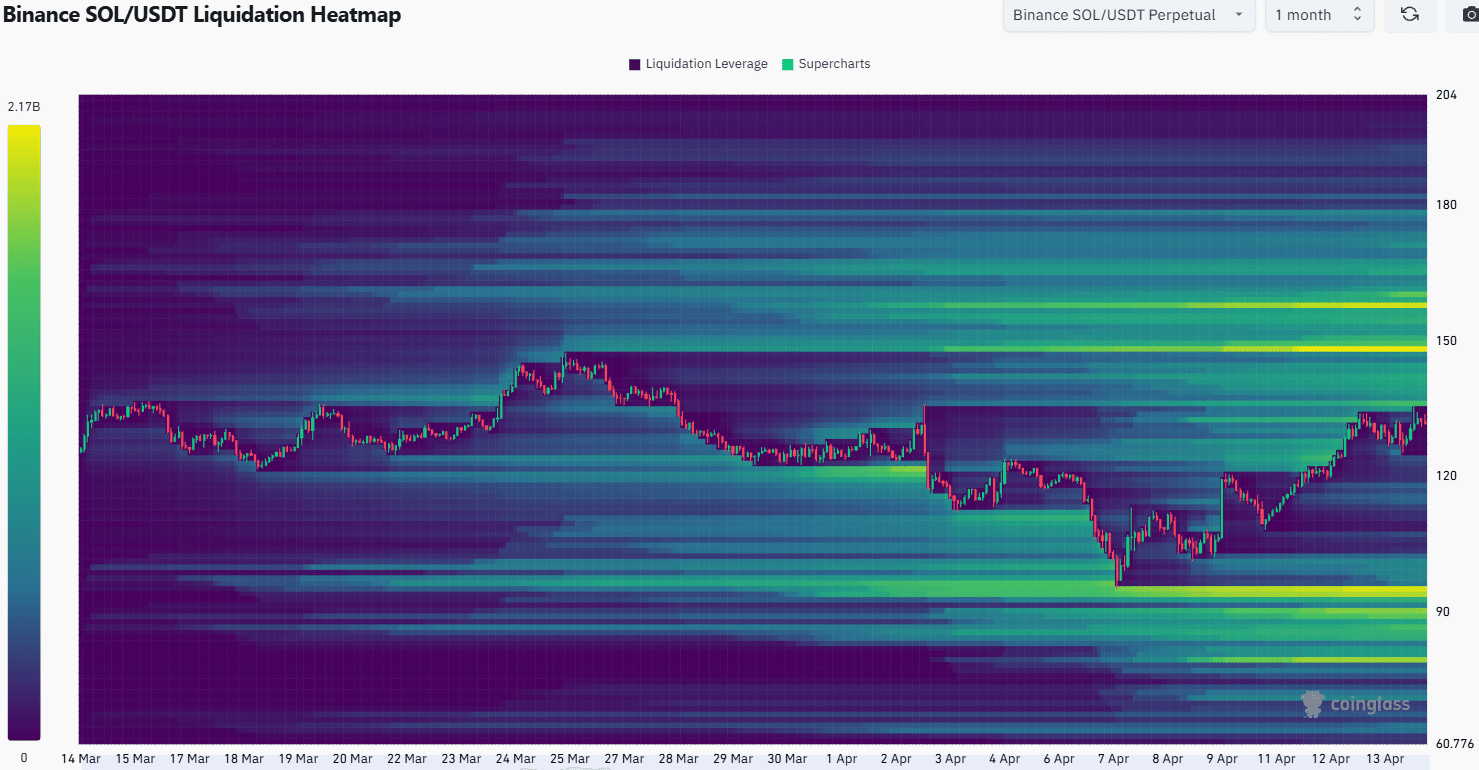

Source: Coringlass

The thermal liquidation card, with a 1 -month look period, highlighted $ 150 and $ 158 such as the most important magnetic areas nearby. These levels contained more than $ 2 billion in liquidations. The fork of $ 136 at $ 142 also formed a considerable liquidity cluster.

Further south, a notable liquidation pocket was observed at $ 95. However, its distance makes it little likely to be a short -term price objective. Based on the thermal card and technical indicators, a movement around $ 150 at $ 160 seems likely in the coming days.

The question of whether the bulls can hold the level of $ 140 as a support and maintain their position remains uncertain.

Success at this level could point out the start of an upward trend, subject to Bitcoin recovery (BTC) and a positive feeling in the wider cryptography market.

Notice of non-responsibility: The information presented does not constitute financial investments, exchanges or other types of advice and is only the opinion of the writer