The cryptocurrency market is poised for significant growth in 2025, driven by the growing adoption of stablecoins and the continued rise of exchange-traded funds (ETFs), according to a recent report from Citi.

These developments are expected to fuel positive price performance and expand the crypto ecosystem despite continued macroeconomic uncertainty.

Key Drivers of Crypto Growth

Citi analysts said 2025 could be a pivotal year for digital assets, citing multiple factors that will drive this market. Some of the powerful catalysts include the growing adoption of stablecoins to strengthen DeFi markets and the expansion of crypto ETFs, which are creating easier access and greater institutional exposure in the space.

Source:X

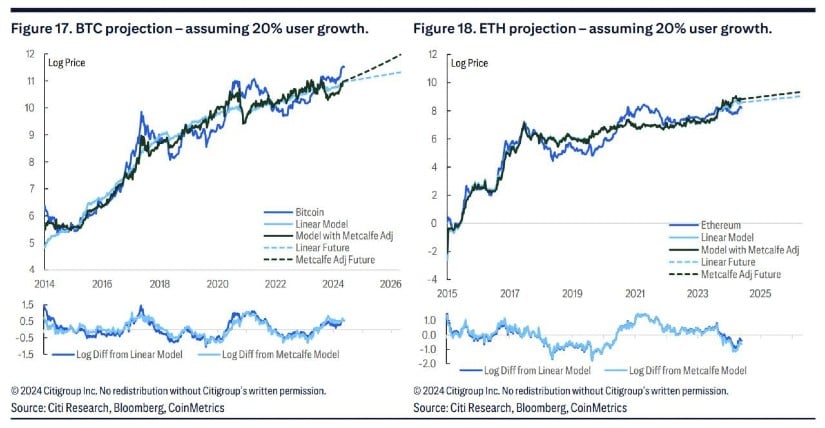

“Adoption is, in our view, the most important concept to track for long-term crypto performance,” the Citi report said. According to the company, growing ETF activity and stablecoin market capitalization are two of the signs of a growing crypto ecosystem.

The role of ETFs and institutional flows

One of the main catalysts for this crypto rally are exchange-traded funds, which are reportedly seeing massive inflows into Bitcoin ETFs. According to Citi, for this year alone, almost 46% of the price movement of BTC could be attributed to flows from said Bitcoin ETFs in 2024. These flows have a direct impact on prices, with $1 billion in investments in ETF leading to around 4.7% return. . As of November 2024, Bitcoin ETFs exceeded $100 billion in net assets, signaling growing institutional interest in the sector.

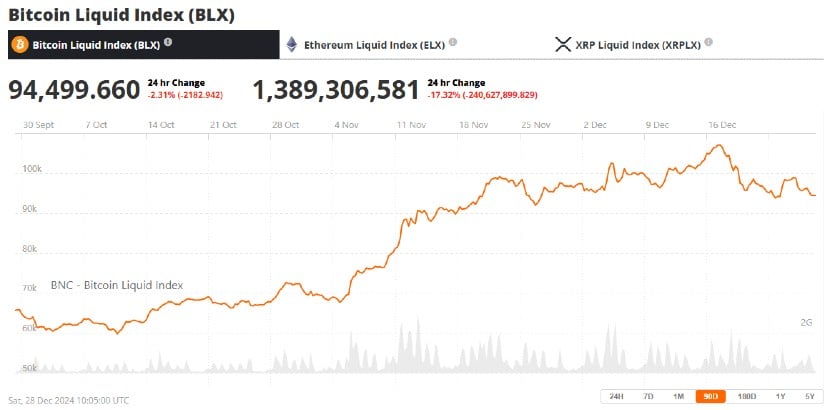

Bitcoin (BTC) Price Chart. Source:Bitcoin Liquid Index (BLX) via Brave new piece

The approval of Bitcoin and Ethereum spot ETFs has significantly changed the investment landscape, providing traditional investors with a more convenient way to gain exposure to cryptocurrencies. Since their launch in early 2024, these ETFs have attracted billions of entries, further fueling the bullish sentiment around Bitcoin and Ethereum.

The Growing Role of Stablecoins in DeFi

Stablecoins, particularly Tether (USDT), USD Coin (USDC), and Dai (DAI), also play a central role in crypto growth. The combined market capitalization of major stablecoins increased by more than $25 billion following the 2024 US presidential election, signaling a shift in the digital asset landscape. Citi views stablecoins as the primary driver of decentralized finance (DeFi), noting that “stablecoins are the gateway to decentralized finance.”

As stablecoin usage grows, more participants are likely to access DeFi applications, which use these assets for lending, borrowing, and other financial services. Rapid increases in Ethereum network activity, including Layer 2 scaling solutions, have also bolstered this growth, with on-chain activity up 210% from 2023 levels.

Trump’s Election: A Catalyst for Crypto

The election of Donald Trump as the president-elect of the United States is another crucial factor cited by Citi analysts. His stance on the industry, particularly his support for pro-crypto officials, is widely seen as a major driver of optimism among investors for their support. It will also strengthen pro-crypto policies launched under his administration and involve appointing key officials at key agencies, like Securities and Exchange Commission head Paul Atkins.

Prices of cryptocurrencies, including Bitcoin, reached an unprecedented valuation of $100,000 for the first time in history, surging immediately after Trump’s victory in November 2024. A favorable regulatory framework coupled with growing involvement institutions could lead to a “demand shock” for Bitcoin. , driving its price even higher over the next few years.

Sustained growth through adoption and regulation

Citi analysts added that while the outlook for 2025 remains optimistic, sustained growth would depend on widespread adoption. They cite countries like Turkey, Argentina and Venezuela, which face economic instability and therefore increased demand for digital assets, as countries to watch. However, they warned that current regulatory developments could also play a very important role in determining the fate of the market.

Citi believes the regulatory environment under the Trump administration is poised to become clearer. Moving from enforcement-based regulation to more legislation-based regulation could mean much-needed stability to attract even more institutional capital and retail investors to the sector.

A promising year 2025 for crypto?

According to Citi, 2025 could be a pivotal year for the cryptocurrency market, assuming stablecoin adoption, inflows to ETFs, and a favorable regulatory environment drive steady growth in the sector. Although many challenges remain, such as macroeconomic circumstances and an unclear regulatory regime, the combination of these elements allows the crypto market to expand further. Indeed, the stage is already set for a new era of growth within the blockchain ecosystem, with increased adoption of digital assets among institutions and individual investors.