Join our Telegram channel to stay up to date with the latest news

Banking giant JPMorgan says the strategy of Michael Saylor, formerly MicroStrategy, holds the key to BTC’s future direction, and its potential removal from MSCI stock indexes next month is already being factored in.

With the ratio of Strategy’s enterprise value to its Bitcoin holdings, or mNAV, remaining above 1, the world’s largest Bitcoin buyer is unlikely to be forced to sell some of its $60 billion worth of BTC, analysts led by Chief Executive Nikolaos Panigirtzoglou said.

“If this ratio remains above 1.0 and MicroStrategy can eventually avoid selling bitcoin, markets will likely be reassured and the worst for bitcoin prices will likely be behind us,” the analysts said.

They reiterated their belief that Bitcoin has huge upside potential, with its volatility-adjusted comparison of Bitcoin versus gold implying a theoretical BTC price near $170,000 over the next six to 12 months.

This represents an 84% increase from the $92,354 level Bitcoin is trading at as of 3:43 a.m. EST, according to CoinMarketCap.

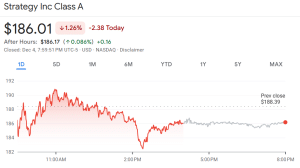

JPMorgan’s comments follow a more than 49% drop in MSTR’s price over the past month amid a broad correction in the crypto market.

Strategic share price (Source: Google Finance)

This share price drop has sparked fears that Strategy will be forced to sell some of its 650,000 BTC to meet its upcoming debt obligations. The fears are compounded by Strategy’s recent slowdown in Bitcoin accumulation, which CryptoQuant says shows the company is preparing for a bear market.

Reserve fund buffer

JPMorgan analysts said Strategy’s decision to create a US$1.4 billion reserve fund to ensure it can meet dividend payments and other obligations further reduces the likelihood that forced Bitcoin sales from Strategy will take place “for the foreseeable future.”

To view the associated press release and investor presentation, click here:

– Strategy (@Strategy) December 1, 2025

In a recent SEC filing, the company said the reserve gives it 12 months of headroom to repay its debt. Strategy added that it would look to extend coverage to a 24-month period.

Potential removal of MSCI already factored in

Amid fears that Strategy will sell BTC as MSTR continues to fall, there is also the company’s potential removal from MSCI, which is a benchmark used by several fund management companies.

Strategy’s stock price has fallen 40% since MSCI announced on October 10 the potential removal of digital asset treasury companies from its indexes. He has also underperformed Bitcoin by 20% during the same period, which equates to around $18 billion in market value.

Earlier, JPMorgan warned that the potential removal of MSCI would trigger up to $12 billion in potential outflows for MSTR.

But its analysts now say that the impact a possible removal would have on MSTR is “already more than expected”.

This aligns with comments made by Bitwise CIO Matt Hougan earlier this week.

“I’m not convinced the withdrawal would be a big problem for the stock,” Hougan said. “In my experience observing index additions and deletions over the years, the effect is usually smaller than you think and accounted for well in advance. »

When MSTR was added to the Nasdaq 100 Index last December, Hougan said funds tracking the index were required to buy $2.1 billion of MSTR, but its stock price “barely moved.”

MSCI is expected to make its decision on January 15.

JPMorgan analysts said that if MSCI kept Strategy in its indices, there would be a strong rebound for Bitcoin and MSTR, believing that this could see prices return to levels before the October 10 flash crash.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news