Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

The founder and CEO of the cryptotics Ki Young Ju fell for his lower prediction after the price of Bitcoin broke out above $ 100,000. This decision has taken the entire market by surprise after calls at lower prices have dominated cryptographic space in recent months. While the feeling has returned to the positive, Young has become bullish, explaining the change in its position and what is happening with the market at the moment.

The Bitcoin Bull cycle is not finished

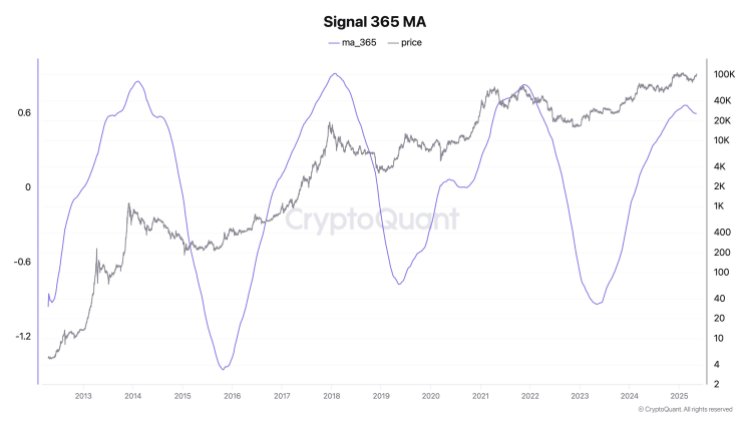

In a post X, CEO Ki Young Ju explained how the current market has moved away from previous cycles. On the one hand, it explains that the market no longer depends on old Bitcoins whales, retail investors and minors to move the market. It was the way to know the top of the cycle, which was when the old whales and the minors unloaded their bags. However, the market has managed to move on and the price of Bitcoin is now better placed to absorb significant sales without problem.

Related reading

Young explains that this can be attributed to the diversity of the market so far. The advent of the FNB Bitcoin Spot, which were approved by the Securities and Exchange Commission (SEC) in 2024, opened new paths for liquidity. Now, not only new retail investors playing in the field, but also institutional investors who have received an avenue to enter the market and with much larger pockets.

This new and substantial liquidity flow has ensured that even sales of large whales will no longer have an impact on the price of Bitcoin as they did before. Thus, the CEO considers that it is time to really move the development of the old to the new.

Given this change in the tide, the CEO Cryptoque said it could be time to throw cycle theory. This is due to changes in the flow of liquidity, because the sources have become more uncertain. “Now, instead of worrying about the sale of old whales, it is more important to focus on the quantity of new liquidity from institutions and FNBs, because this new influx can prevail even on high whale sales,” said Young.

Related reading

Nevertheless, it always postulates that the current market does not flash a clear or bullish bearish scheme with regard to the profit cycle. As he explains, the market is still slow around the absorption of all new liquidity from different sources and indicators “always drag around the limit”.

As for the Bitcoin price, he continues to show his strength after crossing $ 100,000, because Bulls bulls have new heights of all time above $ 109,000. The profitability of investors has also soared and 99% of all Bitcoin holders are now for profit, according to intotheblock data.

Dall.e star image, tradingView.com graphic