The next Chinese technological outfit is preparing to raise up to $ 500 million thanks to a stock offer, with a portion reserved for the purchase of Bitcoin.

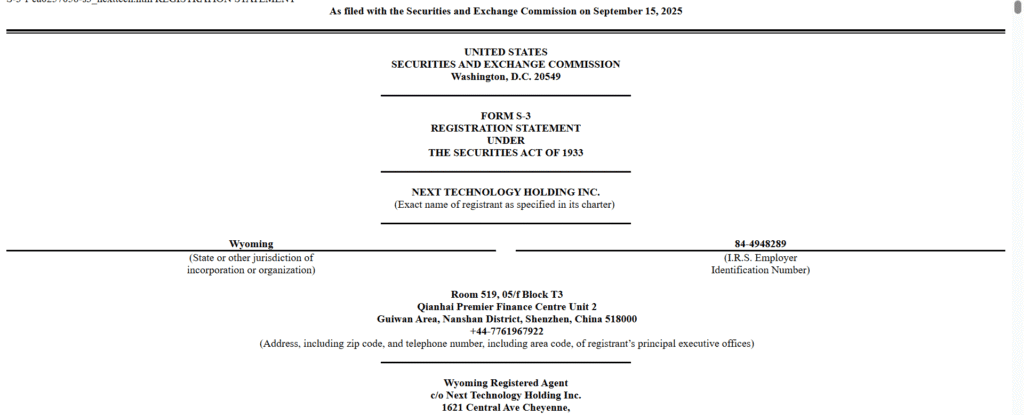

The company, which has already been registered on the NASDAQ, shared the plan in a file with the Securities and Exchange American Commission this week. The software giant noted that the product would go to “general ends of the company”, which may include an increase in its Bitcoin reserves.

The company is already among the biggest corporate bitcoin holders in the world. According to BitcoinTareries.net, Next Technology currently holds 5,833 Bitcoin worth around 672 million dollars. This figure class 15th on a global scale.

A new purchase funded by the offer could considerably expand this position. If half of the expected increase was going to Bitcoin at current prices, the next technology could add more than 2,000 rooms, which increases its total to more than 8,000.

Is part of a broader trend

Next is not the only one to increase your Bitcoin holdings. Instead, his recent decision is part of a broader trend in listed companies that turn to capital markets to finance crypto allowances. In the past year, companies have increasingly adopted Bitcoin strategies similar to Microstrategy by Michael Saylor, which now leads the corporate pack with nearly 639,000 bitcoin.

Collectively, more than 190 listed companies hold bitcoin, exceeding one million parts in combined reserves, which represents more than 5% of the supply in circulation.

Always on the side of prudence

Despite the growing participation of institutions in the cryptography market, market reaction is still on the side of caution. The actions of the next technology fell by almost 5% on the NASDAQ during the session on Monday and slipped further into trade after working hours.

However, the company took advantage of its previous cryptographic bets. Since its Bitcoin entry at the end of 2023, with purchases at an average cost of $ 31,386 per room, the next technology has experienced paper of more than 260%.

Unlike peers that have set long -term accumulation objectives, the next technology indicates that it will take a measured approach, buying Bitcoin in an opportunistic way as market conditions are evolving.

The strategy maintains the flexible company while deepening its links with an increasing trend of the company: treating Bitcoin not only as an investment, but in the context of a wider cash strategy.

Non-liability clause

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and information only. All information or strategies are relevant thoughts and opinions for accepted levels of tolerance to the risk of the writer / examiners, and their risk tolerance may be different from yours.

We are not responsible for the losses that you can undergo due to any investment directly or indirectly linked to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so make reasonable diligence.

Copyright Altcoin Buzz Pte Ltd.

The post-Chinese company provides for a sale of shares of $ 500 million for Bitcoin appeared first on Altcoin Buzz.