More than $ 5 billion will be distributed to the creditors of the FTX of the Crypto Exchange bankruptcy in the coming weeks, because the next wave of reimbursements should take place on May 30, according to the FTX Recovery Trust declaration published yesterday (May 15).

The distributions of May 30 to come are the second phase of the FTX bankruptcy recovery plan. With this next wave, four groups of creditors should be reimbursed, with distributions between 54% and 102% of the value of their FTX assets to the point that the exchange collapsed in November 2022.

Complaints from the FTX creditor

FTX customers:

Class 5: complaint> $ 50,000

5A: FTX International

5B: WeClass 7: Complaint <= $ 50K

7a: ftx intl

7b: weClass 6: not-customies

Can find your class on your FTX voting form pic.twitter.com/ptz10q7q7q

– Sunil (champion of the creditor FTX) (@sunil_trades) May 16, 2025

Notes of the FTX Recovery Trust administrator on the scale of FTX reimbursements, says: “This is an unprecedented distribution process”

“These first distributions of non -convincing classes are an important step for the FTX,” said the administrator of the FTX Recovery Trust, John J. Ray III in the press release yesterday. “The scope and magnitude of the base of the FTX creditor make it an unprecedented distribution process.”

Under the recovery plan, class 5 members of creditors – a group that includes lenders and business partners from Alameda Research and other traders and sellers – will receive distributions between 54% and 72% of their complaints.

Another group of FTX victims with small non-guaranteed complaints can expect disbursements of 61%, while complaints involving inter-society interest will be paid to 120%.

Discover: 12 Best Crypto Parts AI to invest in 2025

Bitgo and Kraken work with the Recovery Trust and will send the funds directly to the exchange accounts of eligible creditors within one to three working days from May 30.

In total, more than $ 5 billion should be distributed on May 30. International complaints of more than $ 50,000 should receive 72% of their lost portfolio value, while $ 50,000 and more complaints in the United States will receive 54%.

Strangely, complaints on portfolios worth $ 50,000 should receive 120%, without any information provided why a creditor would receive more than the original value of his lost portfolio.

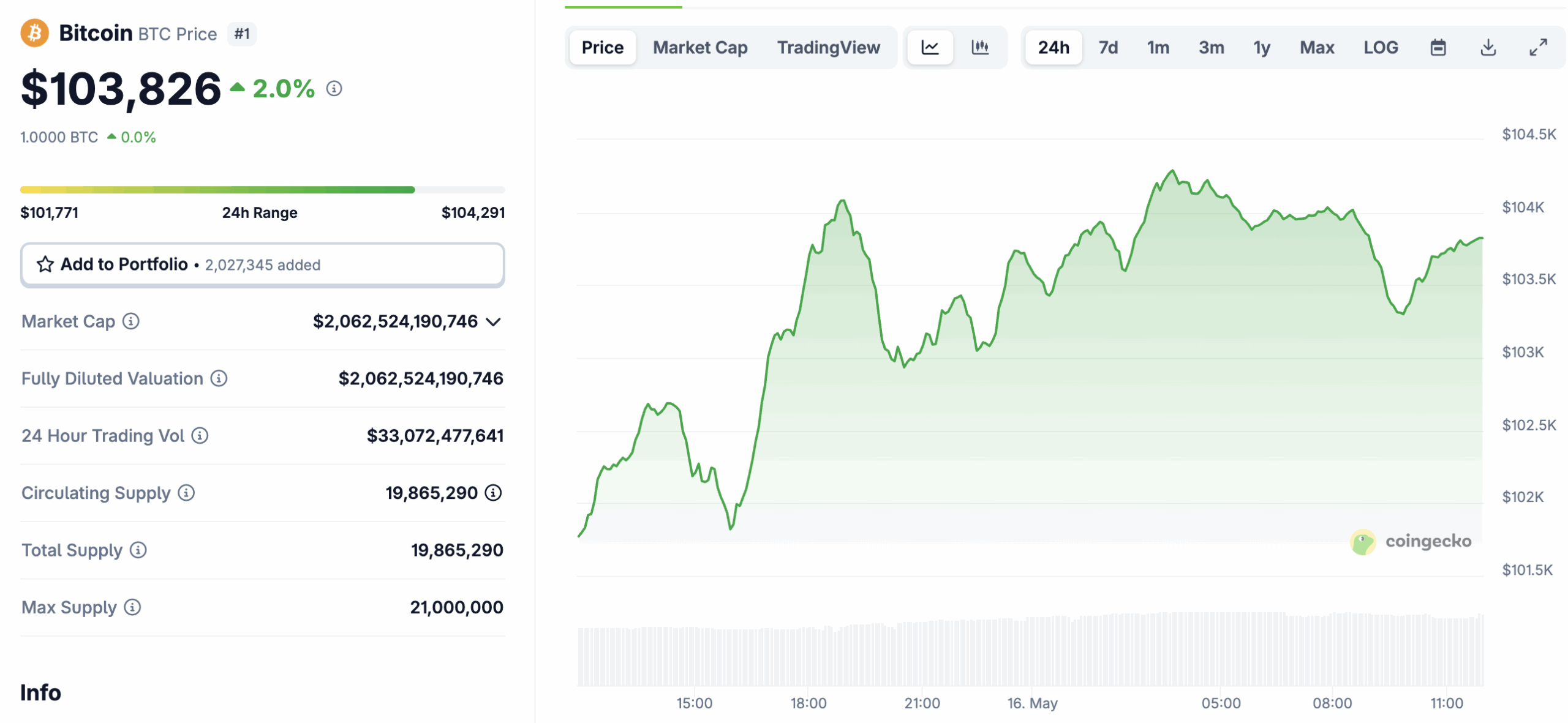

Bitcoin is currently negotiated at around $ 103,800 and is up 2% the day following the new FTX reimbursements at the end of the month.

(Coingecko)

Why are $ 5 billion in reimbursements optimistic for Bitcoin: a new summit of all time soon?

In simple terms, these FTX Trust reimbursements will lead to a huge injection of liquidity in cryptographic markets. The reimbursements of May 30 will see a distribution of significant capital to creditors.

These creditors are a mixture of retail and professional cryptography investors, and therefore, they are likely to reinvest these funds on the markets. After having already suffered once with the collapse of the FTX and the tumultuous journey to recover their funds, creditors can act more risks with the funds recovered, making bitcoin the most logical investment choice.

This capital of capital could increase the purchase pressure and increase the price of bitcoin, leading to the fed meetings of June, that many provide for rate reductions. If Powell indeed reduces interest rates in June, this would give participants in the market the green light to be paid again into risky assets.

Finally, the current feeling of the market before these reimbursements is incredibly high, especially compared to November 2022 when FTX initially crushed and BTC was at the bottom of the rocks, exchanging $ 16,000.

We are currently in the middle of the period from 12 to 16 months after a reduction of half of Bitcoin which has always been the best period for the action of BTC prices. This, associated with the next FOMC meetings and $ 5 billion in new capital flowing in Crypto, could launch the Bitcoin race at $ 150,000 and more in the coming months.

The payment of FTX creditors of $ 5 billion and Bitcoin Vegas occur at the end of the month

All time in the 2 weeks

kiss

higher

– rookiexbt

(@Rookiexbt) May 15, 2025

EXPLORE: 20+ Next Crypto to explode in 2025

Join the 99Bitcoins News Discord here for the latest market updates

The FTX Recovery Trust will distribute $ 5 billion to creditors on May 30

-

Refunds will start with accounts worth $ 50,000

-

BTC is up 2% on the day following the news of the reimbursements

-

$ 5 billion in fresh liquidity injected into the markets could lead BTC to new heights and really launch the Haussier market in the process

The drop in $ 5 billion FTX stimulus is about to supply a new Bitcoin Ath: this is why appeared first on 99Bitcoins.

(@Rookiexbt)

(@Rookiexbt)