In astonishing development, 80,000 Bitcoin (BTC), valued at more than $ 8.6 billion, were transferred to new wallets fixing a wave of speculation on the cryptography market. Contributing to this speech, Conor Grogan, manager of the Coinbase product, said that it is important that this series of recent whale transactions can be a real robbery of crypto.

Did the largest Bitcoin flight take place in silence?

In an X Post on July 4, the eminent analysis company Arkham Intelligence Firm reports that a single entity has now transferred 80,000 BTC in share to eight new portfolios. The data on the chain reveal that these Bitcoins farms were initially deposited in their previous portfolios on April 2 and May 4, 2011, suggesting more than 14 years of full dormancy.

As with other major whale transactions, the recent activation of these long -standing BTC has alerted merchants and market investors, in particular in the midst of current BTC prices. However, the fact that these transfers did not imply portfolios affiliated with exchange helped to mitigate the concerns of an imminent market sale.

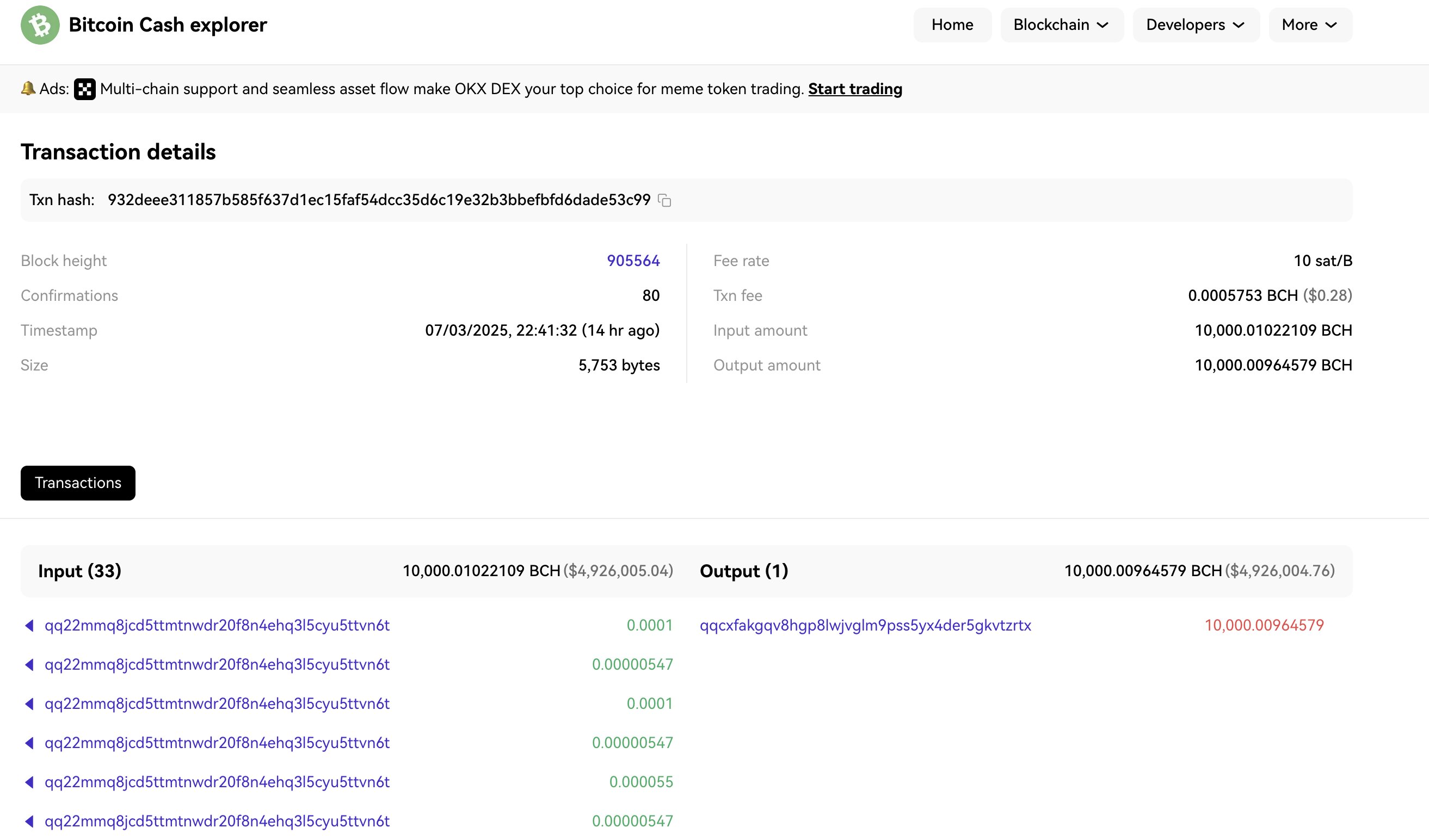

However, Conor Grogan warned that these sudden Bitcoin transfers could have been the greatest cryptographic robbery in history. By explaining this theory, the executive of Coinbase draws attention to a small Bitcoin Cash transaction (BCH) of one of the corresponding wallet clusters approximately 14 hours before the massive movements of Bitcoin.

The transaction which is a test production of 10,000 BCH worth $ 4.9 million was drawn on the Bitcoin cash. Grogan explains the fact that other BCH portfolios have stayed in sleep suggest that this particular BCH transfer may have been hackers who were testing the private key because BCH transactions are now generally followed by whale monitoring services.

Another concern underlined by the Coinbase executive is that transfers were not automated or linked to exchange, but rather seemed to be manual transactions, thus increasing the suspicions of compromised private keys. However, Grogan retains the position that this theory represents “extreme speculation” suggesting that transactions may indeed have been initiated by the legitimate owner of the portfolio.

In particular, several Crypto analysts and enthusiasts have pushed the grogan account, describing the recent transfer of 8,000 BTC as a “handshake” rather than a hack. In particular, an analyst with X Username Binji stressed that the slow and deliberate pace of transactions seemed incompatible with the behavior generally observed in the hacks, especially if they were executed by a single entity.

Bitcoin price preview

At the time of writing the time of the editorial staff, Bitcoin exchange of hands at $ 108,150 after a drop of 1.06% during the last day. However, the main cryptocurrency maintains positive performance on larger deadlines, as evidenced respectively by 0.98% and 2.78% gains on the weekly and monthly graph.

PEXELS star image, tradingView graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.