The data confirms that Tether (USDT) flows continued to shape crypto market dynamics amid the ongoing uptrend.

In recent weeks, the crypto market has been flooded with enthusiasm as digital assets, led by Bitcoin, continue to reach new highs. Behind this price rise is an increase in demand, which is reflected in the flows of stablecoins, particularly USDT.

Crypto analyst “IT Tech” recently highlighted this trend. In an X article on Wednesday, December 11, the analyst pointed out that USDT activity has increased alongside the price of Bitcoin.

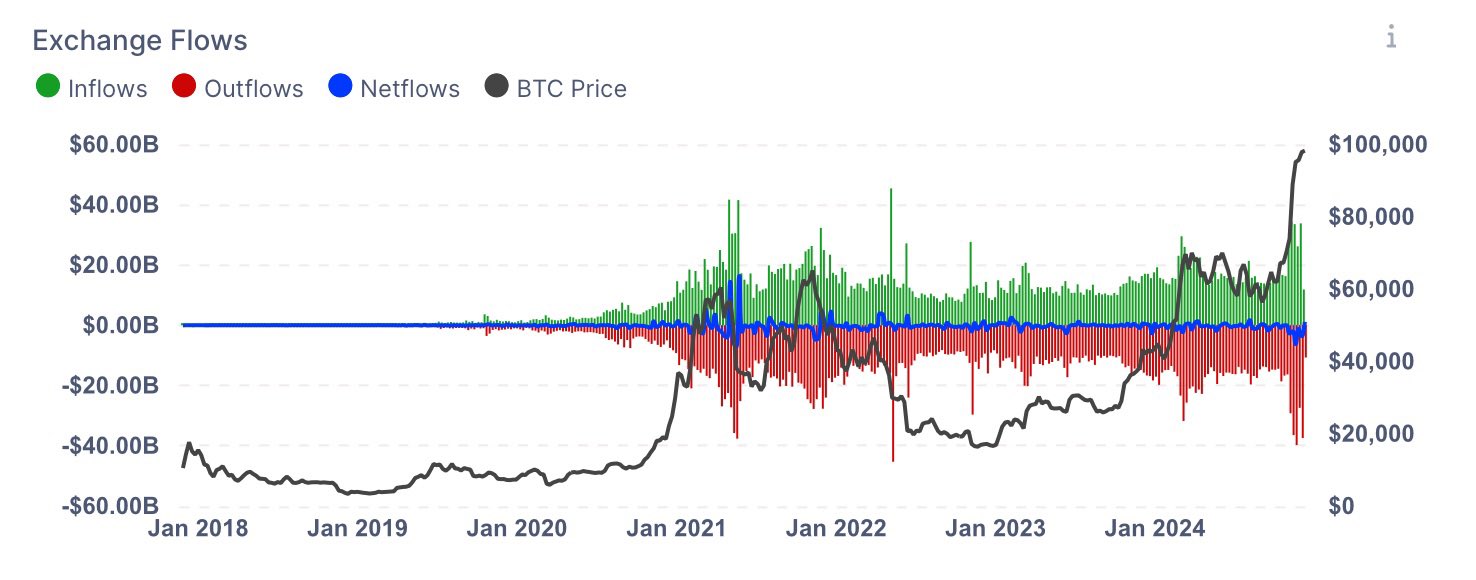

The correlation comes because stable coin activity often offers insight into market sentiment. For example, increased flows to exchanges can often signal growing market demand, and this has been the case in 2024. In the block According to a chart shared by IT Tech, these flows reached nearly $40 billion this year.

At the same time, the number of active USDT addresses has increased alongside the price of Bitcoin. Specifically, active USDT addresses increased sharply in 2024, from around 100,000 in January to almost 350,000 in December.

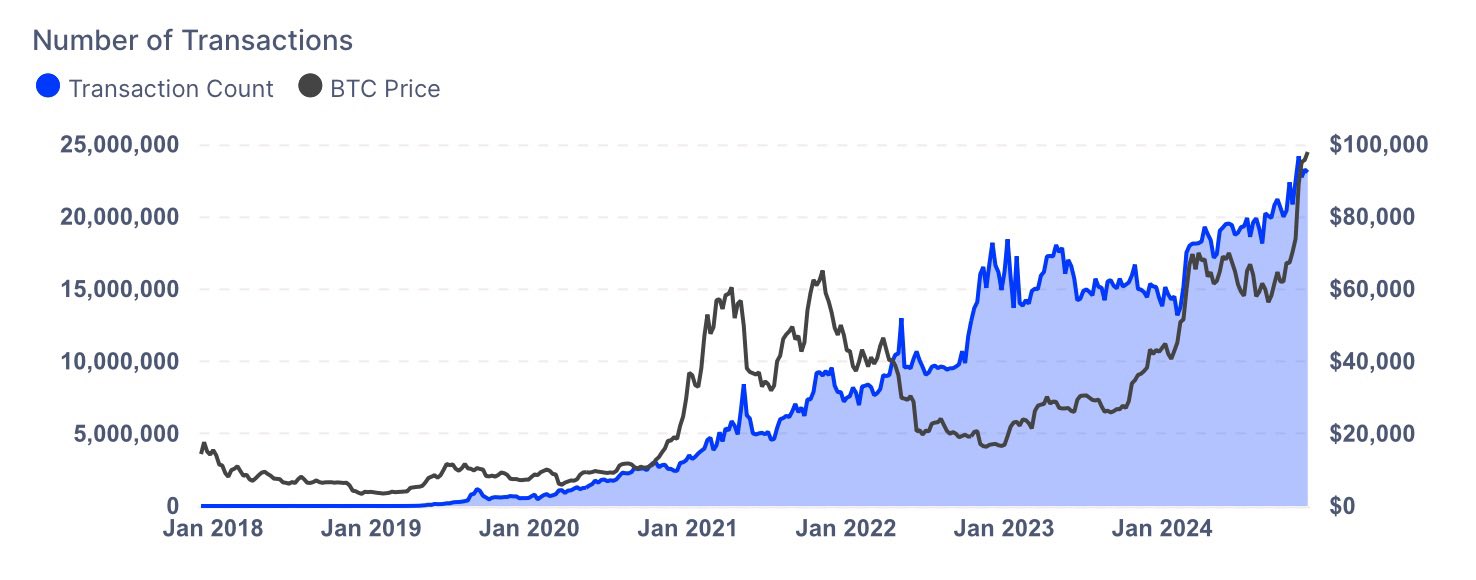

The same trend is observable with the number of USDT transactions. This metric increased almost fivefold from just over 5 million to almost 25 million as the price of Bitcoin increased.

Commenting on the data, IT Tech argued that it highlighted broader market participation and the increasingly important role of stablecoins in liquidity and trading.

Interestingly, USDT’s dominant role is also reflected in its market capitalization. The frequently cited figure nearly doubles in 2024, from $91.7 billion at the start of the year to $139 billion.

DisClamier: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.