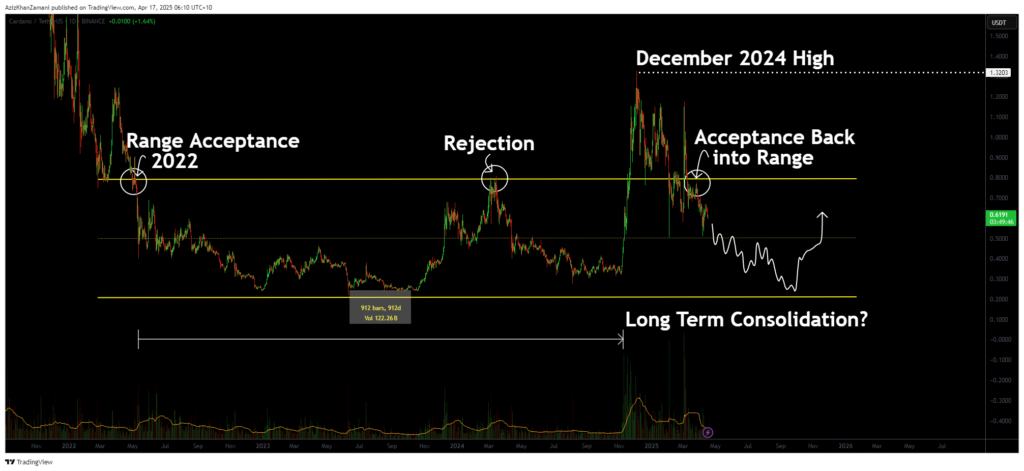

CARDANO (ADA) has shown major structural developments on a multi -year commercial range. The recent price action suggests acceptance in this long -term structure, with indicators pointing towards a potential movement to the lower support region.

Cardano (ADA) has entered an important commercial range which has contained its price action for over three years. After an escape at the end of 2024 which lacked volume, the asset failed to maintain its peaks and now shows signs of weakness. For merchants, this passage in the range leads to major implications for the medium -term price trajectory of ADA.

Key points covered

- Ada has closed several candles in a multi -year trading range, pointing out a real acceptance

- The rupture of 2024 lacked volume confirmation, indicating a potential climatic summit

- An evolution towards the lower support region is more and more likely because ADA is looking for a real market value

After more than 912 days of negotiation in a well -defined range since 2022, Ada finally broke out in December 2024, fixing a new summit. However, this escape lacked the critical component of the monitoring volume. A sharp decline in volume immediately after rupture reported a weakening momentum, suggesting a peak peak rather than a lasting upward trend.

The price action has since fallen below the high range and closed several candles below, a clear sign of acceptance in the range. This is significant from a structural point of view. Rather than consolidating above and building new support, ADA now signals a potential return to its value area, probably towards the lower limit of the long-term beach.

The volume profile strengthens this theory. The expansion of the summits of December was not equaled by the sustained interest of buyers. Instead, the volume has tapered, indicating that the break may have been speculative and not supported by conviction. In such cases, the price often comes back to balance levels to reassess the fair market value.

What to expect in the action of upcoming prices

ADA is now firmly inside the beach in the long term, a slow version to the lower support region is increasingly likely. Traders must be patient, avoiding premature entries until there is either a confirmed trend reversal or a test of the lower limit. The real opportunity can reside in the possible consolidation and structure of ADA near this historic range.